Question: I ask this question earlier and it was completely wrong with different figures. The person that answer it just put a answer that was given

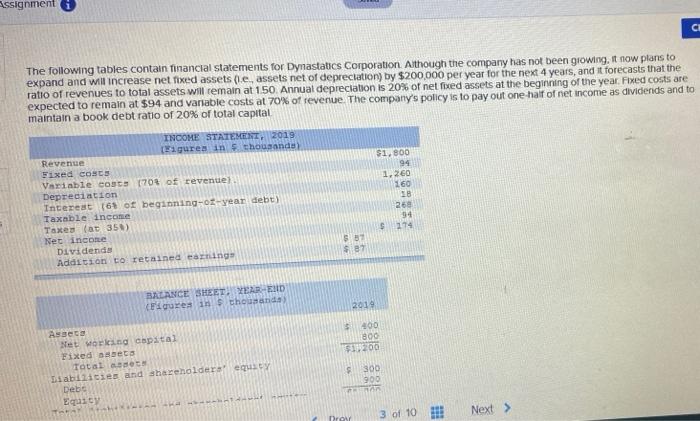

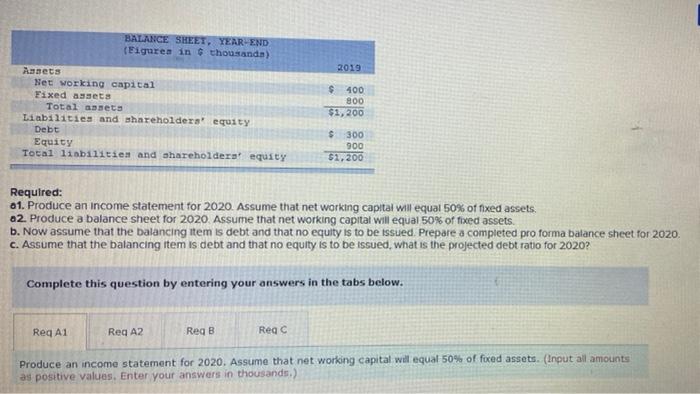

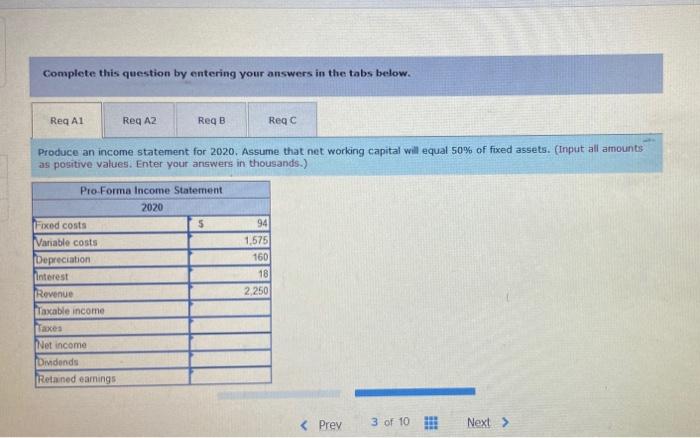

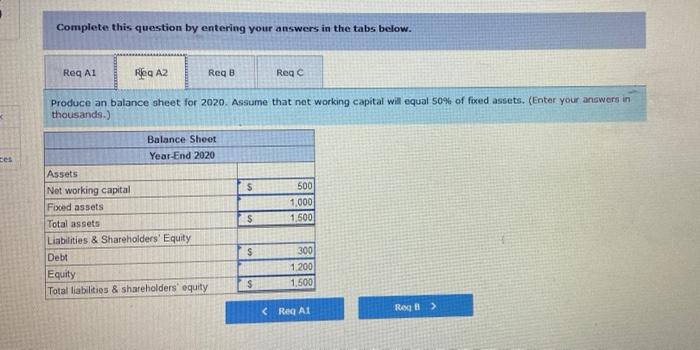

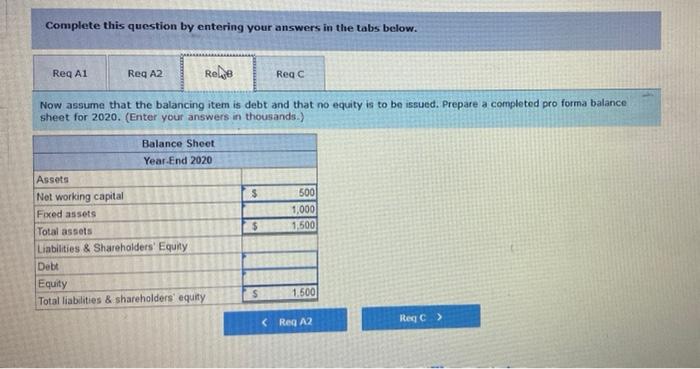

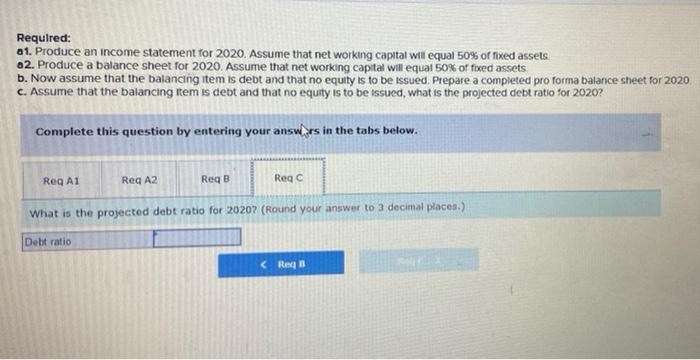

ssignment CI The following tables contain financial statements for Dynastatics Corporation. Although the company has not been growing, it now plans to expand and will increase netTixed assets (le, assets net of depreciation) by $200,000 per year for the next 4 years, and it forecasts that the ratio of revenues to total assets will remain at 150 Annual depreciation is 20% of net fixed assets at the beginning of the year. Fixed costs are expected to remain at $94 and variable costs at 70% of revenue. The company's policy is to pay out one half of net income as dividends and to maintain a book debt ratio of 20% of total capital INCOME STATEMENT, 2019 Figures in thousands Revenue sixed COSES Variable costs 70% of revenue Depreciation Interest 16 of beginning-02-year debt) Taxable income Taxes (at 359) Net income Dividende Addition to retnined earnings $1,800 94 1.260 160 18 26 94 174 $ 87 BALANCE SHEET YEAR-END (Figures in thousands 2014 3 100 800 SE200 Assets Net word capital Fixed bets Total asset Liabilities and shareholders' equity Debe Equity - 300 900 Drony 3 of 10 Next > BALANCE SHEET, YEAR-END (Eigures in thousanda) 2019 Assets Networking capital Fixed assets Total assets Liabilities and shareholders' equity Debt Equity Total libilities and shareholders' equity S 400 800 $2,200 $ 300 900 $2,200 Required: 31. Produce an income statement for 2020. Assume that net working capital will equal 50% of fixed assets. a2. Produce a balance sheet for 2020 Assume that net working capital will equal 50% of fixed assets. b. Now assume that the balancing item is debt and that no equity is to be issued Prepare a completed pro forma balance sheet for 2020 c. Assume that the balancing item is debt and that no equity is to be issued, what is the projected debt ratio for 2020? Complete this question by entering your answers in the tabs below. Req A1 Reg A2 RegB Regc Produce an income statement for 2020. Assume that net working capital will equal 50% of fixed assets. (Input all amounts as positive values. Enter your answers in thousands) Complete this question by entering your answers in the tabs below. Reg A1 Reg A2 Reg B Regc Produce an income statement for 2020. Assume that net working capital will equal 50% of fixed assets. (Input all amounts as positive values. Enter your answers in thousands.) 94 Pro-Forma Income Statement 2020 Fixed costs Variable costs Depreciation interest Revenue Taxable income Taxes Net income Dividends Retained earnings 1,575 160 18 2.250 Prey 3 of 10 Next > Complete this question by entering your answers in the tabs below. Reg A1 Reg A2 Reg Regc Produce an balance sheet for 2020. Assume that not working capital will equal 50% of fixed assets. (Enter your answers in thousands.) ces $ Balance Sheet Year-End 2020 Assets Net working capital Fixed assets Total assets Liabilities & Shareholders' Equity Debt Equity Total liabilities & shareholders' equity 500 1,000 1,500 $ $ 300 1.200 1,500 $ C Reg A1 Reg> Complete this question by entering your answers in the tabs below. Reg A1 Reg A2 Rele Regc Now assume that the balancing item is debt and that no equity is to be issued. Prepare a completed pro forma balance sheet for 2020. (Enter your answers in thousands.) $ Balance Sheet Year-End 2020 Assets Net working capital Fixed assets assets Liabilities & Shareholders' Equity Debt Equity Total liabilities & shareholders' equity 500 1,000 1,500 $ s 1,500 (Reg A2 Reg C> Required: 01. Produce an income statement for 2020. Assume that net working capital will equal 50% of fixed assets 02. Produce a balance sheet for 2020. Assume that net working capital will equal 50% of fixed assets. b. Now assume that the balancing item is debt and that no equity is to be issued. Prepare a completed pro forma balance sheet for 2020 c. Assume that the balancing item is debt and that no equity is to be issued, what is the projected debt ratio for 2020? Complete this question by entering your answors in the tabs below. Reg A1 Reg A2 ReqB Reg What is the projected debt ratio for 2020? (Round your answer to 3 decimal places.) Debt ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts