Question: I am unsure how to go about solving the problem I'v tried several times to solve it Crane Company is a multidivisional company. Its managers

I am unsure how to go about solving the problem I'v tried several times to solve it

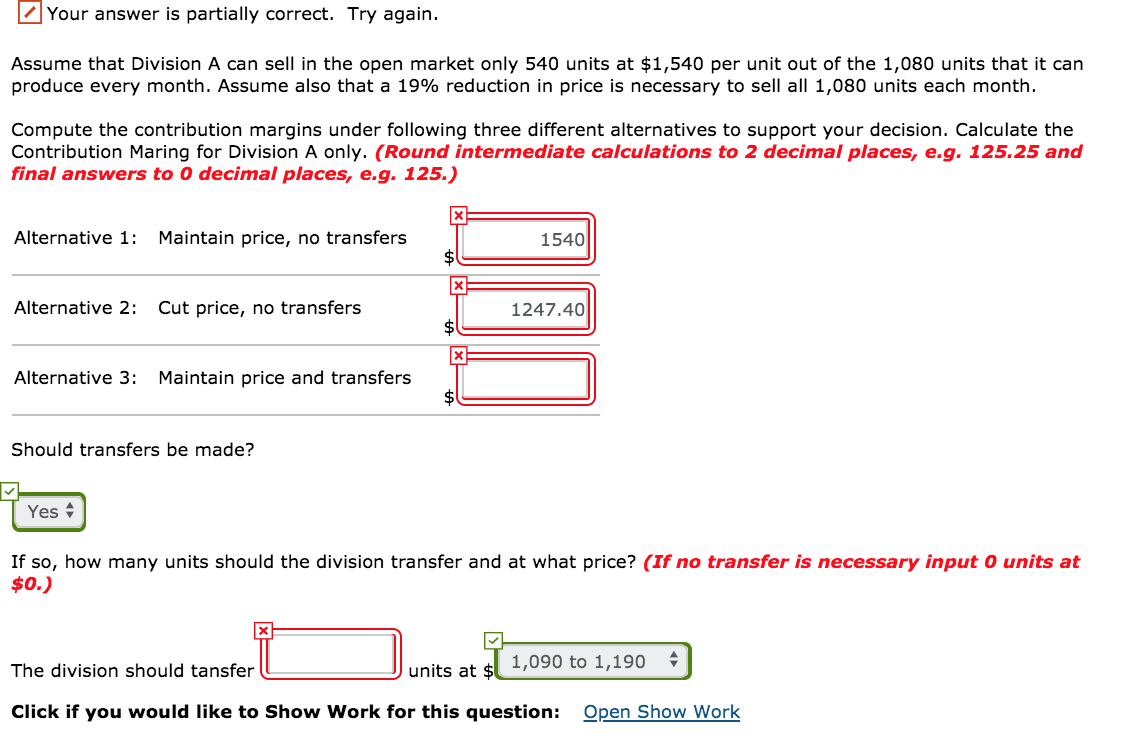

Crane Company is a multidivisional company. Its managers have full responsibility for profits and complete autonomy to accept or reject transfers from other divisions. Division A produces a subassembly part for which there is a competitive market. Division B currently uses this subassembly for a final product that is sold outside at $2,440. Division A charges Division B market price for the part, which is $1,540 per unit. Variable costs are $1,090 and $1,190 for Divisions A and B, respectively. The manager of Division B feels that Division A should transfer the part at a lower price than market because at market, Division B is unable to make a profit. Your answer is partially correct. Try again. Assume that Division A can sell in the open market only 540 units at $1,540 per unit out of the 1,080 units that it can produce every month. Assume also that a 19% reduction in price is necessary to sell all 1,080 units each month. Compute the contribution margins under following three different alternatives to support your decision. Calculate the Contribution Maring for Division A only. (Round intermediate calculations to 2 decimal places, e.g. 125.25 and final answers to 0 decimal places, e.g. 125.) Alternative 1: Maintain price, no transfers 1540 A XA Alternative 2: Cut price, no transfers 1247.40 x Alternative 3: Maintain price and transfers # Should transfers be made? Yes If so, how many units should the division transfer and at what price? (If no transfer is necessary input 0 units at $0.) The alvasion should tanse units at 322,090 to 1,190 3 The division should tansfer units at 1,090 to 1,190 - Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts