Question: Question Four (7 marks) Jak Shoe Making Plc is currently trying to calculate its weighted average cost of capital. As the company's finance director, you

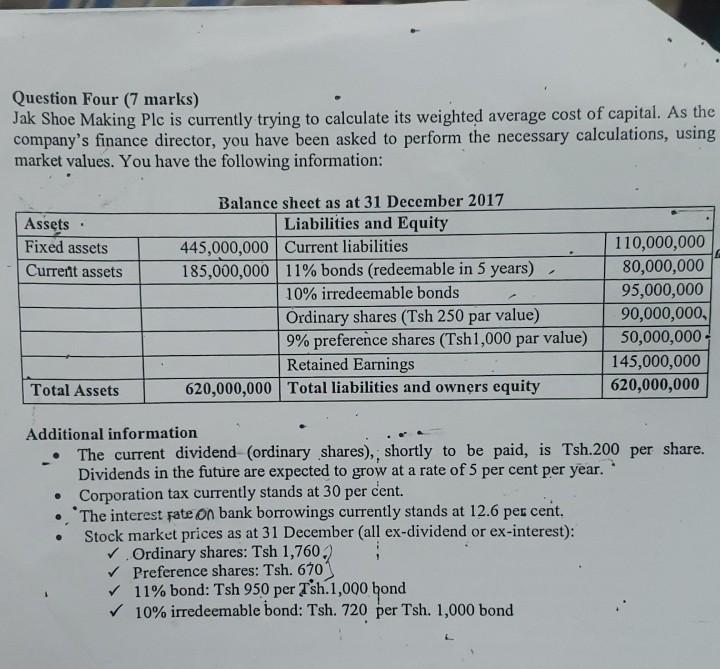

Question Four (7 marks) Jak Shoe Making Plc is currently trying to calculate its weighted average cost of capital. As the company's finance director, you have been asked to perform the necessary calculations, using market values. You have the following information: Assets Fixed assets Current assets Balance sheet as at 31 December 2017 Liabilities and Equity 445,000,000 Current liabilities 185,000,000 11% bonds (redeemable in 5 years) 10% irredeemable bonds Ordinary shares (Tsh 250 par value) 9% preference shares (Tsh1,000 par value) Retained Earnings 620,000,000 Total liabilities and owners equity 110,000,000 80,000,000 95,000,000 90,000,000 50,000,000 145,000,000 620,000,000 Total Assets cent. . Additional information The current dividend (ordinary shares),, shortly to be paid, is Tsh.200 per share. Dividends in the future are expected to grow at a rate of 5 per cent per year. Corporation tax currently stands at 30 per The interest rate on bank borrowings currently stands at 12.6 per cent. Stock market prices as at 31 December (all ex-dividend or ex-interest): Ordinary shares: Tsh 1,760,2 Preference shares: Tsh. 670 11% bond: Tsh 950 per Tsh 1,000 hond 10% irredeemable bond: Tsh. 720 per Tsh. 1,000 bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts