Question: I don't know how to set up this question. If someone could provide what equation/steps I would follow if all of these number were variables

I don't know how to set up this question. If someone could provide what equation/steps I would follow if all of these number were variables along with an explanation that would be perfect.

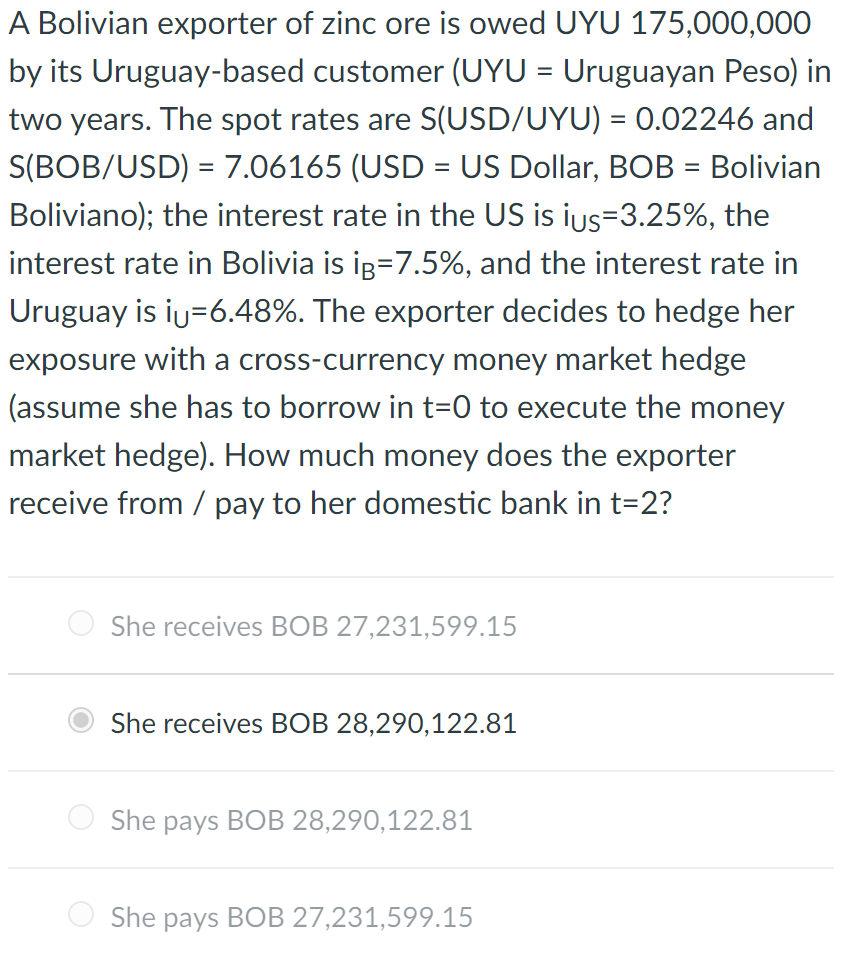

A Bolivian exporter of zinc ore is owed UYU 175,000,000 by its Uruguay-based customer (UYU = Uruguayan Peso) in two years. The spot rates are S(USD/UYU) = 0.02246 and S(BOB/USD) = 7.06165 (USD = US Dollar, BOB = Bolivian Boliviano); the interest rate in the US is ius=3.25%, the interest rate in Bolivia is ib=7.5%, and the interest rate in Uruguay is iu=6.48%. The exporter decides to hedge her exposure with a cross-currency money market hedge (assume she has to borrow in t=0 to execute the money market hedge). How much money does the exporter receive from / pay to her domestic bank in t=2? She receives BOB 27,231,599.15 She receives BOB 28,290,122.81 She pays BOB 28,290,122.81 She pays BOB 27,231,599.15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts