Question: I just need help with 2. and 3. 2. Ben wants to take a long position in a futures contract for cor. He calls his

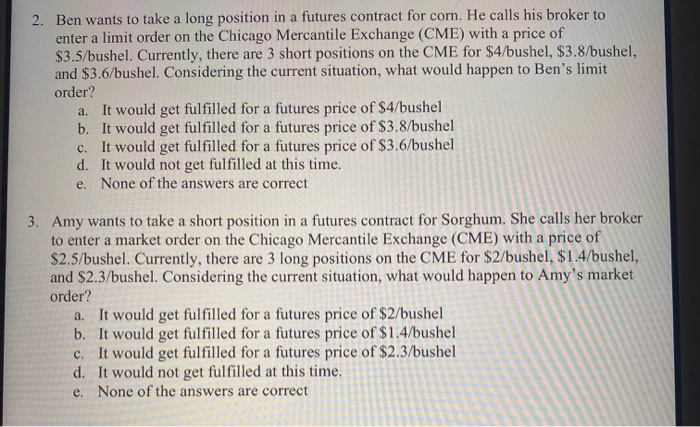

2. Ben wants to take a long position in a futures contract for cor. He calls his broker to enter a limit order on the Chicago Mercantile Exchange (CME) with a price of $3.5/bushel. Currently, there are 3 short positions on the CME for $4/bushel, $3.8/bushel, and $3.6/bushel. Considering the current situation, what would happen to Ben's limit order? a. It would get fulfilled for a futures price of $4/bushel b. It would get fulfilled for a futures price of $3.8/bushel c. It would get fulfilled for a futures price of $3.6/bushel d. It would not get fulfilled at this time. e. None of the answers are correct 3. Amy wants to take a short position in a futures contract for Sorghum. She calls her broker to enter a market order on the Chicago Mercantile Exchange (CME) with a price of $2.5/bushel. Currently, there are 3 long positions on the CME for $2/bushel, $1.4/bushel, and $2.3/bushel. Considering the current situation, what would happen to Amy's market order? a. It would get fulfilled for a futures price of $2/bushel b. It would get fulfilled for a futures price of $1.4/bushel c. It would get fulfilled for a futures price of $2.3/bushel d. It would not get fulfilled at this time. e. None of the answers are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts