Question: I need a regression for Tesla (TSLA) against returns on market index (more info below) thank you :) Part IV-Estimating the Cost of Capital 1.

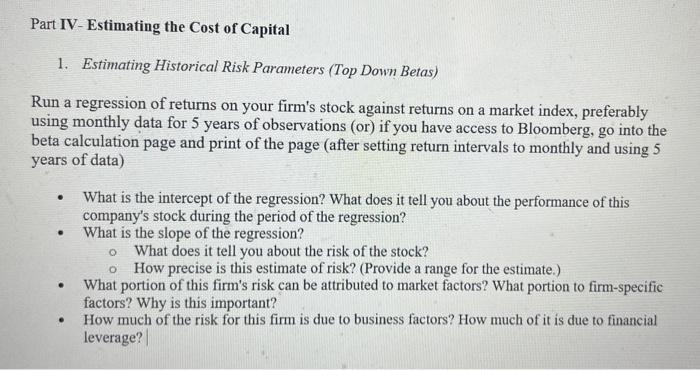

Part IV-Estimating the Cost of Capital 1. Estimating Historical Risk Parameters (Top Down Betas) Run a regression of returns on your firm's stock against returns on a market index, preferably using monthly data for 5 years of observations (or) if you have access to Bloomberg, go into the beta calculation page and print of the page (after setting return intervals to monthly and using 5 years of data) - What is the intercept of the regression? What does it tell you about the performance of this company's stock during the period of the regression? - What is the slope of the regression? - What does it tell you about the risk of the stock? - How precise is this estimate of risk? (Provide a range for the estimate.) - What portion of this firm's risk can be attributed to market factors? What portion to firm-specific factors? Why is this important? - How much of the risk for this firm is due to business factors? How much of it is due to financial leverage? Part IV-Estimating the Cost of Capital 1. Estimating Historical Risk Parameters (Top Down Betas) Run a regression of returns on your firm's stock against returns on a market index, preferably using monthly data for 5 years of observations (or) if you have access to Bloomberg, go into the beta calculation page and print of the page (after setting return intervals to monthly and using 5 years of data) - What is the intercept of the regression? What does it tell you about the performance of this company's stock during the period of the regression? - What is the slope of the regression? - What does it tell you about the risk of the stock? - How precise is this estimate of risk? (Provide a range for the estimate.) - What portion of this firm's risk can be attributed to market factors? What portion to firm-specific factors? Why is this important? - How much of the risk for this firm is due to business factors? How much of it is due to financial leverage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts