Question: I need fast help in these two questions. Please do them correctly and 100% and fast plz Question 2 = Homework: Ch 13 Homework Question

I need fast help in these two questions. Please do them correctly and 100% and fast plz

Question 2

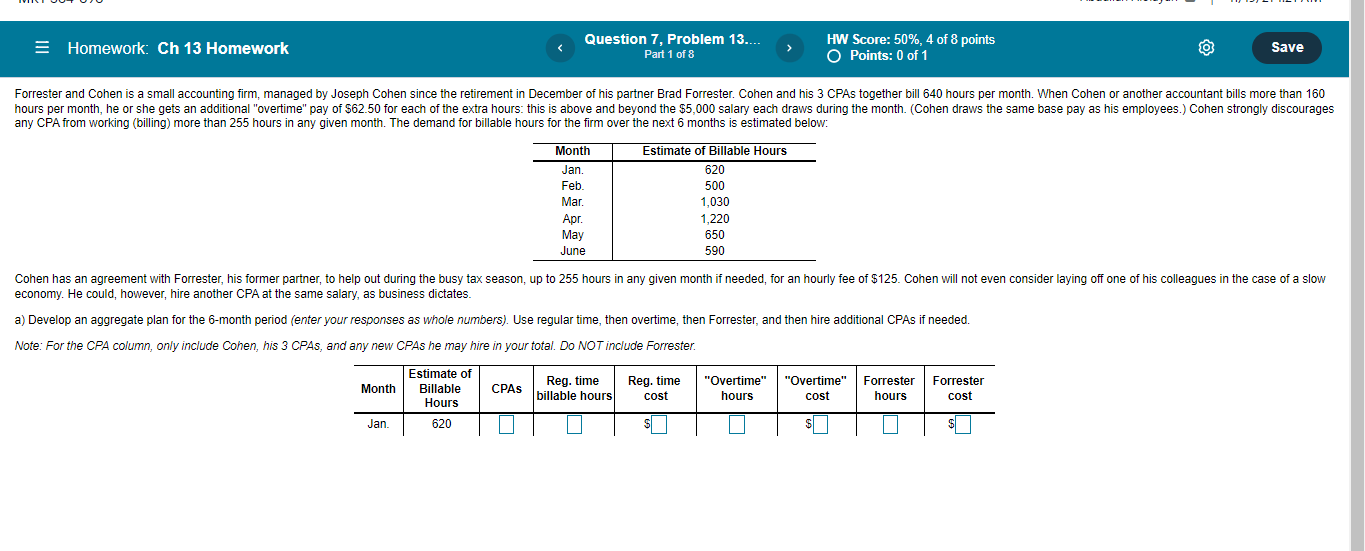

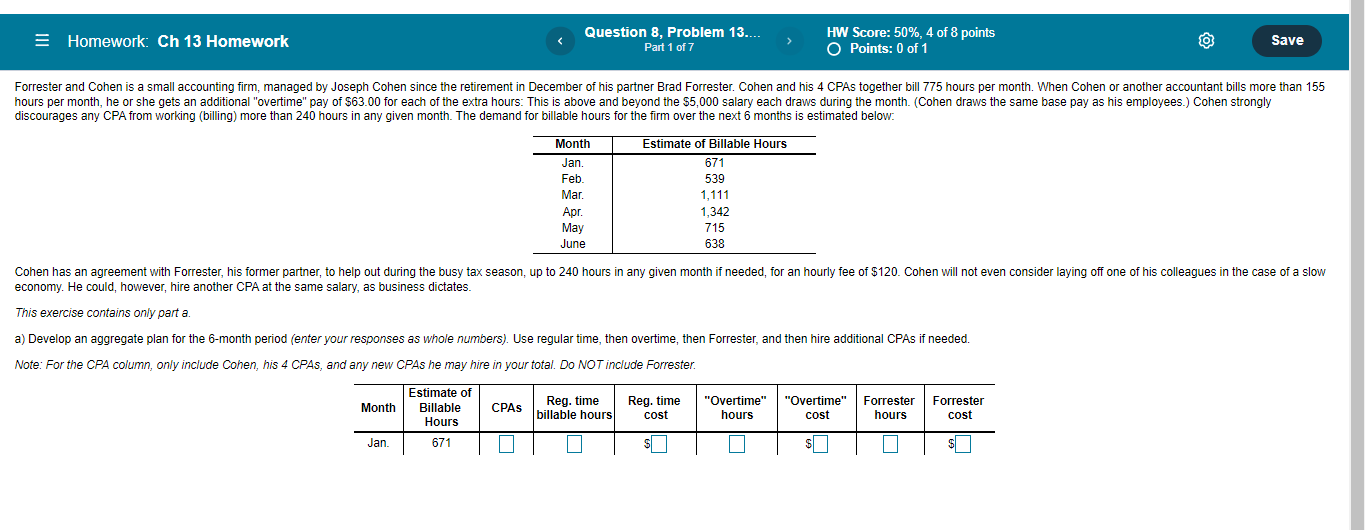

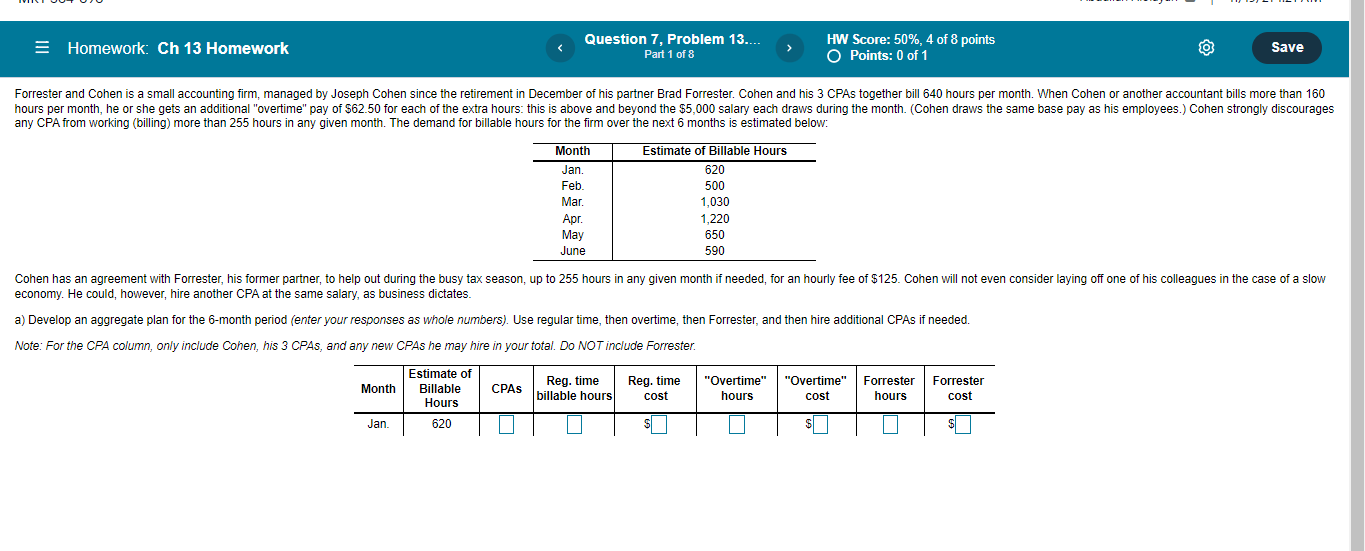

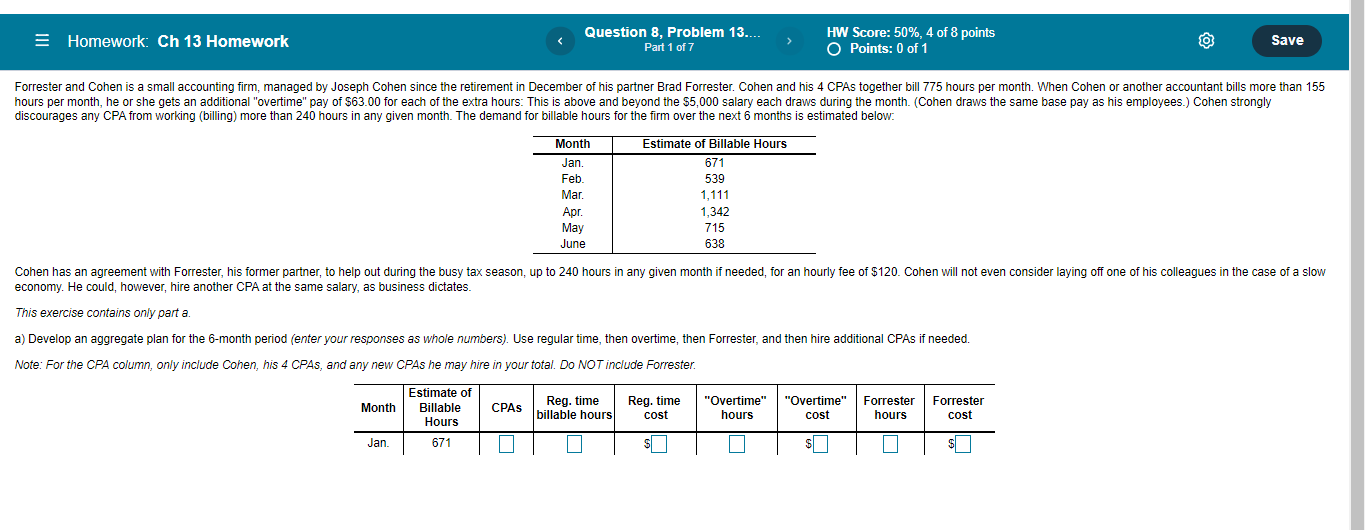

= Homework: Ch 13 Homework Question 7, Problem 13.... Part 1 of 8 1 HW Score: 50%, 4 of 8 points O Points: 0 of 1 Save Forrester and Cohen is a small accounting firm, managed by Joseph Cohen since the retirement in December of his partner Brad Forrester. Cohen and his 3 CPAs together bill 640 hours per month. When Cohen or another accountant bills more than 160 hours per month, he or she gets an additional "overtime" pay of $62.50 for each of the extra hours: this is above and beyond the $5,000 salary each draws during the month. (Cohen draws the same base pay as his employees.) Cohen strongly discourages any CPA from working (billing) more than 255 hours in any given month. The demand for billable hours for the firm over the next 6 months is estimated below: . Month Estimate of Billable Hours Jan. 620 Feb. 500 Mar. 1,030 Apr. 1.220 May 650 June 590 Cohen has an agreement with Forrester, his former partner, to help out during the busy tax season, up to 255 hours in any given month if needed, for an hourly fee of $125. Cohen will not even consider laying off one of his colleagues in the case of a slow economy. He could, however, hire another CPA at the same salary, as business dictates. a) Develop an aggregate plan for the 6-month period (enter your responses as whole numbers). Use regular time, then overtime, then Forrester, and then hire additional CPAs if needed. Note: For the CPA column, only include Cohen, his 3 CPAs, and any new CPAs he may hire in your total. Do NOT include Forrester. Estimate of Billable Hours Reg. time Month CPAS billable hours Reg. time cost "Overtime" "Overtime" Forrester hours cost hours Forrester cost Jan. 620 S $ = Homework: Ch 13 Homework Question 8, Problem 13.... Part 1 of 7 HW Score: 50%, 4 of 8 points O Points: 0 of 1 Save Forrester and Cohen is a small accounting firm, managed by Joseph Cohen since the retirement in December of his partner Brad Forrester. Cohen and his 4 CPAs together bill 775 hours per month. When Cohen or another accountant bills more than 155 hours per month, he or she gets an additional "overtime" pay of $63.00 for each of the extra hours: This is above and beyond the $5,000 salary each draws during the month. (Cohen draws the same base pay as his employees.) Cohen strongly discourages any CPA from working (billing) more than 240 hours in any given month. The demand for billable hours for the firm over the next 6 months is estimated below. Month Jan. Feb Mar. Apr. May June Estimate of Billable Hours 671 539 1,111 1,342 715 638 Cohen has an agreement with Forrester, his former partner, to help out during the busy tax season, up to 240 hours in any given month if needed, for an hourly fee of $120. Cohen will not even consider laying off one of his colleagues in the case of a slow economy. He could, however, hire another CPA at the same salary, as business dictates. This exercise contains only part a. a) Develop an aggregate plan for the 6-month period (enter your responses as whole numbers). Use regular time, then overtime, then Forrester, and then hire additional CPAs if needed. Note: For the CPA column, only include Cohen, his 4 CPAs, and any new CPAs he may hire in your total. Do NOT include Forrester. Month CPAS Estimate of Billable Hours 671 Reg. time billable hours Reg. time cost "Overtime" hours "Overtime" cost Forrester hours Forrester cost Jan S $ $