Question: I have provided what I have so far, please help me with #4 and on if possible, thanks!!! A portfolio manager is considering the benefits

I have provided what I have so far, please help me with #4 and on if possible, thanks!!!

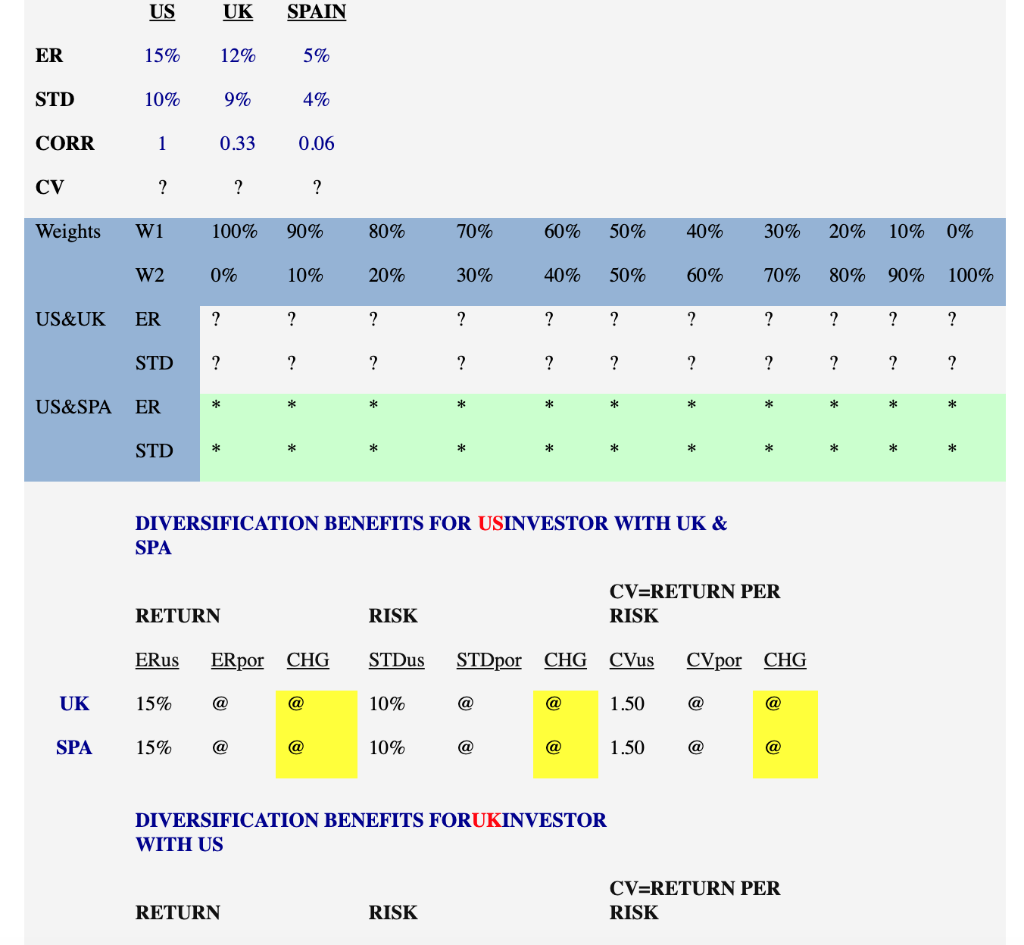

A portfolio manager is considering the benefits of increasing her diversification by investing overseas. She can purchase shares in individual country funds with the expected return (ER), standard deviation (STD) and correlations (CORR) characteristic provided above.

Initially assume that exchange rate between $ and Pound and $ and Euro is expected to be stable (no change during the year).

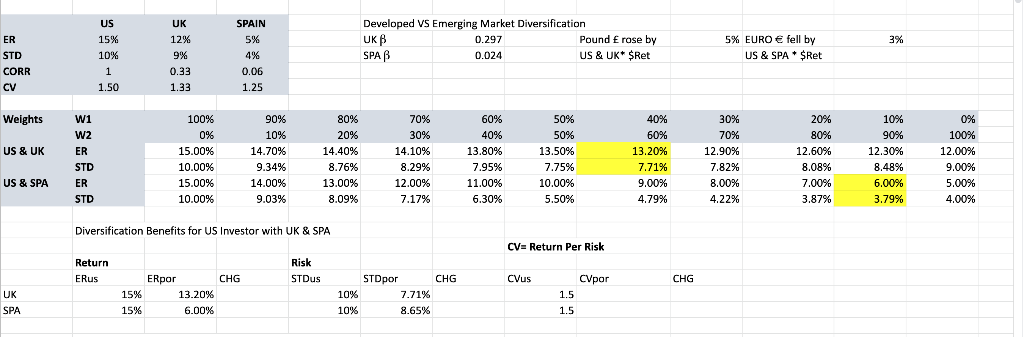

1. What are the expected returns and standard deviations of returns of US&UK portfolios with different mixes such as 100% invested in US, 0% in UK; 90% invested in US, 10% in UK; 80% invested in US, 20% in UK;; 10% invested in US, 90% in UK; 0% invested in US, 100% in UK? Replace ?s with the right info at the above table with the help of Excel formulas.

2. What are the expected returns and standard deviations of returns of US & Spain portfolios with different mixes such as 100% invested in US, 0% in Spain; 90% invested in US, 10% in Spain; 80% invested in US, 20% in Spain;; 10% invested in US, 90% in Spain; 0% invested in US, 100% in Spain? Replace *s with the right info at the above table with the help of Excel formulas.

3. Plot these two sets of risk-return combinations as in the case at the back (one for US&UK and another for US & Spain portfolio).

4. Which combination leads to a better risk and return (the most efficient) choice from a US investor perspective [answer by calculating the changes (CHG) in ER (return improvement), STD (risk reduction) and CV (coefficient of variation return per unit of risk) and by replacing @s]. From UK investor perspective (replace #s)? From Spanish investor perspective (replace !s). Explain your answers.

5. What is the beta of the British market from a U.S. perspective? What is the beta of the Spanish market from a U.S. perspective?

6. Assume now that the British pound appreciated by %5 against dollar by the end of the year. What would the realized percentage dollar return be if the US investor had invested in the most efficient US & UK portfolio?

7. Assume also that euro depreciated by %3 against dollar by the end of the year. What would the realized percentage dollar return be if the US investor had invested in the most efficient US & Spanish portfolio?

ER STD CORR CV Weights W1 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% US UK SPAIN 15% 12% 10% 9% 5% 4% 0.330.06 W2 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% US&UK ER STD? US&SPA ER STD * DIVERSIFICATION BENEFITS FOR USINVESTOR WITH UK & SPA CV-RETURN PER RISK RETURN ERus ERpor CHG STDus STDpor CHG CVus CVpor CHG 15% @ RISK UK 10% 1.50@ SPA 15% @ 10% 1.50@ DIVERSIFICATION BENEFITS FORUKINVESTOR WITH US CV=RETURN PER RISK RETURN RISK Developed VS Emerging Market Diversification US 15% 10% SPAIN 12% 9% 0.33 1.33 0.297 Pound rase by US & UK* $Ret 5% EURO fell by SPA B US & SPA $Ret STD CORR CV 0.024 0.06 1.25 1.50 Weights 100% 096 15.00% 10.00% 15.00% 10.00% 80% 20% 14.40% 8.76% 13.00% 8.09% 60% 40% 13.80% 7.95% 11.00% 6.30% W1 W2 90% 10% 14.70% 9.34% 14.00% 9.03% 70% 30% 14.10% 8.29% 12.00% 717% 50% 50% 13.50% 7 75% 10.00% 5.50% 10% 60% 13.20% 7.71% 9.00% 4.79% 0% 100% 12.00% 9.00% 5.00% 4.00% US & UK 12.90% 7.82% 8.00% 4.22% 12.60% 8.08% 7.00% 3.87% 12.30% 8.48% 6.00% 3.79% STD US & SPA Diversification Benefits for US Investor with UK & SPA CV- Return Per Risk Risk STDus Return ERpor CHG STDpor CHG CVpor CHG UK SPA 13.20% 6.00% 10% 10% 15% 7.71% 15% 8.65% ER STD CORR CV Weights W1 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% US UK SPAIN 15% 12% 10% 9% 5% 4% 0.330.06 W2 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% US&UK ER STD? US&SPA ER STD * DIVERSIFICATION BENEFITS FOR USINVESTOR WITH UK & SPA CV-RETURN PER RISK RETURN ERus ERpor CHG STDus STDpor CHG CVus CVpor CHG 15% @ RISK UK 10% 1.50@ SPA 15% @ 10% 1.50@ DIVERSIFICATION BENEFITS FORUKINVESTOR WITH US CV=RETURN PER RISK RETURN RISK Developed VS Emerging Market Diversification US 15% 10% SPAIN 12% 9% 0.33 1.33 0.297 Pound rase by US & UK* $Ret 5% EURO fell by SPA B US & SPA $Ret STD CORR CV 0.024 0.06 1.25 1.50 Weights 100% 096 15.00% 10.00% 15.00% 10.00% 80% 20% 14.40% 8.76% 13.00% 8.09% 60% 40% 13.80% 7.95% 11.00% 6.30% W1 W2 90% 10% 14.70% 9.34% 14.00% 9.03% 70% 30% 14.10% 8.29% 12.00% 717% 50% 50% 13.50% 7 75% 10.00% 5.50% 10% 60% 13.20% 7.71% 9.00% 4.79% 0% 100% 12.00% 9.00% 5.00% 4.00% US & UK 12.90% 7.82% 8.00% 4.22% 12.60% 8.08% 7.00% 3.87% 12.30% 8.48% 6.00% 3.79% STD US & SPA Diversification Benefits for US Investor with UK & SPA CV- Return Per Risk Risk STDus Return ERpor CHG STDpor CHG CVpor CHG UK SPA 13.20% 6.00% 10% 10% 15% 7.71% 15% 8.65%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts