Question: I do not understand how to work through this problem from my practice exam. Would love if someone could SHOW ALL WORK when completing this

I do not understand how to work through this problem from my practice exam. Would love if someone could SHOW ALL WORK when completing this problem. Thank you!

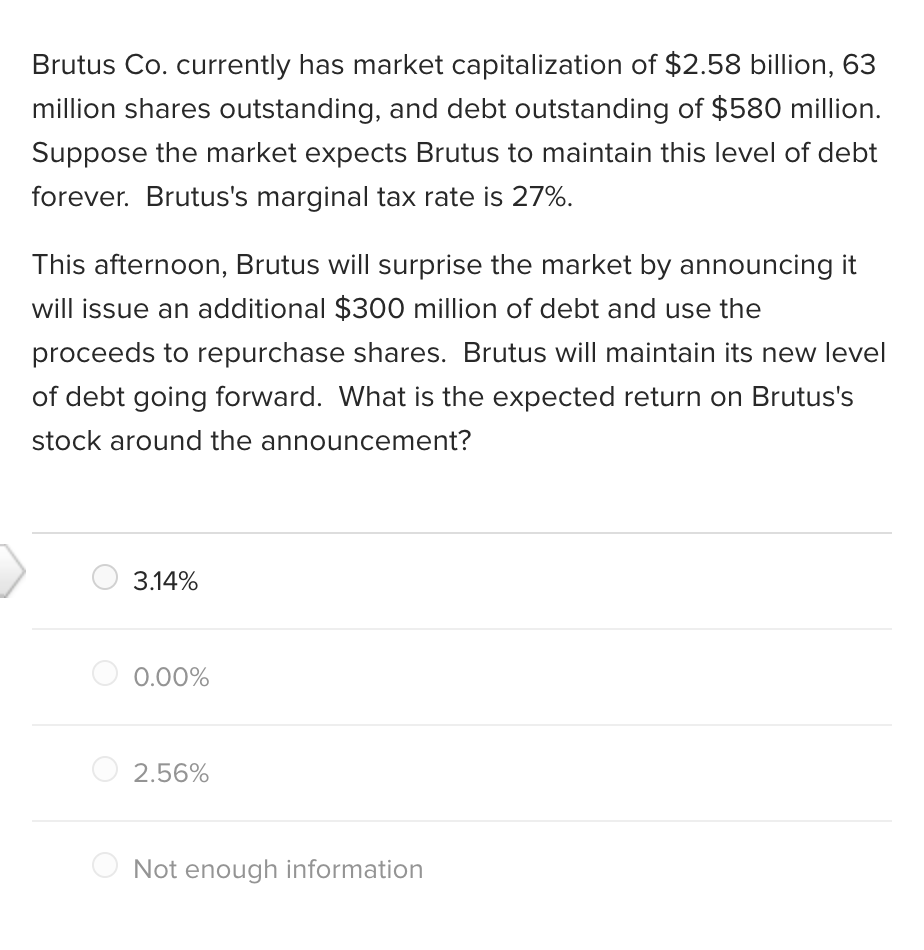

Brutus Co. currently has market capitalization of $2.58 billion, 63 million shares outstanding, and debt outstanding of $580 million. Suppose the market expects Brutus to maintain this level of debt forever. Brutus's marginal tax rate is 27%. This afternoon, Brutus will surprise the market by announcing it will issue an additional $300 million of debt and use the proceeds to repurchase shares. Brutus will maintain its new level of debt going forward. What is the expected return on Brutus's stock around the announcement? 3.14% 0.00% 2.56% Not enough information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts