Question: I just need the answer from the empty textbox. AAA Hardware uses the LIFO method to report its inventory. Inventory at the beginning of the

I just need the answer from the empty textbox.

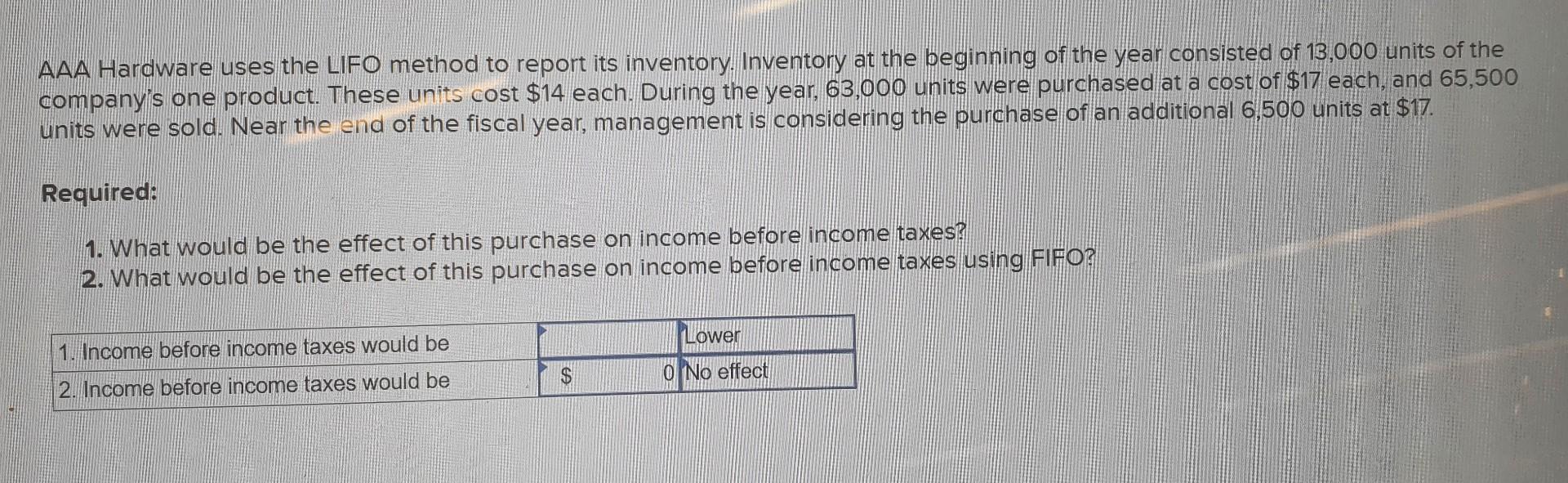

AAA Hardware uses the LIFO method to report its inventory. Inventory at the beginning of the year consisted of 13,000 units of the company's one product. These units cost $14 each. During the year, 63,000 units were purchased at a cost of $17 each, and 65,500 units were sold. Near the end of the fiscal year, management is considering the purchase of an additional 6,500 units at $17. Required: 1. What would be the effect of this purchase on income before income taxes? 2. What would be the effect of this purchase on income before income taxes using FIFO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts