Question: i dont know how to do (b), the answer is on the second picture but i dont get why it is discounted back by (1+ke)^n

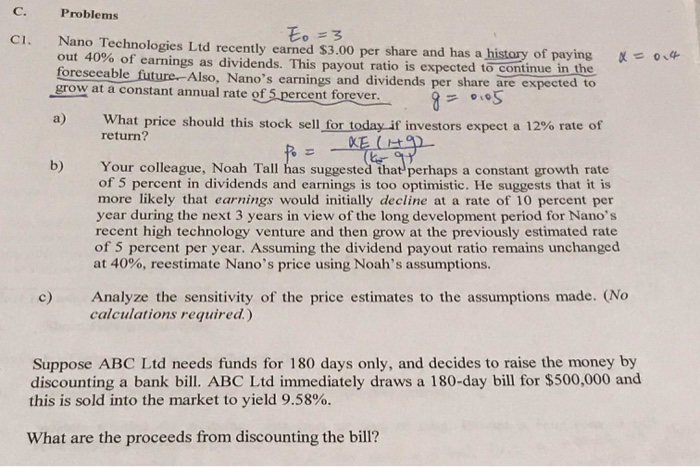

Problems Eo=3 Nano Technologies Ltd recently earned $3.00 per share and has a history of paying out 40% of earnings as dividends. This payout ratio is expected to continue in the foreseeable future. Also, Nano's earnings and dividends per share are expected to grow at a constant annual rate of 5 percent forever. es x = 0 a) Po - 9 What price should this stock sell for today if investors expect a 12% rate of return? - KECHG Your colleague, Noah Tall has suggested that perhaps a constant growth rate of 5 percent in dividends and earnings is too optimistic. He suggests that it is more likely that earnings would initially decline at a rate of 10 percent per year during the next 3 years in view of the long development period for Nano's recent high technology venture and then grow at the previously estimated rate of 5 percent per year. Assuming the dividend payout ratio remains unchanged at 40%, reestimate Nano's price using Noah's assumptions. Analyze the sensitivity of the price estimates to the assumptions made. (No calculations required.) Suppose ABC Ltd needs funds for 180 days only, and decides to raise the money by discounting a bank bill. ABC Ltd immediately draws a 180-day bill for $500,000 and this is sold into the market to yield 9.58%. What are the proceeds from discounting the bill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts