Question: I need help on this question. 6% does not seem to be correct nor does 3%. Partial Question 3 0.5 / 1 pts Tidewater Home

I need help on this question. 6% does not seem to be correct nor does 3%.

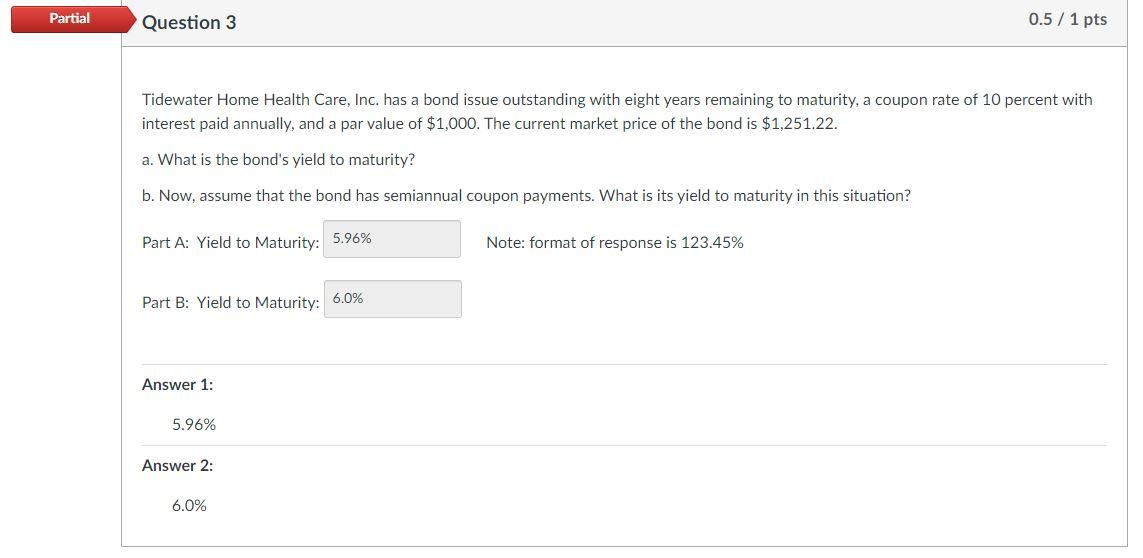

Partial Question 3 0.5 / 1 pts Tidewater Home Health Care, Inc. has a bond issue outstanding with eight years remaining to maturity, a coupon rate of 10 percent with interest paid annually, and a par value of $1,000. The current market price of the bond is $1,251.22. a. What is the bond's yield to maturity? b. Now, assume that the bond has semiannual coupon payments. What is its yield to maturity in this situation? Part A: Yield to Maturity: 5.96% Note: format of response is 123.45% Part B: Yield to Maturity: 6.0% Answer 1: 5.96% Answer 2: 6.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts