Question: I just need to to have solution and answer for this. Will give good feedback for those who can help14.B is the answer 14. Arcie

I just need to to have solution and answer for this. Will give good feedback for those who can help14.B is the answer

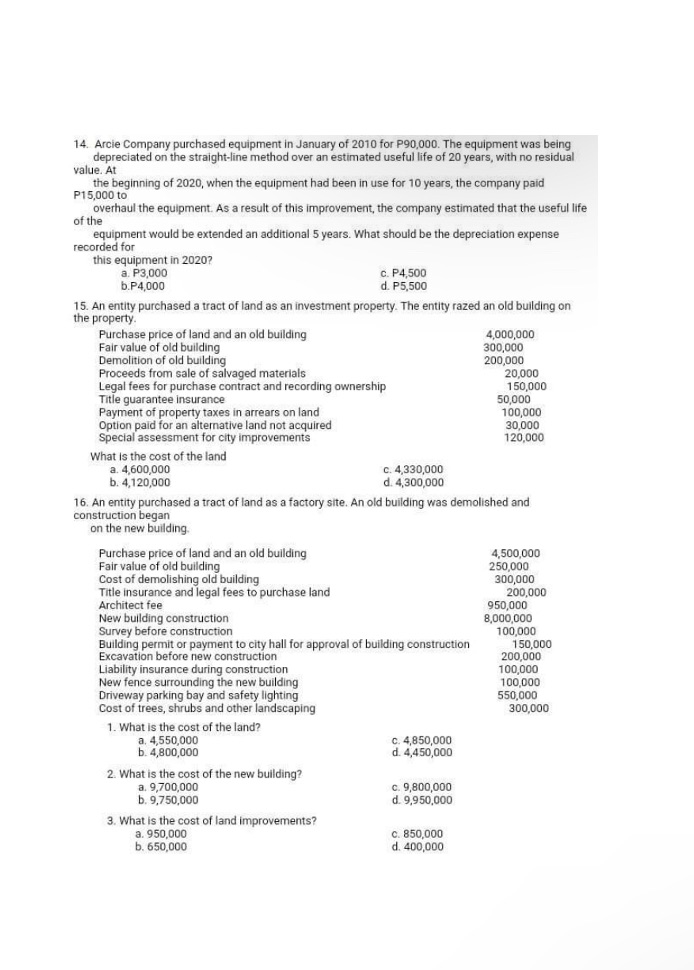

14. Arcie Company purchased equipment in January of 2010 for P90,000. The equipment was being depreciated on the straight-line method over an estimated useful life of 20 years, with no residual value. At the beginning of 2020, when the equipment had been in use for 10 years, the company paid P15,000 to overhaul the equipment. As a result of this improvement, the company estimated that the useful life of the equipment would be extended an additional 5 years. What should be the depreciation expense recorded for this equipment in 2020? a. P3,000 C. P4,500 b.P4,000 d. P5,500 15. An entity purchased a tract of land as an investment property. The entity razed an old building on the property. Purchase price of land and an old building 4,000,000 Fair value of old building 300,000 Demolition of old building 200,000 Proceeds from sale of salvaged materials 20,000 Legal fees for purchase contract and recording ownership 150,000 Title guarantee insurance 50,000 Payment of property taxes in arrears on land 100,000 Option paid for an alternative land not acquired 30,000 Special assessment for city improvements 120,000 What is the cost of the land a. 4,600,000 c. 4,330,000 b. 4,120,000 d. 4,300,000 16. An entity purchased a tract of land as a factory site. An old building was demolished and construction began on the new building Purchase price of land and an old building 4,500,000 Fair value of old building 250,000 Cost of demolishing old building 300,000 Title insurance and legal fees to purchase land 200.000 Architect fee 950,000 New building construction 8,000,000 Survey before construction 100,000 Building permit or payment to city hall for approval of building construction 150,000 Excavation before new construction 200,000 Liability insurance during construction 100,000 New fence surrounding the new building 100,000 Driveway parking bay and safety lighting 550,000 Cost of trees, shrubs and other landscaping 300,000 1. What is the cost of the land? a, 4,550,000 C. 4,850,000 6. 4,800,000 d. 4,450,000 2. What is the cost of the new building? a. 9,700,000 C. 9,800,000 b. 9,750,000 d. 9,950,000 3. What is the cost of land improvements? a. 950,000 c. 850,000 b. 650,000 d. 400,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts