Question: I know the answer. Can you just explain why the first answer is false and the rest are true briefly? Which of the following is

I know the answer. Can you just explain why the first answer is false and the rest are true briefly?

I know the answer. Can you just explain why the first answer is false and the rest are true briefly?

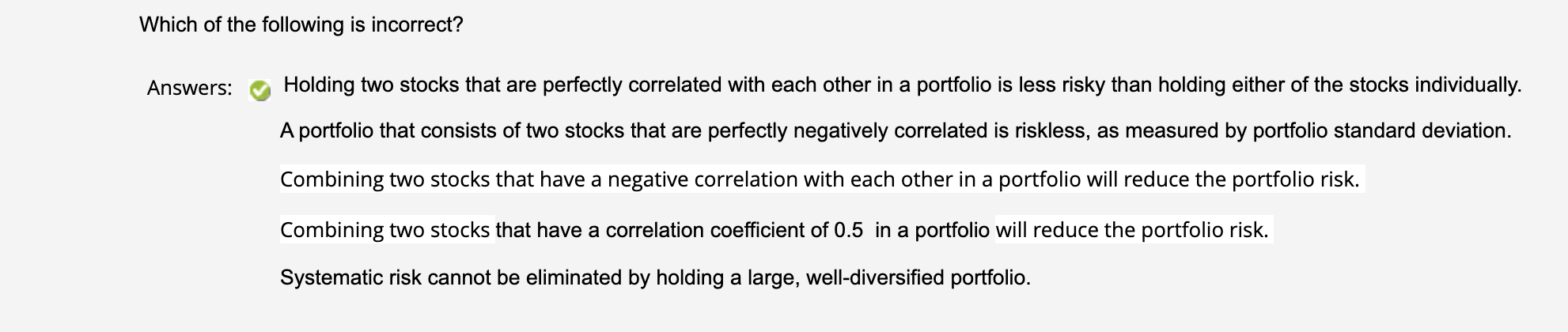

Which of the following is incorrect? Answers: Holding two stocks that are perfectly correlated with each other in a portfolio is less risky than holding either of the stocks individually. A portfolio that consists of two stocks that are perfectly negatively correlated is riskless, as measured by portfolio standard deviation. Combining two stocks that have a negative correlation with each other in a portfolio will reduce the portfolio risk. Combining two stocks that have a correlation coefficient of 0.5 in a portfolio will reduce the portfolio risk. Systematic risk cannot be eliminated by holding a large, well-diversified portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts