Question: i need excel formulas please.. (Excel Formulas) Chen Chocolate Company's stock is currently valued at $40. Its dividend payment is $1.2 per share for the

i need excel formulas please..

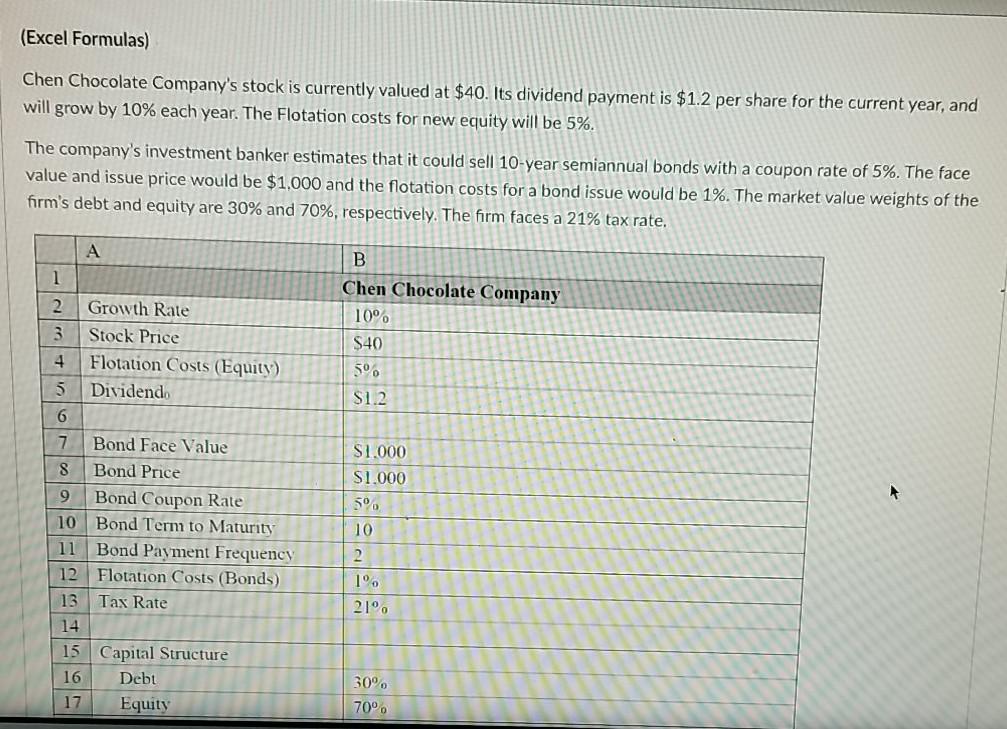

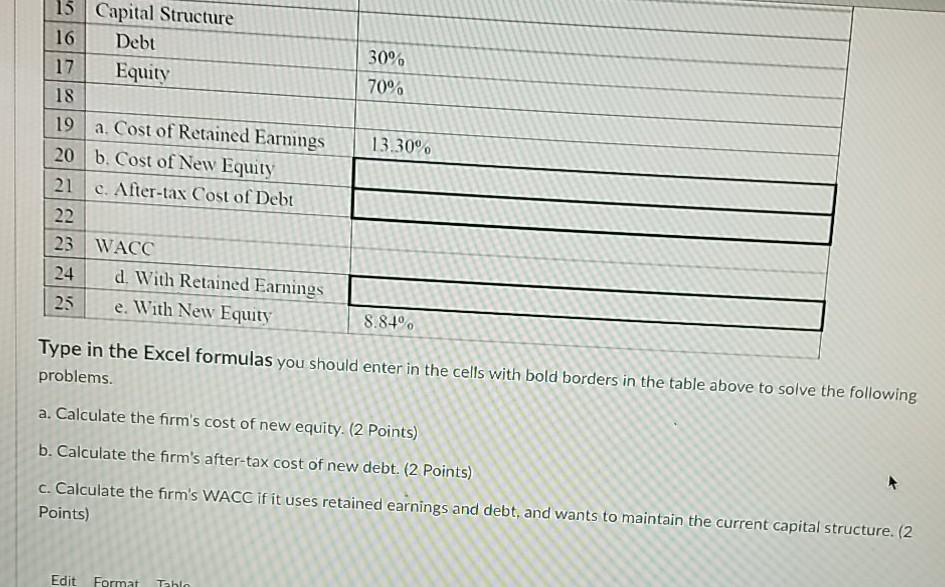

(Excel Formulas) Chen Chocolate Company's stock is currently valued at $40. Its dividend payment is $1.2 per share for the current year, and will grow by 10% each year. The Flotation costs for new equity will be 5%. The company's investment banker estimates that it could sell 10-year semiannual bonds with a coupon rate of 5%. The face value and issue price would be $1,000 and the flotation costs for a bond issue would be 1%. The market value weights of the firm's debt and equity are 30% and 70%, respectively. The firm faces a 21% tax rate, A B Chen Chocolate Company 10 $40 5 91.2 1 2 Growth Rate 3 Stock Price 4 Flotation Costs (Equity) 5 Dividend 6 7 Bond Face Value 8 Bond Price 9 Bond Coupon Rate 10 Bond Term to Maturity 11 Bond Payment Frequency 12 Flotation Costs (Bonds) 13 Tax Rate 14 15 Capital Structure 16 Debt 17 Equity $1.000 S1.000 50 + 10 2 1% 21 30% 70 30% 70% 13.30% 15 Capital Structure 16 Debt 17 Equity 18 19 a. Cost of Retained Earnings 20 b. Cost of New Equity 21 c. After-tax Cost of Debt 22 23 WACC 24 d. With Retained Earnings 25 e. With New Equity 8.849 Type in the Excel formulas you should enter in the cells with bold borders in the table above to solve the following problems. a. Calculate the firm's cost of new equity. (2 Points) b. Calculate the firm's after-tax cost of new debt. (2 Points) c. Calculate the firm's WACC if it uses retained earnings and debt and wants to maintain the current capital structure. (2 Points) Edit Format Tabla

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts