Question: i know the answer is 213 but cannot figure out how to do it. please explain withoht excel 2. A project costs $60,000 and will

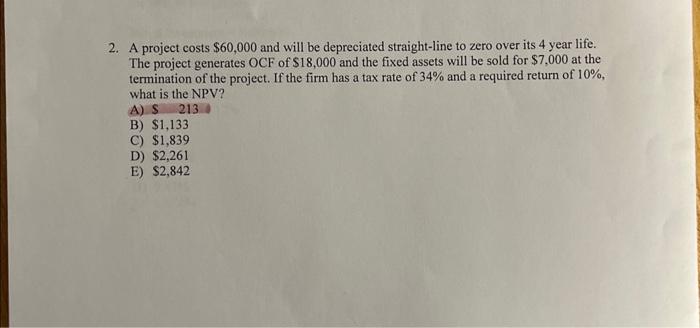

2. A project costs $60,000 and will be depreciated straight-line to zero over its 4 year life. The project generates OCF of $18,000 and the fixed assets will be sold for $7,000 at the termination of the project. If the firm has a tax rate of 34% and a required return of 10%, what is the NPV? A) $213 B) $1,133 C) $1,839 D) $2,261 E) $2,842

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts