Question: I did the question(a) correct. WebWork 1: Problem 13 Previous Problem Problem List Next Problem (1 point) A bond matures in six years and pays

I did the question(a) correct.

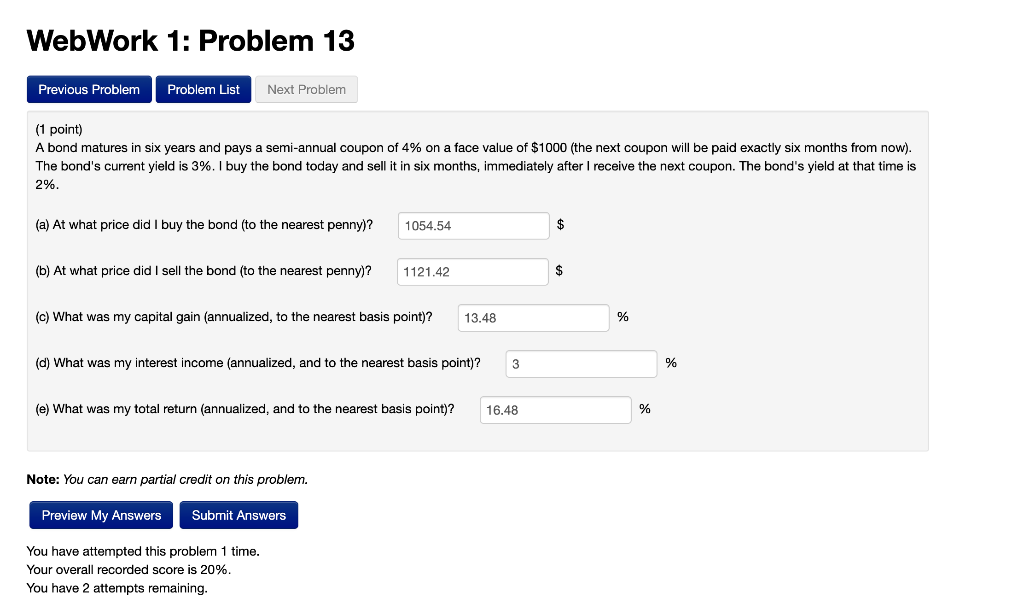

WebWork 1: Problem 13 Previous Problem Problem List Next Problem (1 point) A bond matures in six years and pays a semi-annual coupon of 4% on a face value of $1000 (the next coupon will be paid exactly six months from now). The bond's current yield is 3%. I buy the bond today and sell it in six months, immediately after receive the next coupon. The bond's yield at that time is 2%. (a) At what price did I buy the bond to the nearest penny)? 1054.54 (b) At what price did I sell the bond (to the nearest penny)? 1121.42 $ (c) What was my capital gain (annualized, to the nearest basis point)? 13.48 % (d) What was my interest income (annualized, and to the nearest basis point)? 3 % (e) What was my total return (annualized, and to the nearest basis point)? 16.48 % Note: You can earn partial credit on this problem. Preview My Answers Submit Answers You have attempted this problem 1 time. Your overall recorded score is 20%. You have 2 attempts remaining

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts