Question: I need help on these questions, please show the work as well (If applicable). I greatly appreciate it! Which of the following statements regarding Sinking

I need help on these questions, please show the work as well (If applicable). I greatly appreciate it!

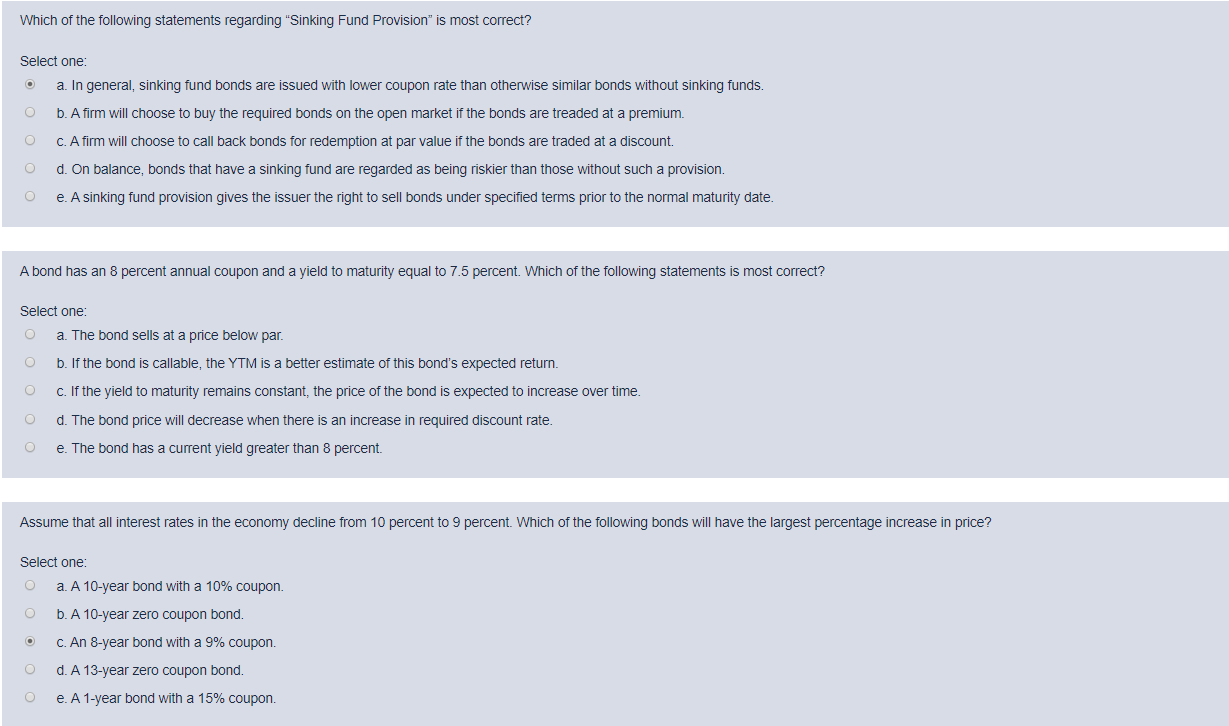

Which of the following statements regarding "Sinking Fund Provision" is most correct? Select one: a. In general, sinking fund bonds are issued with lower coupon rate than otherwise similar bonds without sinking funds. O O O b. A firm will choose to buy the required bonds on the open market if the bonds are treaded at a premium. c. A firm will choose to call back bonds for redemption at par value if the bonds are traded at a discount. d. On balance, bonds that have a sinking fund are regarded as being riskier than those without such a provision. e. A sinking fund provision gives the issuer the right to sell bonds under specified terms prior to the normal maturity date. A bond has an 8 percent annual coupon and a yield to maturity equal to 7.5 percent. Which of the following statements is most correct? Select one: O a. The bond sells at a price below par. o b. If the bond is callable, the YTM is a better estimate of this bond's expected return. c. If the yield to maturity remains constant, the price of the bond is expected to increase over time. d. The bond price will decrease when there is an increase in required discount rate. e. The bond has a current yield greater than 8 percent. Assume that all interest rates in the economy decline from 10 percent to 9 percent. Which of the following bonds will have the largest percentage increase in price? Select one: a. A 10-year bond with a 10% coupon. b. A 10-year zero coupon bond. c. An 8-year bond with a 9% coupon. d. A 13-year zero coupon bond. e. A 1-year bond with a 15% coupon

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts