Question: I need help with B, C, and D. please show your work with steps. 1. Consider the regression of R&D spending measured in millions of

I need help with B, C, and D. please show your work with steps.

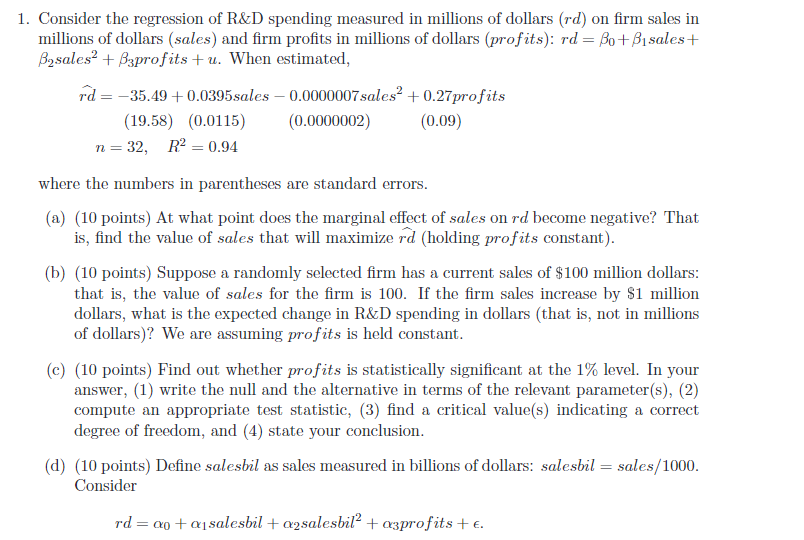

1. Consider the regression of R\&D spending measured in millions of dollars (rd) on firm sales in millions of dollars (sales) and firm profits in millions of dollars (profits): rd=0+1 sales + 2 sales 2+3 profits +u. When estimated, n=32,R2=0.94 where the numbers in parentheses are standard errors. (a) (10 points) At what point does the marginal effect of sales on rd become negative? That is, find the value of sales that will maximize rd (holding profits constant). (b) (10 points) Suppose a randomly selected firm has a current sales of $100 million dollars: that is, the value of sales for the firm is 100 . If the firm sales increase by $1 million dollars, what is the expected change in R\&D spending in dollars (that is, not in millions of dollars)? We are assuming profits is held constant. (c) (10 points) Find out whether profits is statistically significant at the 1\% level. In your answer, (1) write the null and the alternative in terms of the relevant parameter(s), (2) compute an appropriate test statistic, (3) find a critical value(s) indicating a correct degree of freedom, and (4) state your conclusion. (d) (10 points) Define salesbil as sales measured in billions of dollars: salesbil = sales /1000. Consider rd=0+1salesbil+2salesbil2+3profits+ 1. Consider the regression of R\&D spending measured in millions of dollars (rd) on firm sales in millions of dollars (sales) and firm profits in millions of dollars (profits): rd=0+1 sales + 2 sales 2+3 profits +u. When estimated, n=32,R2=0.94 where the numbers in parentheses are standard errors. (a) (10 points) At what point does the marginal effect of sales on rd become negative? That is, find the value of sales that will maximize rd (holding profits constant). (b) (10 points) Suppose a randomly selected firm has a current sales of $100 million dollars: that is, the value of sales for the firm is 100 . If the firm sales increase by $1 million dollars, what is the expected change in R\&D spending in dollars (that is, not in millions of dollars)? We are assuming profits is held constant. (c) (10 points) Find out whether profits is statistically significant at the 1\% level. In your answer, (1) write the null and the alternative in terms of the relevant parameter(s), (2) compute an appropriate test statistic, (3) find a critical value(s) indicating a correct degree of freedom, and (4) state your conclusion. (d) (10 points) Define salesbil as sales measured in billions of dollars: salesbil = sales /1000. Consider rd=0+1salesbil+2salesbil2+3profits+

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts