Question: I need help answering these problems. can you all answer these questions with explanations? QUESTION 3 4 points Sa Ronnie A qualifying child cannot include:

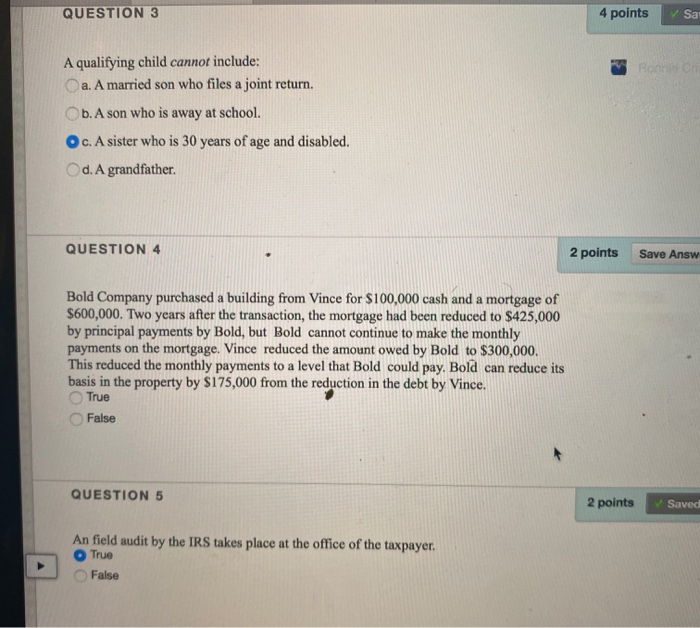

QUESTION 3 4 points Sa Ronnie A qualifying child cannot include: a. A married son who files a joint return. b. A son who is away at school. c. A sister who is 30 years of age and disabled. d. A grandfather QUESTION 4 2 points Save Answ Bold Company purchased a building from Vince for $100,000 cash and a mortgage of $600,000. Two years after the transaction, the mortgage had been reduced to $425,000 by principal payments by Bold, but Bold cannot continue to make the monthly payments on the mortgage. Vince reduced the amount owed by Bold to $300,000. This reduced the monthly payments to a level that Bold could pay. Bold can reduce its basis in the property by $175,000 from the reduction in the debt by Vince. True False QUESTION 5 2 points Saved An field audit by the IRS takes place at the office of the taxpayer. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts