Question: I do not need process, just answer thx Green Elf Corporation's common stock has a return of 12%. Assume the risk-free rate is 12. Suppose

I do not need process, just answer thx

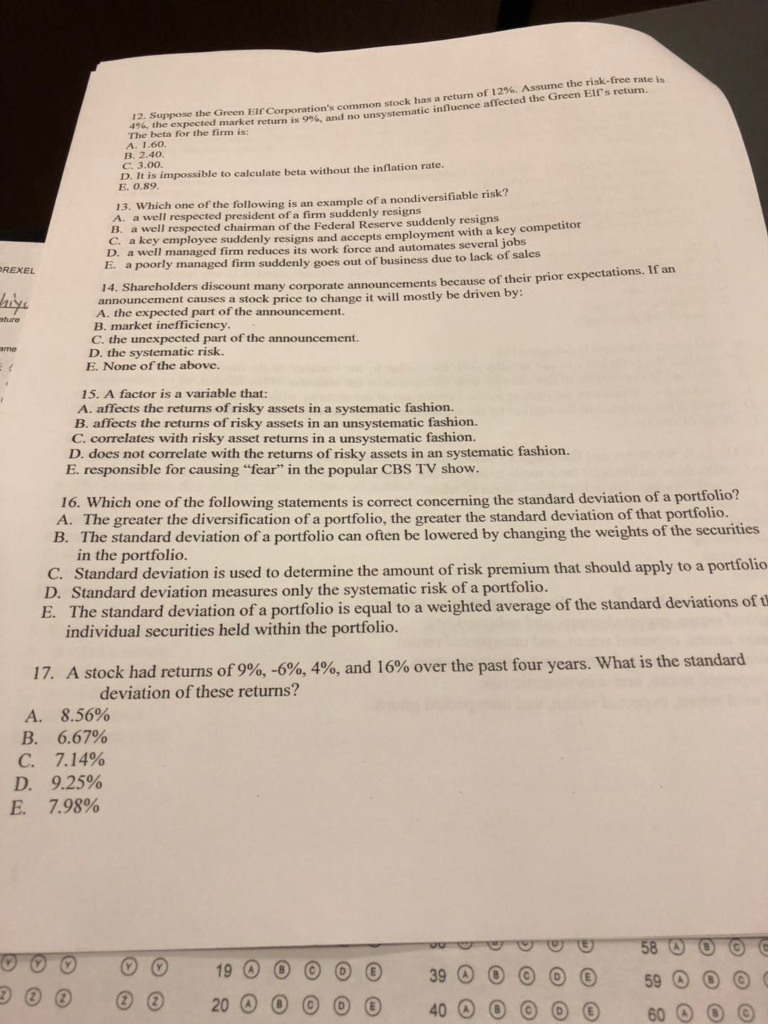

Green Elf Corporation's common stock has a return of 12%. Assume the risk-free rate is 12. Suppose the 4%, the expected market return i s 9%, and no unsystemnatic influence affected the Green Elf's return. The beta for the firm is: he beta f A. 1.60. B. 2.40. C. 3.00. D. It is impossible to calculate beta without the inflation rate. E. 0.89 13. Which one of the following is an examp le of a nondiversifiable risk? A. a well respected president of a fim suddenly resigns B. a well res pected chairman of the Federal Reserve suddenly resigns C. a key employee suddenly resigns and accepts employment with a key competitor REXEL a poorly managed firm suddenly goes out of business due to lack of sales 14. Shareholders d iscount many corporate announcements because of their prior expectations. If an announcement causes a stock price to change it will mostly be driven by A. the expected part of the announcement. ture B. market inefficiency C. the unexpected part of the announcement. D. the systematic risk. E. None of the above. 15. A factor is a variable that: A. affects the returns of risky assets in a systematic fashion. B. affects the returns of risky assets in an unsystematic fashion. C. correlates with risky asset returns in a unsystematic fashion. D. does not correlate with the returns of risky assets in an systematic fashion. E. responsible for causing fear" in the popular CBS TV show. 16. Which one of the following statements is correct concerning the standard deviation of a The greater the diversification of a portfolio, the greater the standard deviation of that portfolio. C. Standard deviation is used to determine the amount of risk premium that should apply to a portfolio E. The standard deviation of a portfolio is equal to a weighted average of the standard deviations of d A. B. The standard deviation of a portfolio can often be lowered by changing the weights of the securities in the portfolio. D. Standard deviation measures only the systematic risk of a portfolio. individual securities held within the portfolio. 17. A stock had returns of 9% 6%,4%, and 16% over the past four years. What is the standard deviation of these returns? A. 8.56% B. 6.67% C. 7.14% D. 9.25% E. 7.98%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts