Question: I have this homework to do and I need it asap however I'm not interested in excel calculations, I need written step by step please.

I have this homework to do and I need it asap however I'm not interested in excel calculations, I need written step by step please.

I have this homework to do and I need it asap however I'm not interested in excel calculations, I need written step by step please.

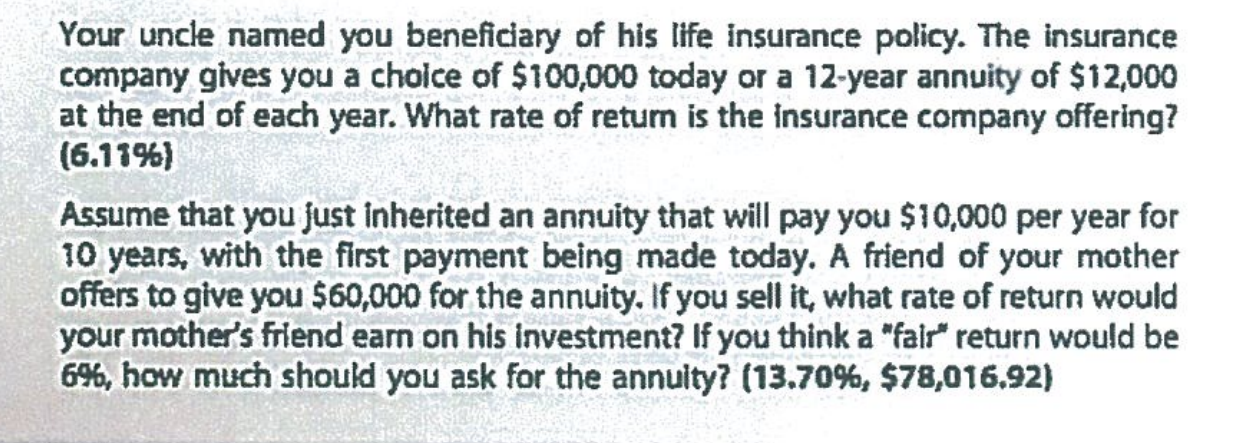

Your uncle named you beneficiary of his life insurance policy. The insurance company gives you a choice of $100,000 today or a 12-year annuity of $12,000 at the end of each year. What rate of return is the insurance company offering? (6.11%) Assume that you just inherited an annuity that will pay you $10,000 per year for 10 years, with the first payment being made today. A friend of your mother offers to give you $60,000 for the annuity. If you sell it, what rate of return would your mother's friend earn on his investment? If you think a "fair return would be 6%, how much should you ask for the annuity? (13.70%, $78,016.92)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts