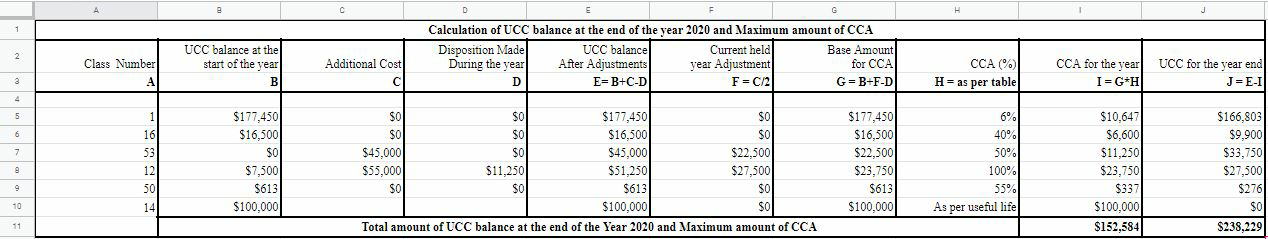

Question: I asked a CCA question and received this answer below also the excel sheet, I am confused because the answer doesn't match the excel sheet.

I asked a CCA question and received this answer below also the excel sheet, I am confused because the answer doesn't match the excel sheet.

What I learned from the book and the internet search that the CCA for the year is 4,000 and UCC is 96,000

The question is:

Intangible Assets: On January 1, 2021, James signed a new 25-year distributorship agreement with the owner of a well-known motorcycle brand. James paid $100,000 to obtain the 25-year license, which is effective January 1, 2021 and expires on December 31, 2044.

Answer I received from Chegg, also found the same answer at course hero:

Class 14: Intangible Asset (Licenses)

For the license having a limited period, CCA is the least from the below:

1. Capital cost distributed over the years of Useful Life i.e.$4,000 ($100,000/25 Years)

Or

2.UCC closing balance of year ended, i.e.$96,000

So, the CCA for the license is $4,000

I need explanation please. And can I apply AIIP?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts