Question: i have completed these questions however i have no way of verifying if the answers are correct. please let me know with work so i

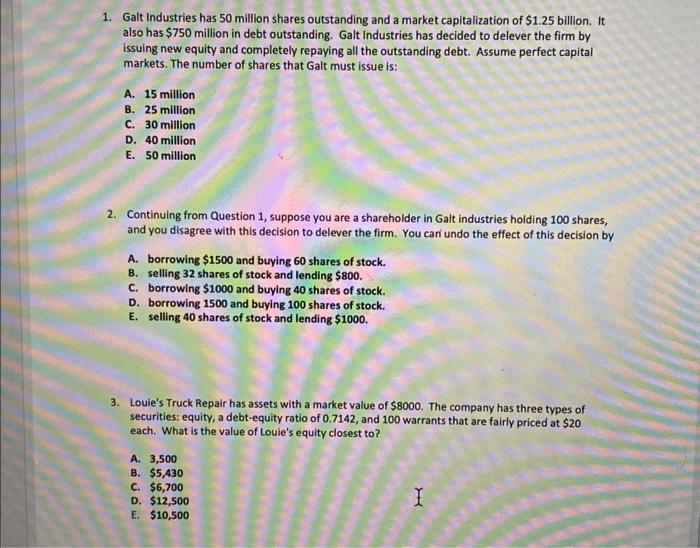

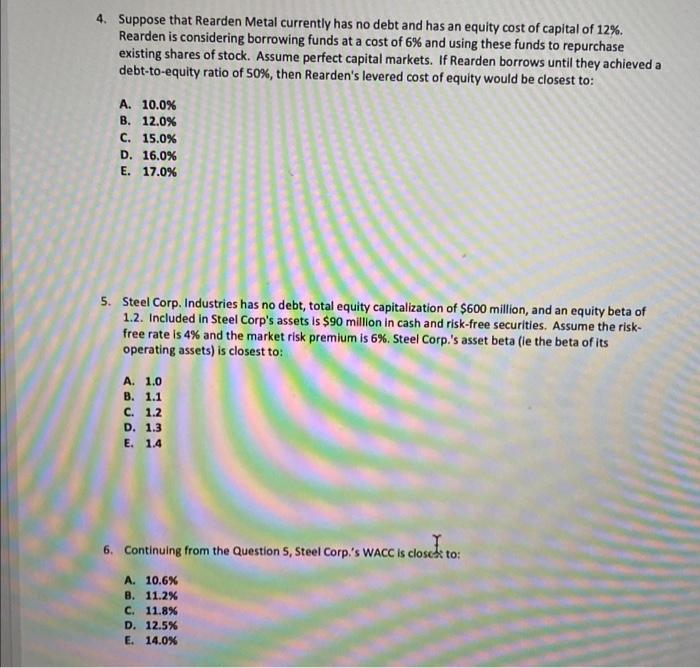

1. Galt Industries has 50 million shares outstanding and a market capitalization of $1.25 billion. It also has $750 million in debt outstanding. Galt Industries has decided to delever the firm by issuing new equity and completely repaying all the outstanding debt. Assume perfect capital markets. The number of shares that Galt must issue is: A. 15 million B. 25 million C. 30 million D. 40 million E. 50 million 2. Continuing from Question 1, suppose you are a shareholder in Galt industries holding 100 shares, and you disagree with this decision to delever the firm. You cari undo the effect of this decision by A. borrowing $1500 and buying 60 shares of stock. B. selling 32 shares of stock and lending $800. C. borrowing $1000 and buying 40 shares of stock. D. borrowing 1500 and buying 100 shares of stock. E. selling 40 shares of stock and lending $1000. 3. Louie's Truck Repair has assets with a market value of $8000. The company has three types of securities: equity, a debt-equity ratio of 0.7142 , and 100 warrants that are fairly priced at $20 each. What is the value of Louie's equity closest to? A. 3,500 B. $5,430 C. $6,700 D. $12,500 E. $10,500 4. Suppose that Rearden Metal currently has no debt and has an equity cost of capital of 12%. Rearden is considering borrowing funds at a cost of 6% and using these funds to repurchase existing shares of stock. Assume perfect capital markets. If Rearden borrows until they achieved a debt-to-equity ratio of 50%, then Rearden's levered cost of equity would be closest to: A. 10.0% B. 12.0% C. 15.0% D. 16.0% E. 17.0% 5. Steel Corp. Industries has no debt, total equity capitalization of $600 million, and an equity beta of 1.2. Included in Steel Corp's assets is $90 million in cash and risk-free securities. Assume the riskfree rate is 4% and the market risk premium is 6%. Steel Corp.'s asset beta (ie the beta of its operating assets) is closest to: A. 1.0 B. 1.1 C. 1.2 D. 1.3 E. 1.4 6. Continuing from the Question 5 , Steel Corp.'s WACC is close 5 to: A. 10.6% B. 11.2% C. 11.8% D. 12.5% E. 14.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts