Question: I need a correct answer The and tax avoidance. Table 11.2: Difference between Tax Avoidance and Tax Evasion Tax Avoidance Tax Evasion Tax evasion means

I need a correct answer

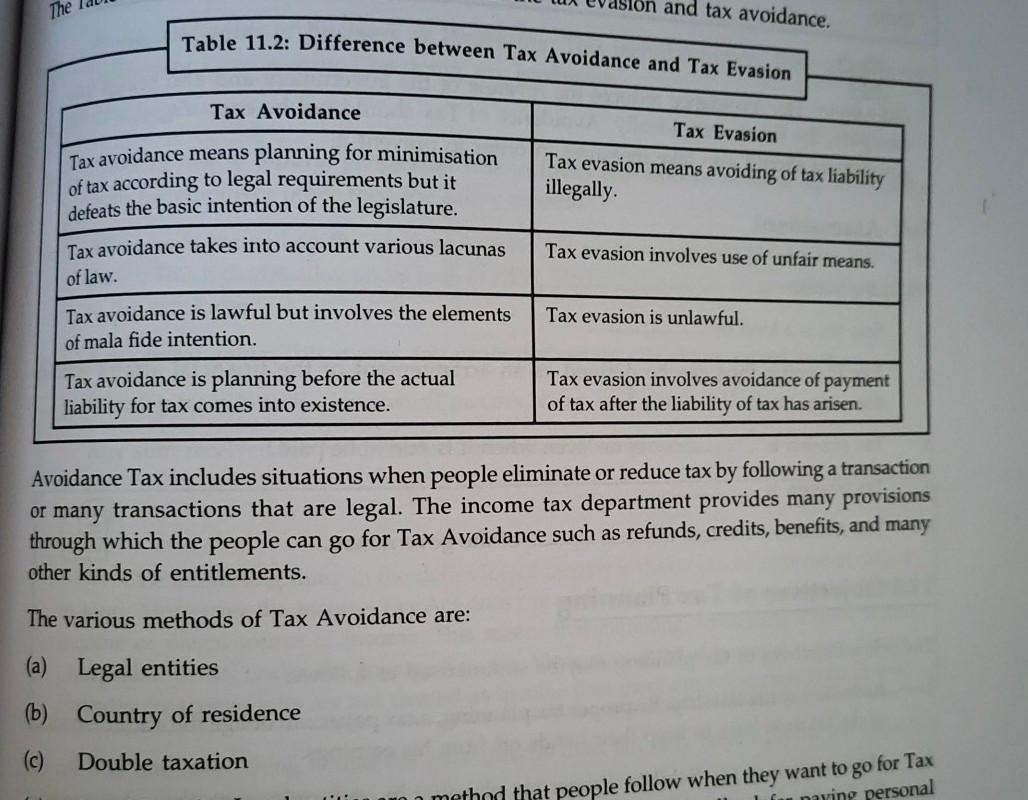

The and tax avoidance. Table 11.2: Difference between Tax Avoidance and Tax Evasion Tax Avoidance Tax Evasion Tax evasion means avoiding of tax liability illegally. Tax avoidance means planning for minimisation of tax according to legal requirements but it defeats the basic intention of the legislature. Tax avoidance takes into account various lacunas Tax evasion involves use of unfair means. of law. Tax evasion is unlawful. Tax avoidance is lawful but involves the elements of mala fide intention. Tax avoidance is planning before the actual liability for tax comes into existence. Tax evasion involves avoidance of payment of tax after the liability of tax has arisen. Avoidance Tax includes situations when people eliminate or reduce tax by following a transaction or many transactions that are legal. The income tax department provides many provisions through which the people can go for Tax Avoidance such as refunds, credits, benefits, and many other kinds of entitlements. The various methods of Tax Avoidance are: (a) Legal entities (b) Country of residence (c) Double taxation mo method that people follow when they want to go for Tax maying personalStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock