Question: I attempted this question. Please let me know where I went wrong (along with the three correct answers), I attached my work. Cold Goose Metal

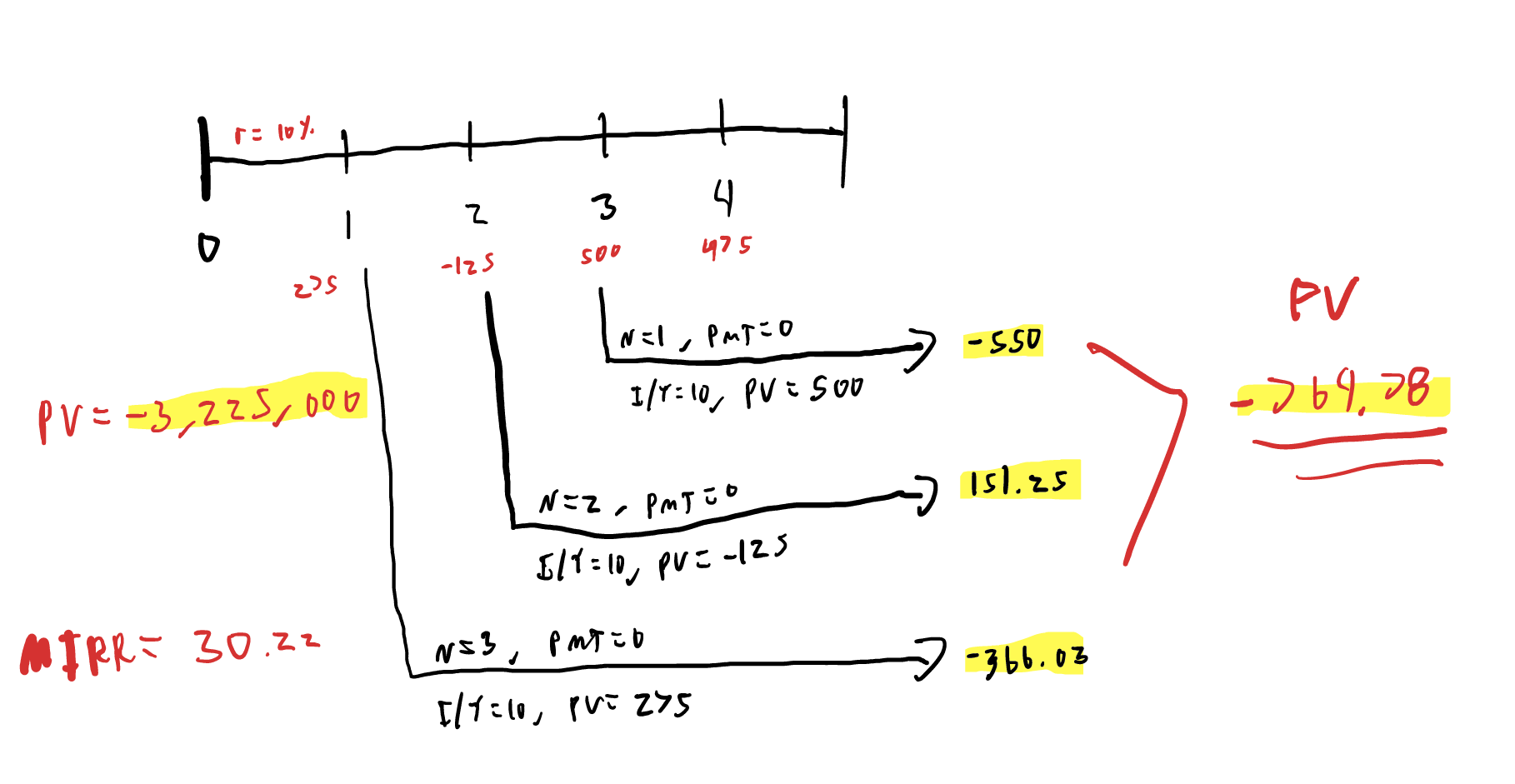

I attempted this question. Please let me know where I went wrong (along with the three correct answers), I attached my work.

I attempted this question. Please let me know where I went wrong (along with the three correct answers), I attached my work.

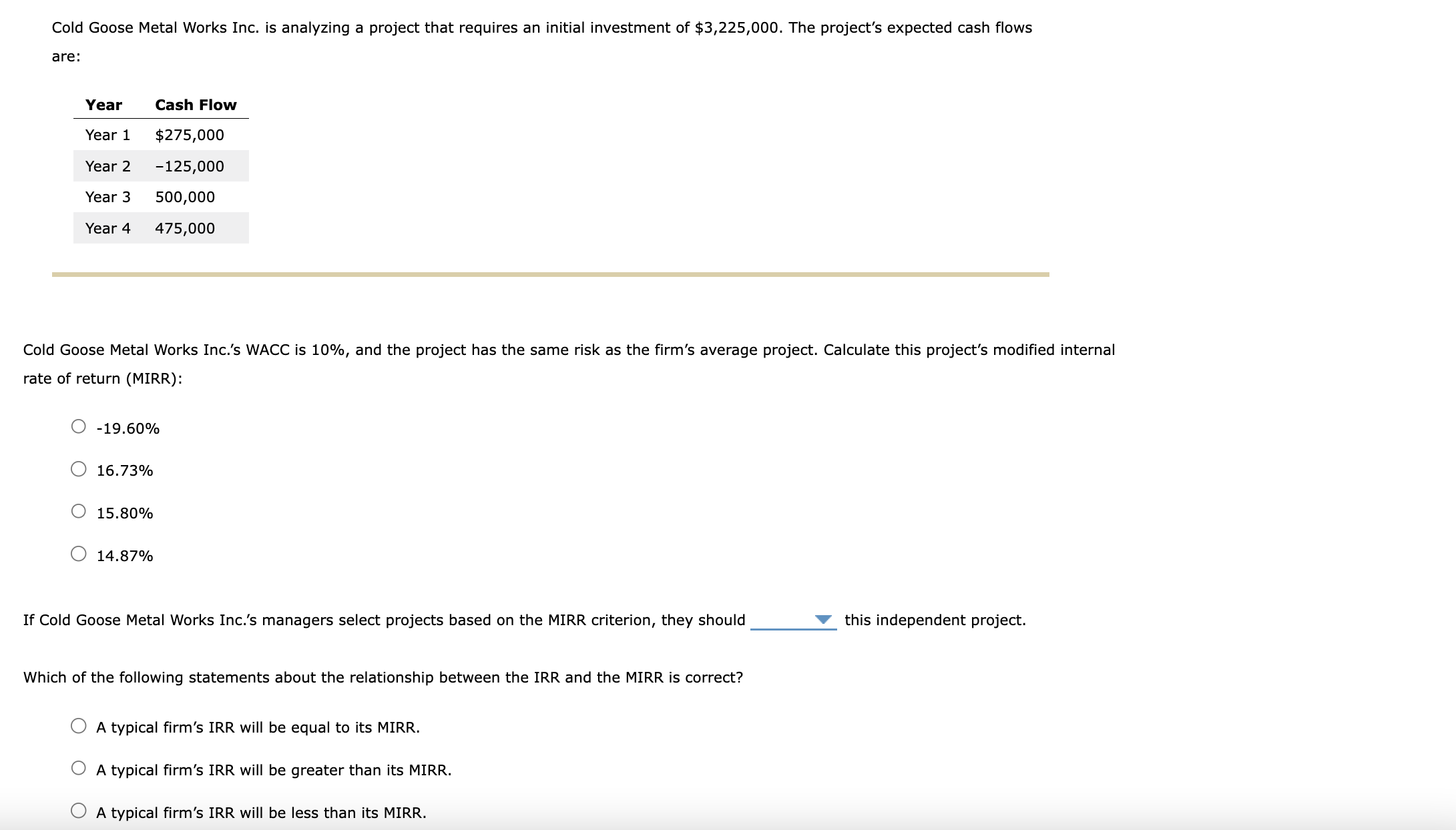

Cold Goose Metal Works Inc. is analyzing a project that requires an initial investment of $3,225,000. The project's expected cash flows are: Cold Goose Metal Works Inc.'s WACC is 10%, and the project has the same risk as the firm's average project. Calculate this project's modified internal rate of return (MIRR): 19.60%16.73%15.80%14.87% If Cold Goose Metal Works Inc.'s managers select projects based on the MIRR criterion, they should this independent project. Which of the following statements about the relationship between the IRR and the MIRR is correct? A typical firm's IRR will be equal to its MIRR. A typical firm's IRR will be greater than its MIRR. A typical firm's IRR will be less than its MIRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts