Question: I do understand it need to use RF +beta(premium) , but not sure need to use TR =systematic risk +unsystemmatic risk formula. Really appreciate !

I do understand it need to use RF +beta(premium) , but not sure need to use TR =systematic risk +unsystemmatic risk formula. Really appreciate !

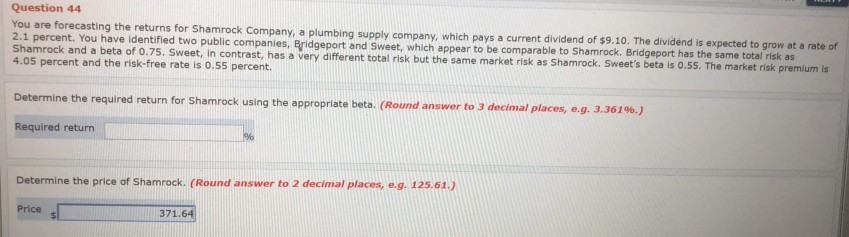

Question 44 You are forecasting the returns for Shamrock Company, a plumbing supply company, which pays a current dividend of $9.10. The dividend is expected to grow at a rate of 2.1 percent. You have identified two public companies, Bridgeport and Sweet, which appear to be comparable to Shamrock. Bridgeport has the same total risk as Shamrock and a beta of 0.75. Sweet, in contrast, has a very different total risk but the same market risk as Shamrock. Sweet's beta is 0.55. The market risk premium is 4.05 percent and the risk-free rate is 0.55 percent. Determine the required return for Shamrock using the appropriate beta. (Round answer to 3 decimal places, e.g. 3.361%.) Required return Determine the price of Shamrock. (Round answer to 2 decimal places, e.g. 125.61.) Prices 371.64

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts