Question: I need help with c sharp programming assignment: Layout Rules: Font must be 10 No word wrap Must be clean and aligned properly Here is

I need help with c sharp programming assignment:

Layout Rules:

Font must be 10

No word wrap

Must be clean and aligned properly

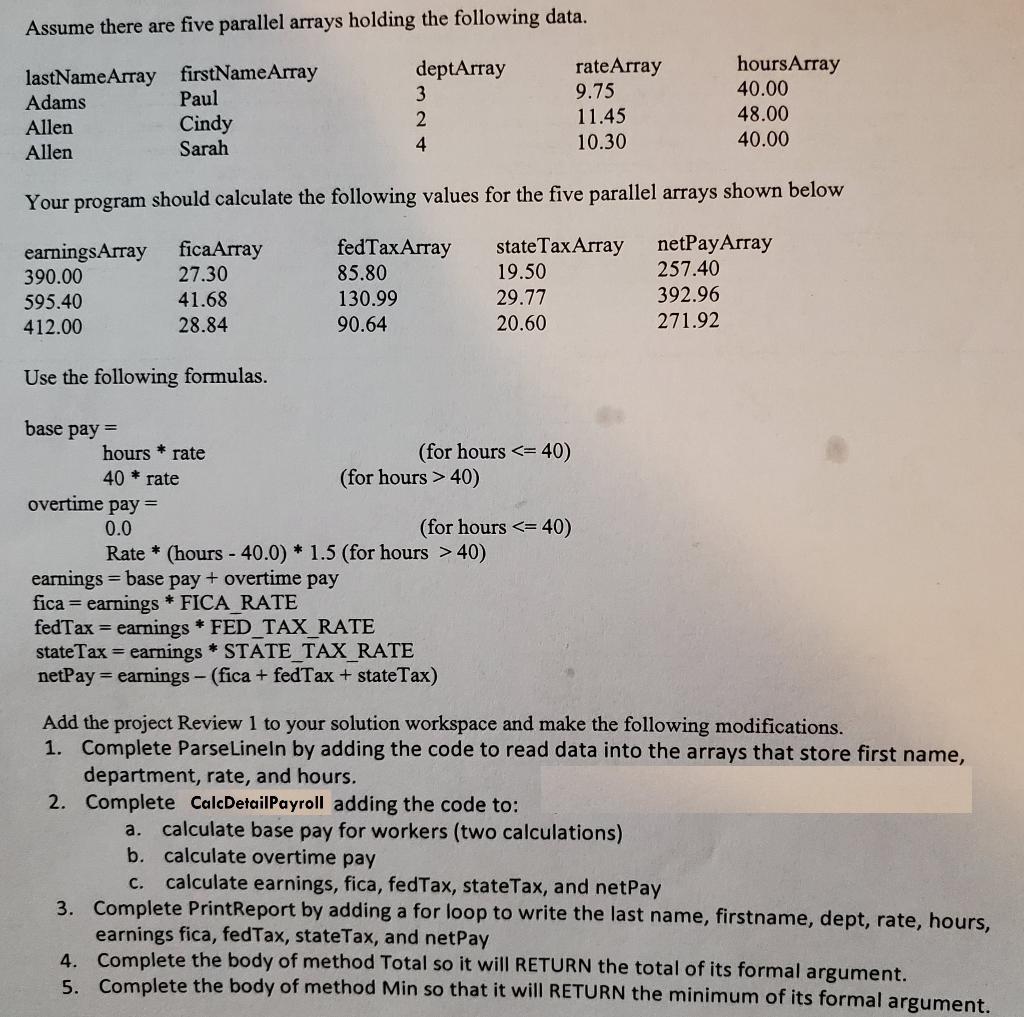

Here is the specific rules that I must go by for the program code:

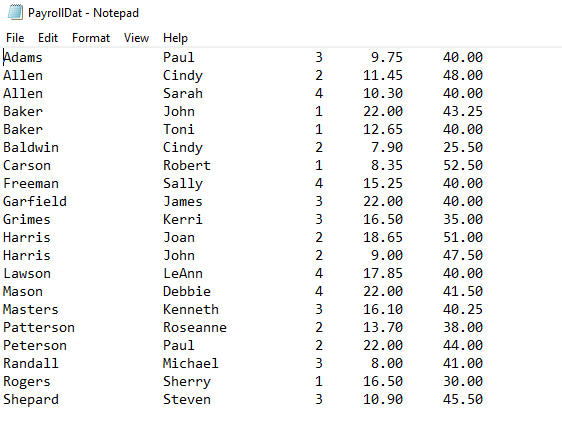

Here is the Payroll data file info:

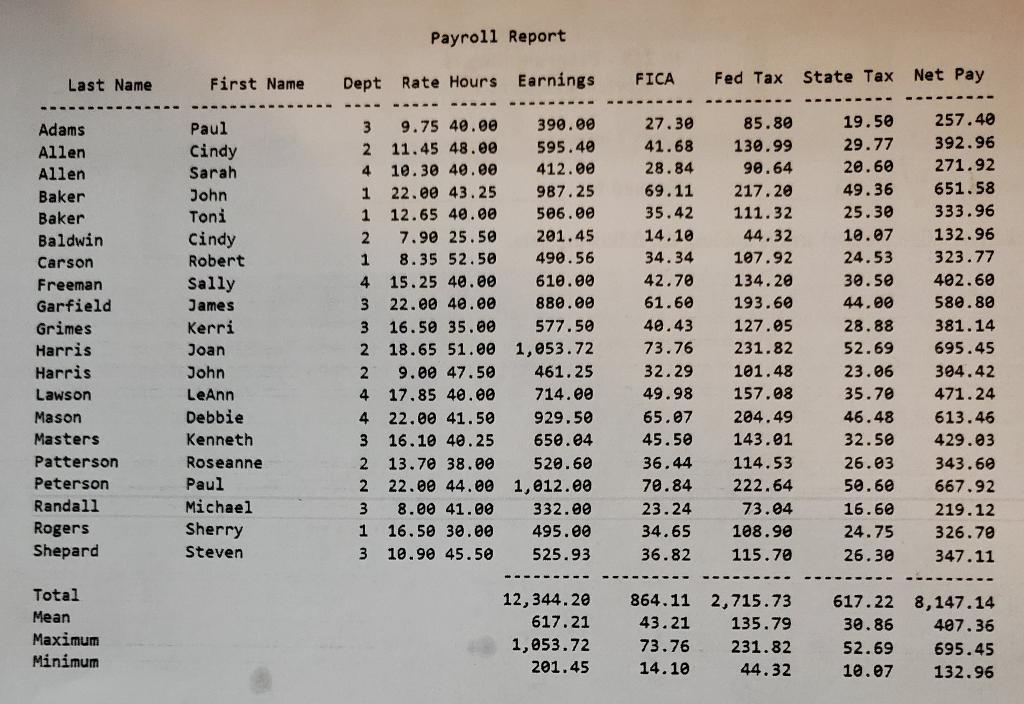

Here is the desired output for the completed program:

Here is the code that I must use and modify to complete this:

/* Purpose: Process payroll report using parallel arrays. */

using System; using System.IO; using System.Text.RegularExpressions; using LibUtil;

// The application class class Ch7Prb1 {

const double FICA_RATE = 0.07; const double FED_TAX_RATE = 0.22; const double STATE_TAX_RATE = 0.05; const string INPUT_FILE_NAME = "...\\...\\PayrollDat.Txt"; const string OUTPUT_FILE_NAME = "...\\...\\PayrollReport.Txt";

static uint numOfEmployees; static string[] lastNameArray = new string[51], firstNameArray = new string[51]; static uint[] deptArray = new uint[51]; static double[] rateArray = new double[51], hoursArray = new double[51]; static double[] earningsArray = new double[51], ficaArray = new double[51]; static double[] fedTaxArray = new double[51], stateTaxArray = new double[51]; static double[] netPayArray = new double[51]; static StreamReader fileIn; static StreamWriter fileOut;

static void Main() { OpenFiles(); InputData(); CalcDetailPayroll(); PrintReport(); CloseFiles(); }

static void OpenFiles() { if (File.Exists(INPUT_FILE_NAME)) { fileIn = File.OpenText(INPUT_FILE_NAME); Console.WriteLine("{0} was opened",INPUT_FILE_NAME); } else { Console.WriteLine("Error: {0} does not exist ",INPUT_FILE_NAME); ConsoleApp.Exit(); } fileOut = File.CreateText(OUTPUT_FILE_NAME); if (File.Exists(OUTPUT_FILE_NAME)) Console.WriteLine("{0} was created ",OUTPUT_FILE_NAME); else { Console.WriteLine("Error: {0} could not be created ",OUTPUT_FILE_NAME); ConsoleApp.Exit(); } }

static void ParseLineIn(string lineIn, uint i) { string[] words = new string[5];

lineIn = lineIn.Trim(); while (Regex.IsMatch(lineIn,"[ ]{2}")) lineIn = lineIn.Replace(" "," "); words = lineIn.Split(' '); lastNameArray[i] = words[0]; //Add code to read in data into remaining arrays }

static void InputData() { uint i; string lineIn;

i = 0; while ((lineIn=fileIn.ReadLine())!=null) { i++; ParseLineIn(lineIn,i); } numOfEmployees = i; }

static void CalcDetailPayroll() { uint i; double basePay,ovtPay;

for (i=1; i

static double Total(double[] doubleArray) { }

static double Mean(double[] doubleArray) { uint i; double sum=0.0;

for (i=1; i

static double Max(double[] doubleArray) { uint i; double max;

max = doubleArray[1]; for (i=2; imax) max = doubleArray[i]; return max; }

static double Min(double[] doubleArray) { }

static void PrintReport() { uint i;

fileOut.WriteLine(" Payroll Report "); fileOut.WriteLine(); fileOut.WriteLine(" Last Name First Name Dept Rate Hours Earnings FICA Fed Tax State Tax Net Pay "); fileOut.WriteLine("--------------- --------------- ---- ----- ----- --------- --------- --------- --------- ---------"); //Create for loop to display last name, firstname, dept, rate, hours, earnings fica, fedTax, stateTax, and netPay fileOut.WriteLine(" --------- --------- --------- --------- ---------"); fileOut.WriteLine("{0,-49}{1,9:n} {2,9:n} {3,9:n} {4,9:n} {5,9:n}", "Total",Total(earningsArray),Total(ficaArray), Total(fedTaxArray),Total(stateTaxArray),Total(netPayArray)); fileOut.WriteLine("{0,-49}{1,9:n} {2,9:n} {3,9:n} {4,9:n} {5,9:n}", "Mean",Mean(earningsArray),Mean(ficaArray), Mean(fedTaxArray),Mean(stateTaxArray),Mean(netPayArray)); fileOut.WriteLine("{0,-49}{1,9:n} {2,9:n} {3,9:n} {4,9:n} {5,9:n}", "Maximum",Max(earningsArray),Max(ficaArray), Max(fedTaxArray),Max(stateTaxArray),Max(netPayArray)); fileOut.WriteLine("{0,-49}{1,9:n} {2,9:n} {3,9:n} {4,9:n} {5,9:n}", "Minimum",Min(earningsArray),Min(ficaArray), Min(fedTaxArray),Min(stateTaxArray),Min(netPayArray)); }

static void CloseFiles() { fileIn.Close(); fileOut.Close(); }

}

Assume there are five parallel arrays holding the following data. lastNameArray firstNameArray Adams Paul Allen Cindy Allen Sarah deptArray 3 2 4 rate Array 9.75 11.45 10.30 hoursArray 40.00 48.00 40.00 Your program should calculate the following values for the five parallel arrays shown below earningsArray 390.00 595.40 412.00 ficaArray 27.30 41.68 28.84 fedTaxArray 85.80 130.99 90.64 state Tax Array 19.50 29.77 20.60 netPay Array 257.40 392.96 271.92 Use the following formulas. base pay hours * rate (for hours 40) overtime pay = 0.0 (for hours 40) earnings = base pay + overtime pay fica = earnings * FICA RATE fedTax = earnings * FED_TAX_RATE state Tax = earnings * STATE_TAX RATE netPay=earnings - (fica + fedTax + state Tax) Add the project Review 1 to your solution workspace and make the following modifications. 1. Complete ParseLineln by adding the code to read data into the arrays that store first name, department, rate, and hours. 2. Complete CalcDetailPayroll adding the code to: a. calculate base pay for workers (two calculations) b. calculate overtime pay c. calculate earnings, fica, fedTax, stateTax, and netPay 3. Complete PrintReport by adding a for loop to write the last name, firstname, dept, rate, hours, earnings fica, fedTax, stateTax, and netPay 4. Complete the body of method Total so it will RETURN the total of its formal argument. 5. Complete the body of method Min so that it will RETURN the minimum of its formal argument. John PayrollDat - Notepad File Edit Format View Help Adams Paul Allen Cindy Allen Sarah Baker Baker Toni Baldwin Cindy Carson Robert Freeman Sally Garfield James Grimes Kerri Harris Joan Harris John Lawson LeAnn Mason Debbie Masters Kenneth Patterson Roseanne Peterson Paul Randall Michael Rogers Sherry Shepard Steven 3 2 4 1 1 2 1 4 3 3 2 2 4 4 3 2 2 3 1 3 9.75 11.45 10.30 22.00 12.65 7.90 8.35 15.25 22.00 16.50 18.65 9.00 17.85 22.00 16.10 13.70 22.00 8.00 16.50 10.90 40.00 48.00 40.00 43.25 40.00 25.50 52.50 40.00 40.00 35.00 51.00 47.50 40.00 41.50 40.25 38.00 44.00 41.00 30.00 45.50 Payroll Report Last Name First Name Dept Rate Hours Earnings FICA Fed Tax State Tax Net Pay 3 2 4 1 1 Adams Allen Allen Baker Baker Baldwin Carson Freeman Garfield Grimes Harris Harris Lawson Mason Masters Pattersor Peterson Randall Rogers Shepard Paul Cindy Sarah John Toni Cindy Robert Sally James Kerri Joan John LeAnn Debbie Kenneth nne Paul Michael Sherry Steven 2 1 4 3 3 2 9.75 40.00 390.00 11.45 48.00 595.40 10.30 40.00 412.00 22.00 43.25 987.25 12.65 40.00 506.00 7.90 25.50 201.45 8.35 52.50 490.56 15.25 40.00 610.00 22.00 40.00 880.00 16.50 35.00 577.50 18.65 51.00 1,053.72 9.00 47.50 461.25 17.85 40.00 714.00 22.00 41.50 929.50 16.10 40.25 650.04 13.70 38.00 520.60 22.00 44.00 1,012.00 8.00 41.00 332.00 16.50 30.00 495.00 10.90 45.50 525.93 27.30 41.68 28.84 69.11 35.42 14.10 34.34 42.70 61.60 40.43 73.76 32.29 49.98 65.07 45.50 36.44 70.84 23.24 34.65 36.82 85.80 130.99 90.64 217.20 111.32 44.32 107.92 134.20 193.60 127.05 231.82 101.48 157.08 204.49 143.01 114.53 222.64 73.04 108.90 115.70 19.50 29.77 20.60 49.36 25.30 10.07 24.53 30.50 44.00 28.88 52.69 23.06 35.70 46.48 32.50 26.03 50.60 16.60 24.75 26.30 257.40 392.96 271.92 651.58 333.96 132.96 323.77 402.60 580.80 381.14 695.45 384.42 471.24 613.46 429.03 343.60 667.92 219.12 326.70 347.11 2 4 4 3 2 2 3 1 3 Total Mean Maximum Minimum 12,344.20 617.21 1,053.72 201.45 864.11 43.21 73.76 14.10 2,715.73 135.79 231.82 44.32 617.22 8,147.14 30.86 407.36 52.69 695.45 10.07 132.96 Assume there are five parallel arrays holding the following data. lastNameArray firstNameArray Adams Paul Allen Cindy Allen Sarah deptArray 3 2 4 rate Array 9.75 11.45 10.30 hoursArray 40.00 48.00 40.00 Your program should calculate the following values for the five parallel arrays shown below earningsArray 390.00 595.40 412.00 ficaArray 27.30 41.68 28.84 fedTaxArray 85.80 130.99 90.64 state Tax Array 19.50 29.77 20.60 netPay Array 257.40 392.96 271.92 Use the following formulas. base pay hours * rate (for hours 40) overtime pay = 0.0 (for hours 40) earnings = base pay + overtime pay fica = earnings * FICA RATE fedTax = earnings * FED_TAX_RATE state Tax = earnings * STATE_TAX RATE netPay=earnings - (fica + fedTax + state Tax) Add the project Review 1 to your solution workspace and make the following modifications. 1. Complete ParseLineln by adding the code to read data into the arrays that store first name, department, rate, and hours. 2. Complete CalcDetailPayroll adding the code to: a. calculate base pay for workers (two calculations) b. calculate overtime pay c. calculate earnings, fica, fedTax, stateTax, and netPay 3. Complete PrintReport by adding a for loop to write the last name, firstname, dept, rate, hours, earnings fica, fedTax, stateTax, and netPay 4. Complete the body of method Total so it will RETURN the total of its formal argument. 5. Complete the body of method Min so that it will RETURN the minimum of its formal argument. John PayrollDat - Notepad File Edit Format View Help Adams Paul Allen Cindy Allen Sarah Baker Baker Toni Baldwin Cindy Carson Robert Freeman Sally Garfield James Grimes Kerri Harris Joan Harris John Lawson LeAnn Mason Debbie Masters Kenneth Patterson Roseanne Peterson Paul Randall Michael Rogers Sherry Shepard Steven 3 2 4 1 1 2 1 4 3 3 2 2 4 4 3 2 2 3 1 3 9.75 11.45 10.30 22.00 12.65 7.90 8.35 15.25 22.00 16.50 18.65 9.00 17.85 22.00 16.10 13.70 22.00 8.00 16.50 10.90 40.00 48.00 40.00 43.25 40.00 25.50 52.50 40.00 40.00 35.00 51.00 47.50 40.00 41.50 40.25 38.00 44.00 41.00 30.00 45.50 Payroll Report Last Name First Name Dept Rate Hours Earnings FICA Fed Tax State Tax Net Pay 3 2 4 1 1 Adams Allen Allen Baker Baker Baldwin Carson Freeman Garfield Grimes Harris Harris Lawson Mason Masters Pattersor Peterson Randall Rogers Shepard Paul Cindy Sarah John Toni Cindy Robert Sally James Kerri Joan John LeAnn Debbie Kenneth nne Paul Michael Sherry Steven 2 1 4 3 3 2 9.75 40.00 390.00 11.45 48.00 595.40 10.30 40.00 412.00 22.00 43.25 987.25 12.65 40.00 506.00 7.90 25.50 201.45 8.35 52.50 490.56 15.25 40.00 610.00 22.00 40.00 880.00 16.50 35.00 577.50 18.65 51.00 1,053.72 9.00 47.50 461.25 17.85 40.00 714.00 22.00 41.50 929.50 16.10 40.25 650.04 13.70 38.00 520.60 22.00 44.00 1,012.00 8.00 41.00 332.00 16.50 30.00 495.00 10.90 45.50 525.93 27.30 41.68 28.84 69.11 35.42 14.10 34.34 42.70 61.60 40.43 73.76 32.29 49.98 65.07 45.50 36.44 70.84 23.24 34.65 36.82 85.80 130.99 90.64 217.20 111.32 44.32 107.92 134.20 193.60 127.05 231.82 101.48 157.08 204.49 143.01 114.53 222.64 73.04 108.90 115.70 19.50 29.77 20.60 49.36 25.30 10.07 24.53 30.50 44.00 28.88 52.69 23.06 35.70 46.48 32.50 26.03 50.60 16.60 24.75 26.30 257.40 392.96 271.92 651.58 333.96 132.96 323.77 402.60 580.80 381.14 695.45 384.42 471.24 613.46 429.03 343.60 667.92 219.12 326.70 347.11 2 4 4 3 2 2 3 1 3 Total Mean Maximum Minimum 12,344.20 617.21 1,053.72 201.45 864.11 43.21 73.76 14.10 2,715.73 135.79 231.82 44.32 617.22 8,147.14 30.86 407.36 52.69 695.45 10.07 132.96

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts