Question: Assignment 10: Problem 4 Previous Problem Problem List Next Problem (1 point) Two bonds, each with a face value of $18000, are redeemable at par

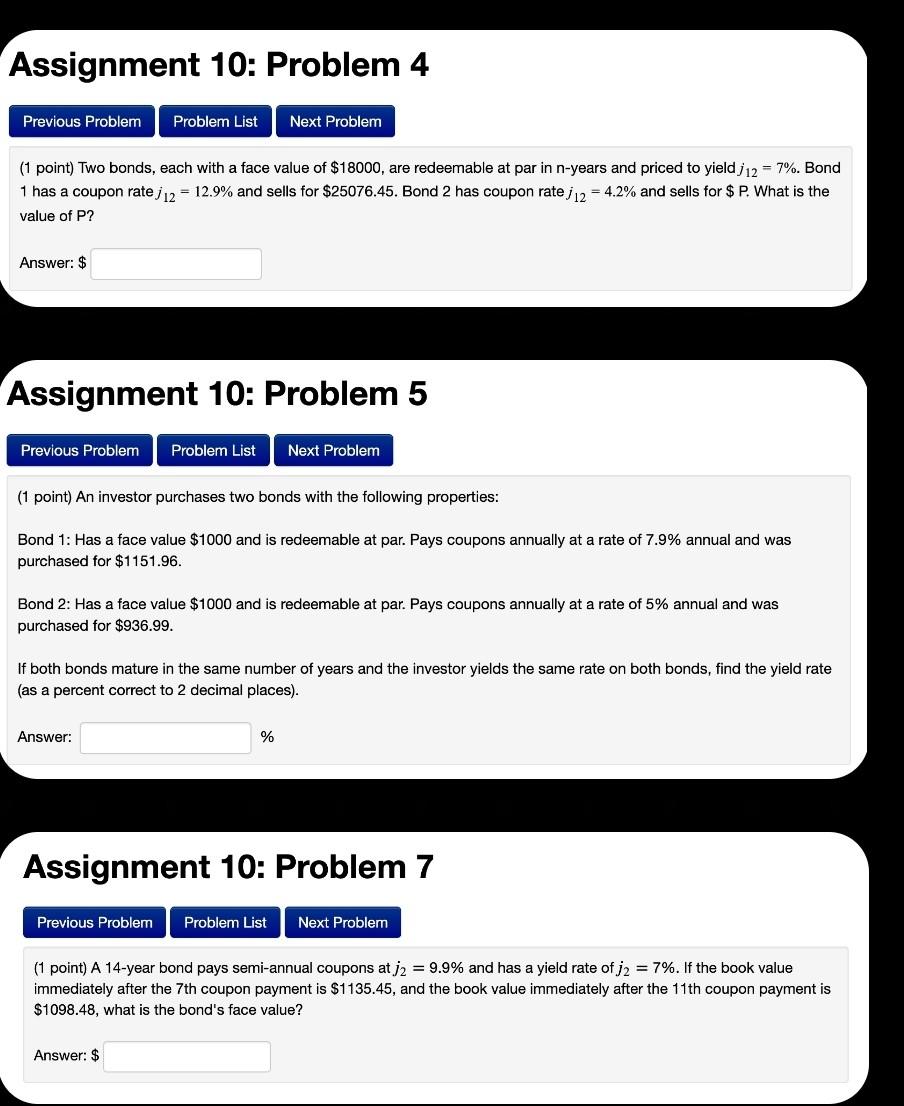

Assignment 10: Problem 4 Previous Problem Problem List Next Problem (1 point) Two bonds, each with a face value of $18000, are redeemable at par in n-years and priced to yield | 12 = 7%. Bond 1 has a coupon rate 12 = 12.9% and sells for $25076.45. Bond 2 has coupon rate 1 12 = 4.2% and sells for $P. What is the value of P? Answer: $ Assignment 10: Problem 5 Previous Problem Problem List Next Problem (1 point) An investor purchases two bonds with the following properties: Bond 1: Has a face value $1000 and is redeemable at par. Pays coupons annually at a rate of 7.9% annual and was purchased for $1151.96 Bond 2: Has a face value $1000 and is redeemable at par. Pays coupons annually at a rate of 5% annual and was purchased for $936.99. If both bonds mature in the same number of years and the investor yields the same rate on both bonds, find the yield rate (as a percent correct to 2 decimal places). Answer: % Assignment 10: Problem 7 Previous Problem Problem List Next Problem (1 point) A 14-year bond pays semi-annual coupons at j2 = 9.9% and has a yield rate of j2 = 7%. If the book value immediately after the 7th coupon payment is $1135.45, and the book value immediately after the 11th coupon payment is $1098.48, what is the bond's face value? Answer: $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts