Question: I just dont understand what is going on. Please help 8-Cost of Capita Example: Calculating break points ni Corporaiine costs for the Omni Corporation is

I just dont understand what is going on. Please help

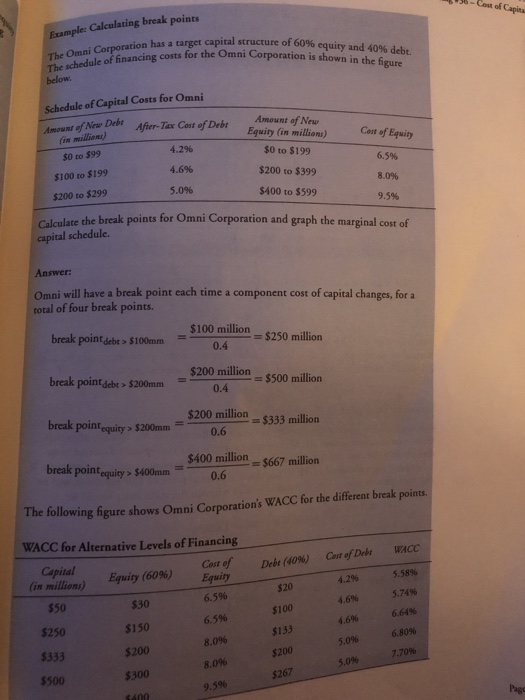

I just dont understand what is going on. Please help8-Cost of Capita Example: Calculating break points ni Corporaiine costs for the Omni Corporation is shown in the figure has a target capital structure of 60% of financing costs equity and 40% debt. The schedule below Schedule of Capital Costs for Omni Amount of New Deb Amount of New in millions $0 to $99 $100 to $199 $200 to $299 Afier-Tax Cast of Debr 4.296 4.6% 5.0% Equity (in millions) $0 to $199 $200 to $399 $400 to $599 Cost of Equity 6.5% 8.0% 9, 5% Calculate the break points for Omni Corporation and graph the marginal cost of capital schedule. Answer Omni will have a break point each time a component cost of capital changes, for a total of four break points. break point debe $100mm 100 million $250 million 0.4 $200 million 0.4 pointdebt >$200mm$500 million break point equiry $200mm00 mion $333 million 0.6 Eequiry >$400mm9400 milin $667 million following fgure shows Omni Corporation's WACC for the differetbreak poins WACC for Alternative Levels of Financing in millions) WACC 5.58% 5.74% 664% 6.80% Capital Equity (609%) Equity Cest ofDebt 4.2% 4.6% 4.6% 5.0% 5.0% Cost of Debt (40%) $50 $250 $333 $500 $30 $150 $200 $300 6.5% 6.5% 8.0% 8.09% 9.5% $20 $100 $133 200 0 5267 770% Page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts