Question: I can't figure it out. Please explain step by step!! eBook Exercise 14-21 (Algorithmic) (L0.3) Heather owns 300 shares of Diego Corporation common stock for

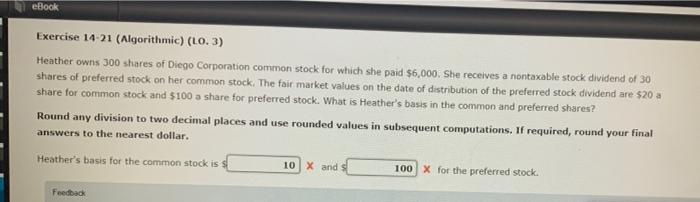

eBook Exercise 14-21 (Algorithmic) (L0.3) Heather owns 300 shares of Diego Corporation common stock for which she paid $6,000. She receives a nortaxable stock dividend of 30 shares of preferred stock on her common stock. The fair market values on the date of distribution of the preferred stock dividend are $20 a share for common stock and $100 a share for preferred stock. What is Heather's basis in the common and preferred shares? Round any division to two decimal places and use rounded values in subsequent computations. If required, round your final answers to the nearest dollar, Heather's basis for the common stock is 10 X and s 100 X for the preferred stock. Feedback

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts