Question: I need help, Question 20 7.5 pt Blue Star Airlines is considering a three-year charter agreement with Adventure Leisure to transport its tour groups to

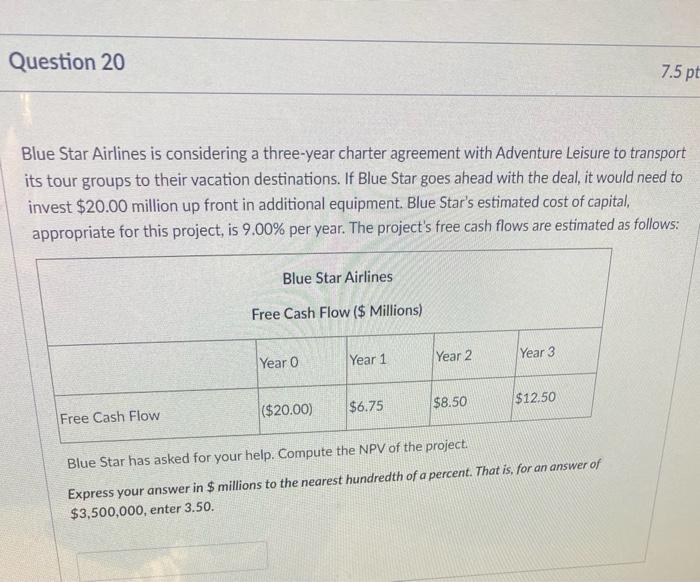

Question 20 7.5 pt Blue Star Airlines is considering a three-year charter agreement with Adventure Leisure to transport its tour groups to their vacation destinations. If Blue Star goes ahead with the deal, it would need to invest $20.00 million up front in additional equipment. Blue Star's estimated cost of capital, appropriate for this project, is 9.00% per year. The project's free cash flows are estimated as follows: Blue Star Airlines Free Cash Flow ($ Millions) Year 1 Year o Year 2 Year 3 $8.50 $6.75 ($20.00) $12.50 Free Cash Flow Blue Star has asked for your help. Compute the NPV of the project Express your answer in $ millions to the nearest hundredth of a percent. That is, for an answer of $3,500,000, enter 3.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts