Question: I know that the correct answer is the letter C, but I need the work for this exercise. Rough & Tumble Clothiers is considering the

I know that the correct answer is the letter C, but I need the work for this exercise.

I know that the correct answer is the letter C, but I need the work for this exercise.

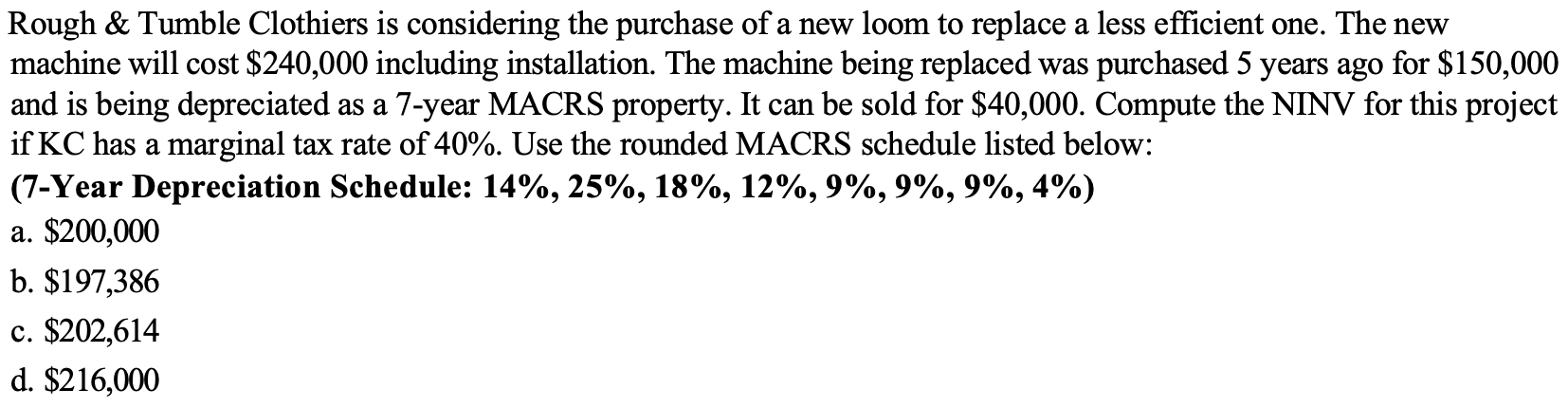

Rough & Tumble Clothiers is considering the purchase of a new loom to replace a less efficient one. The new machine will cost $240,000 including installation. The machine being replaced was purchased 5 years ago for $150,000 and is being depreciated as a 7-year MACRS property. It can be sold for $40,000. Compute the NINV for this project if KC has a marginal tax rate of 40%. Use the rounded MACRS schedule listed below: (7-Year Depreciation Schedule: 14%, 25%, 18%, 12%, 9%, 9%, 9%, 4%) a. $200,000 b. $197,386 c. $202,614 d. $216,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts