Question: I NEED CALCULATION STEPS FOR THESE PLEASE!!! THANK YOU!! Samuel & Sons is a fixed-income specialty firm that offers advisory services to investment management companies.

I NEED CALCULATION STEPS FOR THESE PLEASE!!! THANK YOU!!

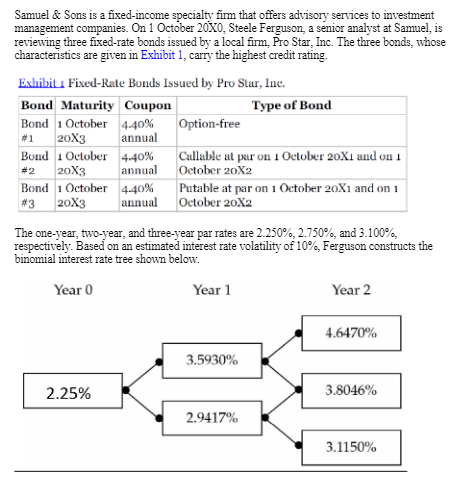

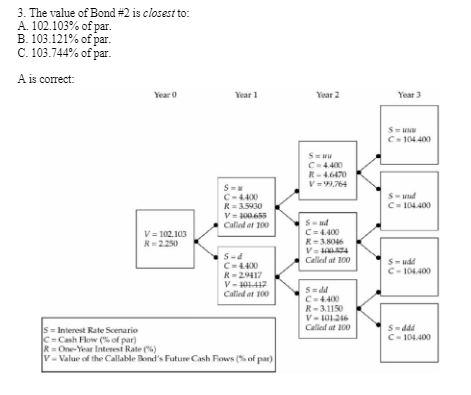

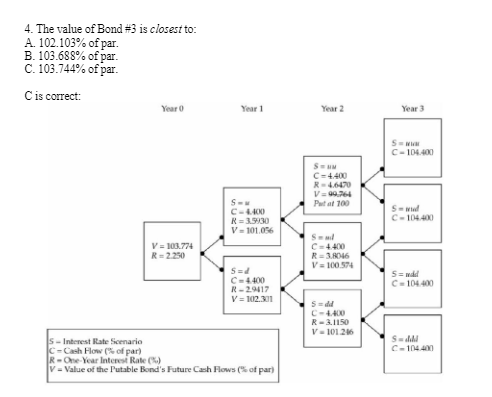

Samuel & Sons is a fixed-income specialty firm that offers advisory services to investment management companies. On 1 October 20X0, Steele Ferguson, a senior analyst at Samuel, is reviewing three fixed-rate bonds issued by a local firm, Pro Star, Inc. The three bonds, whose characteristics are given in Exhibit 1, carry the highest credit rating. Exhibit 1 Fixed-Rate Bonds Issued by Pro Star, Inc. Bond Maturity Coupon Type of Bond Option-free Bond 1 October 4-40% #1 20X3 annual 4.40% Bond 1 October 20X3 Callable at par on 1 October 20X1 and on 1 October 20X2 # 2 annual Bond 1 October 4.40% Putable at par on 1 October 20X1 and on 1 October 20X2 #3 20X3 annual The one-year, two-year, and three-year par rates are 2.250%, 2.750%, and 3.100%, respectively. Based on an estimated interest rate volatility of 10%, Ferguson constructs the binomial interest rate tree shown below. Year 0 Year 1 Year 2 4.6470% 3.5930% 2.25% 3.8046% 2.9417% 3.1150% 3. The value of Bond #2 is closest to: A. 102.103% of par. B. 103.121% of par. C. 103.744% of par. A is correct: Year 0 V = 102.103 R=2.250 Year 1 S= C-4400 R=3.5930 V=100.655 Called at 100 S-d C-4400 R=29417 V-101.417 Called at 100 S=Interest Rate Scenario C-Cash Flow (% of par) R=One-Year Interest Rate(%) V-Value of the Callable Bond's Future Cash Flows (% of par) Year 2 S=uu C-4.400 R-4.6470 V=99,764 S-ud C=4.400 R-3.8046 V=400474 Called at 100 S=dd C=4.400 R-3.1150 V-101.246 Called at 100 Year 3 S=www C=104.400 S- und C=104.400 S-udd C-104.400 S=ddd C-104.400 4. The value of Bond #3 is closest to: A. 102.103% of par. B. 103.688% of par. C. 103.744% of par. C is correct: Year 0 V = 103.774 R=2.250 Year 1 S-M C-4400 R=3.9930 V-101.056 Sud C-4400 R-29417 V=102.301 S-Interest Rate Scenario C-Cash Flow (% of par) R-One-Year Interest Rate(%) V-Value of the Putable Bond's Future Cash Flows (% of par) Year 2 S=UM C=4.400 R-4.6470 V=99,764 Put at 100 Smad C-4400 R=3.8046 V=100.574 S=dd C-4,400 R-3.1150 V-101246 Year 3 5= www C-104.400 S-aud C-104.400 S=udd C-104 400 S-dill C-104.400 Samuel & Sons is a fixed-income specialty firm that offers advisory services to investment management companies. On 1 October 20X0, Steele Ferguson, a senior analyst at Samuel, is reviewing three fixed-rate bonds issued by a local firm, Pro Star, Inc. The three bonds, whose characteristics are given in Exhibit 1, carry the highest credit rating. Exhibit 1 Fixed-Rate Bonds Issued by Pro Star, Inc. Bond Maturity Coupon Type of Bond Option-free Bond 1 October 4-40% #1 20X3 annual 4.40% Bond 1 October 20X3 Callable at par on 1 October 20X1 and on 1 October 20X2 # 2 annual Bond 1 October 4.40% Putable at par on 1 October 20X1 and on 1 October 20X2 #3 20X3 annual The one-year, two-year, and three-year par rates are 2.250%, 2.750%, and 3.100%, respectively. Based on an estimated interest rate volatility of 10%, Ferguson constructs the binomial interest rate tree shown below. Year 0 Year 1 Year 2 4.6470% 3.5930% 2.25% 3.8046% 2.9417% 3.1150% 3. The value of Bond #2 is closest to: A. 102.103% of par. B. 103.121% of par. C. 103.744% of par. A is correct: Year 0 V = 102.103 R=2.250 Year 1 S= C-4400 R=3.5930 V=100.655 Called at 100 S-d C-4400 R=29417 V-101.417 Called at 100 S=Interest Rate Scenario C-Cash Flow (% of par) R=One-Year Interest Rate(%) V-Value of the Callable Bond's Future Cash Flows (% of par) Year 2 S=uu C-4.400 R-4.6470 V=99,764 S-ud C=4.400 R-3.8046 V=400474 Called at 100 S=dd C=4.400 R-3.1150 V-101.246 Called at 100 Year 3 S=www C=104.400 S- und C=104.400 S-udd C-104.400 S=ddd C-104.400 4. The value of Bond #3 is closest to: A. 102.103% of par. B. 103.688% of par. C. 103.744% of par. C is correct: Year 0 V = 103.774 R=2.250 Year 1 S-M C-4400 R=3.9930 V-101.056 Sud C-4400 R-29417 V=102.301 S-Interest Rate Scenario C-Cash Flow (% of par) R-One-Year Interest Rate(%) V-Value of the Putable Bond's Future Cash Flows (% of par) Year 2 S=UM C=4.400 R-4.6470 V=99,764 Put at 100 Smad C-4400 R=3.8046 V=100.574 S=dd C-4,400 R-3.1150 V-101246 Year 3 5= www C-104.400 S-aud C-104.400 S=udd C-104 400 S-dill C-104.400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts