Question: I don't understand where I am going wrong. If you could explain how you found the answer it would be appreciated. (All of my answers

I don't understand where I am going wrong. If you could explain how you found the answer it would be appreciated. (All of my answers are correct except for #16 and #18).

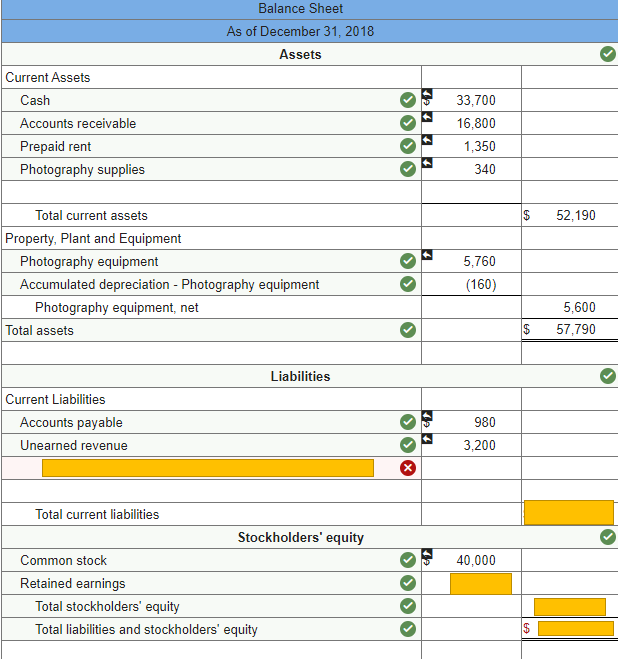

Getting these answers incorrect leads me to an incorrect Income Statement, Statement of Retained Earnings, and Balance Sheet (I have included the Income Statement, Statement of Retained Earnings, and Balance Sheet As Well. The Yellow boxes indicate incorrect answers) Red Rover is a photographer who has started a new photography business. On December 1, 2018, Rover decided to incorporate under the name Rover Head Photography. Rover has hired you to provide accounting services for the company. Read the instructions at the top of each tab. Prepare the required journal entries for the month of December, the necessary adjusting entries and closing entries as of December 31, and a complete set of financial statements, to include all proper labels.

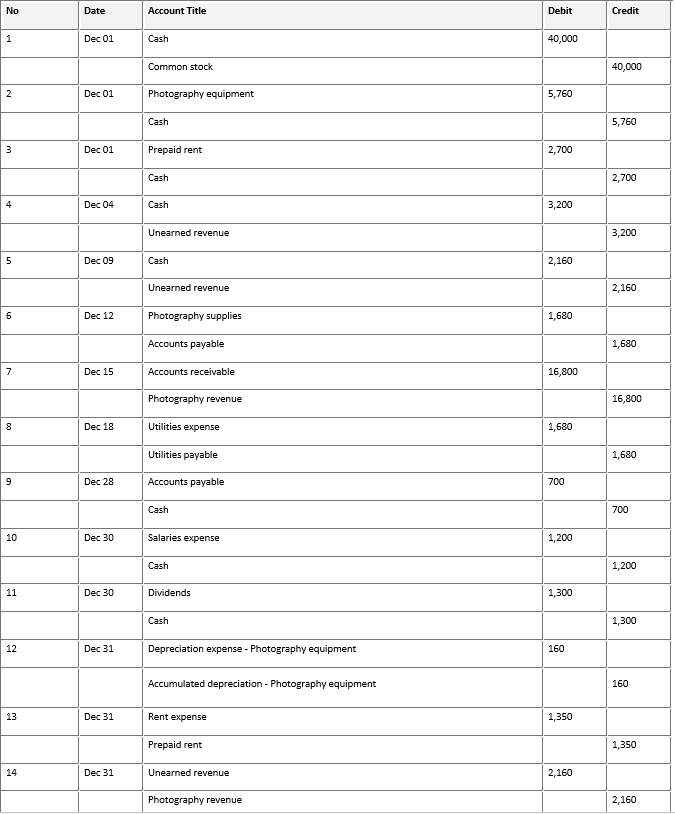

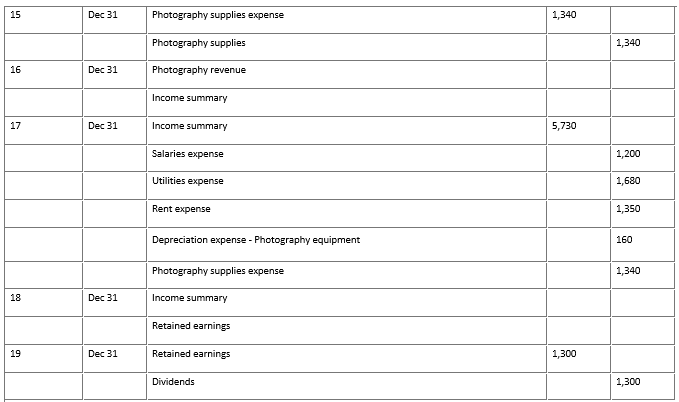

1. On December 1, Rover Head Photography issued 10,000 shares of common stock to Red Rover in exchange for $40,000 cash. 2. On December 1, Rover Head Photography purchased photography equipment for $5,760 3.On December 1, Rover Head Photography prepaid $2,700 for the first 2 month's rent for their photography studio. The company's policy is to initially record prepaid expenses and unearned revenues in balance sheet accounts. 4.On December 4, Rover Head Photography received a $3,200 deposit (partial payment) from New Jordan and Vinny Mozo for their June wedding. The company's policy is to initially record prepaid expenses and unearned revenues in balance sheet accounts. 5. On December 9, Rover Head Photography received $2,160 cash for full payment in advance from Edwin Twit for a late December photo shoot. 6. On December 12, Rover Head Photography purchased $1,680 of photography supplies on account. 7. On December 15, Rover Head Photography performed photography services for a local church and billed the client $16,800. 8. On December 18, Rover Head Photography received its electric bill (utilities) in the amount of $1,680. Payment is due on January 18. 9. On December 28, Rover Head Photography paid $700 on account 10. On December 30, Rover Head Photography paid $1,200 in staff assistant's salary for December. 11. On December 30, Rover Head Photography paid a $1,300 cash dividend 12. Information for adjusting entries: The photography equipment purchased on December 1 has an estimated useful age of 3 years and no residual value. Prepare the adjusting entry to record depreciation for the month of December. 13. Prepare the adjusting entry required for rent expired during December 14. Prepare the adjusting entry to record revenue earned from the photo shoot for Edwin Twit. Twit paid $2,160 in advance on December 9, and the service was completed late in December. 15. A physical count of photography supplies indicate that $340 of supplies are on hand as of December 31. Prepare the required adjusting entry, if any. 16. Prepare the entry to close the revenue account(s) to Income Summary 17. Prepare the entry to close the expense account(s) to Income summary. 18. Prepare the entry to close income summary. 19. Prepare the entry to close the dividends account.

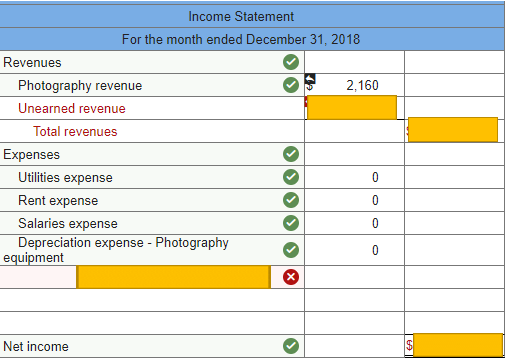

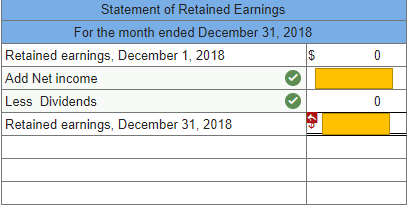

No Date Account Title Debit Credit 1 Dec 01 Cash 40,000 Common stock 40,000 2 Dec 01 Photography equipment 5,760 Cash 5,760 3 Dec 01 Prepaid rent 2,700 Cash 2,700 Dec 04 Cash 3,200 Unearned revenue 3,200 5 Dec 09 Cash 2,160 Unearned revenue 2,160 6 Dec 12 Photography supplies 1,680 Accounts payable 1,680 7 Dec 15 Accounts receivable 16,800 Photography revenue 16,800 8 Dec 18 Utilities expense 1,680 Utilities payable 1,680 9 Dec 28 Accounts payable 700 Cash 700 10 Dec 30 Salaries expense 1,200 Cash 1,200 11 Dec 30 Dividends 1,300 Cash 1,300 12 Dec 31 Depreciation expense - Photography equipment 160 Accumulated depreciation - Photography equipment 160 13 Dec 31 Rent expense 1,350 Prepaid rent 1,350 14 Dec 31 Unearned revenue 2,160 Photography revenue 2,160 15 Dec 31 Photography supplies expense 1,340 Photography supplies 1,340 16 Dec 31 Photography revenue Income summary 17 Dec 31 Income summary 5,730 Salaries expense 1,200 Utilities expense 1,680 Rent expense 1,350 Depreciation expense - Photography equipment 160 Photography supplies expense 1,340 18 Dec 31 Income summary Retained earnings 19 Dec 31 Retained earnings 1,300 Dividends 1,300 Income Statement For the month ended December 31, 2018 Revenues Photography revenue 2,160 Unearned revenue Total revenues Expenses Utilities expense 0 Rent expense 0 Salaries expense 0 Depreciation expense - Photography 0 equipment OOO Net income 0 Statement of Retained Earnings For the month ended December 31, 2018 Retained earnings, December 1, 2018 $ Add Net income Less Dividends Retained earnings, December 31, 2018 0 Balance Sheet As of December 31, 2018 Assets Current Assets Cash Accounts receivable Prepaid rent Photography supplies 33,700 16,800 1,350 340 $ 52,190 Total current assets Property, Plant and Equipment Photography equipment Accumulated depreciation - Photography equipment Photography equipment, net Total assets 5,760 (160) 5,600 57,790 $ Liabilities Current Liabilities Accounts payable Unearned revenue 980 3,200 40,000 Total current liabilities Stockholders' equity Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity CA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts