Question: I don't know how to set up this question. If someone could provide what equation/steps I would follow if all of these number were variables

I don't know how to set up this question. If someone could provide what equation/steps I would follow if all of these number were variables along with an explanation that would be perfect.

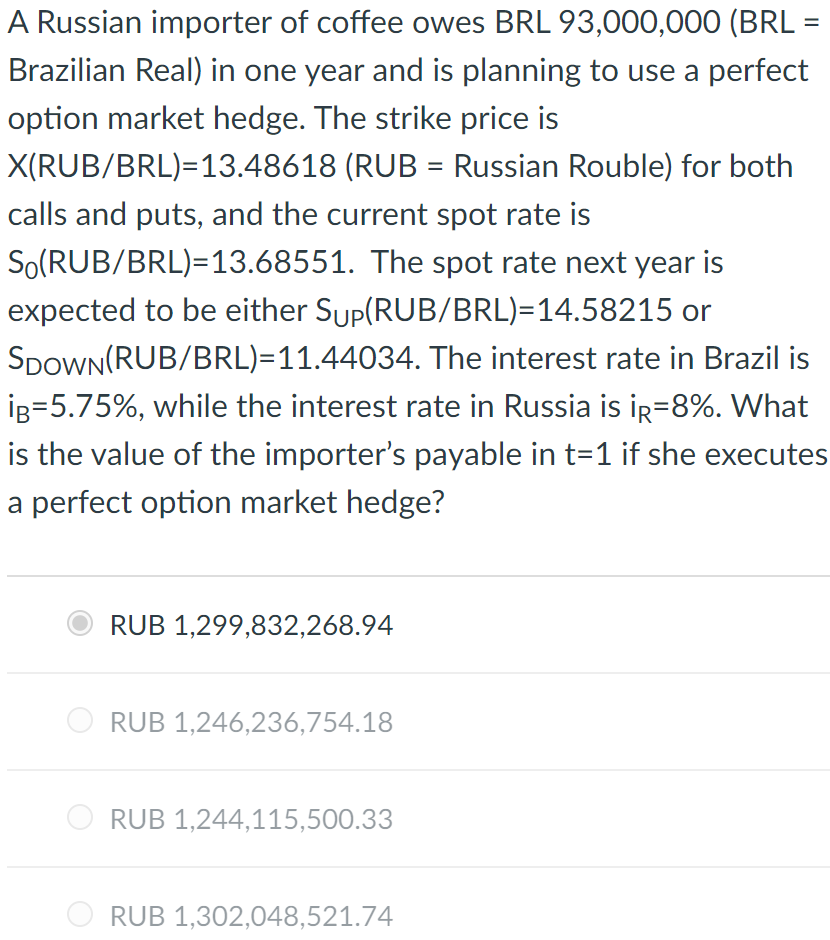

A Russian importer of coffee owes BRL 93,000,000 (BRL = Brazilian Real) in one year and is planning to use a perfect option market hedge. The strike price is X(RUB/BRL)=13.48618 (RUB - Russian Rouble) for both calls and puts, and the current spot rate is So(RUB/BRL)=13.68551. The spot rate next year is expected to be either Sup(RUB/BRL)=14.58215 or SpoWN(RUB/BRL)=11.44034. The interest rate in Brazil is b=5.75%, while the interest rate in Russia is ir=8%. What is the value of the importer's payable in t=1 if she executes a perfect option market hedge? RUB 1,299,832,268.94 RUB 1,246,236,754.18 RUB 1,244,115,500.33 RUB 1,302,048,521.74

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts