Question: I need clarifying step by step , how did we get these answers You are given the following information Spot exchange rate (CAD/GBP) 2.42 Forward

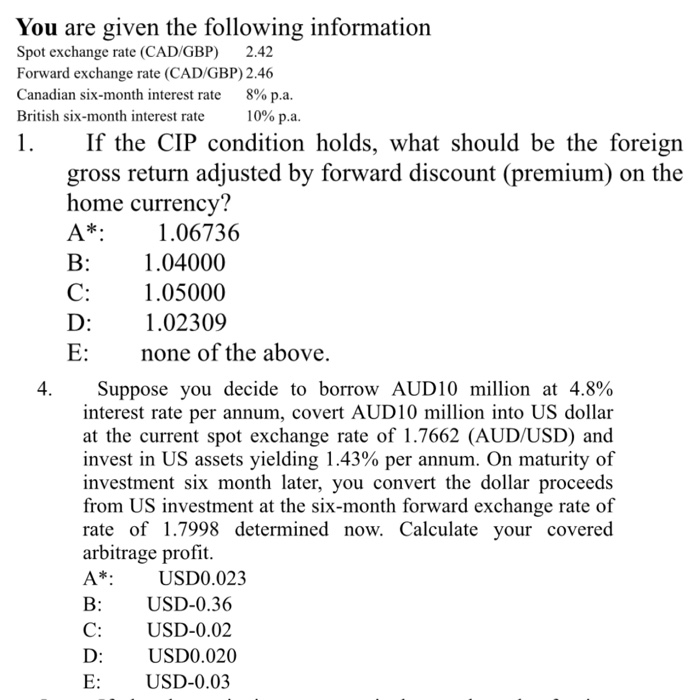

You are given the following information Spot exchange rate (CAD/GBP) 2.42 Forward exchange rate (CAD/GBP) 2.46 Canadian six-month interest rate 8% pa. British six-month interest rate 10% p.a If the CIP condition holds, what should be the foreign gross return adjusted by forward discount (premium) on the home currency? A 1.06736 1.04000 C:1.05000 1.02309 none of the above. 4. Suppose you decide to borrow AUD10 million at 4.8% interest rate per annum, covert AUD10 million into US dollar at the current spot exchange rate of 1.7662 (AUD/USD) and invest in US assets yielding 1.43% per annum. On maturity of investment six month later, you convert the dollar proceeds from US investment at the six-month forward exchange rate of rate of 1.7998 determined now. Calculate your covered arbitrage profit A": USD0.023 B: USD-0.36 C:USD-0.02 USD0.020 E USD-0.03

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts