Question: I need help with 9-1 (a,b,c) 9-3 & 9-6 only thank you U EL SEUIL CUVUULL LOL. (9-3) Cost of Preferred Stock (9-4) Cost of

I need help with 9-1 (a,b,c) 9-3 & 9-6 only

thank you

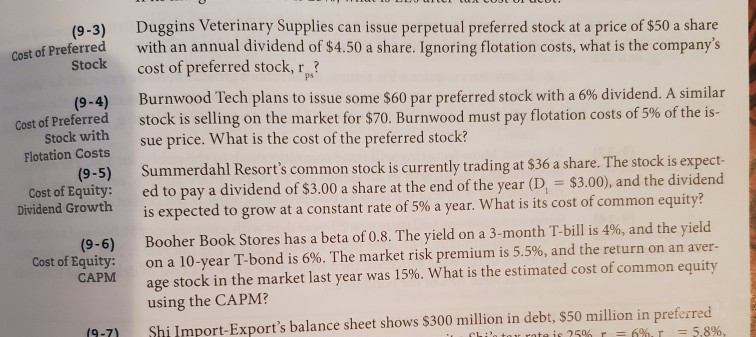

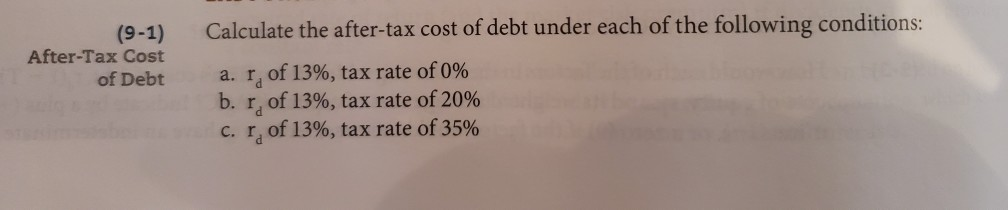

U EL SEUIL CUVUULL LOL. (9-3) Cost of Preferred Stock (9-4) Cost of Preferred Stock with Flotation Costs (9-5) Cost of Equity: Dividend Growth Duggins Veterinary Supplies can issue perpetual preferred stock at a price of $50 a share with an annual dividend of $4.50 a share. Ignoring flotation costs, what is the company's cost of preferred stock, r ? Burnwood Tech plans to issue some $60 par preferred stock with a 6% dividend. A similar stock is selling on the market for $70. Burnwood must pay flotation costs of 5% of the is- sue price. What is the cost of the preferred stock? Summerdahl Resort's common stock is currently trading at $36 a share. The stock is expect- ed to pay a dividend of $3.00 a share at the end of the year (D = $3.00), and the dividend is expected to grow at a constant rate of 5% a year. What is its cost of common equity? Booher Book Stores has a beta of 0.8. The yield on a 3-month T-bill is 4%, and the yield on a 10-year T-bond is 6%. The market risk premium is 5.5%, and the return on an aver- age stock in the market last year was 15%. What is the estimated cost of common equity using the CAPM? Shi Import-Export's balance sheet shows $300 million in debt, $50 million in preferred Clinton rate is 25% = 6% = 5,8%, (9-6) Cost of Equity: CAPM 19-7) (9-1) After-Tax Cost of Debt Calculate the after-tax cost of debt under each of the following conditions: a. r, of 13%, tax rate of 0% b. r, of 13%, tax rate of 20% c. r, of 13%, tax rate of 35%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts