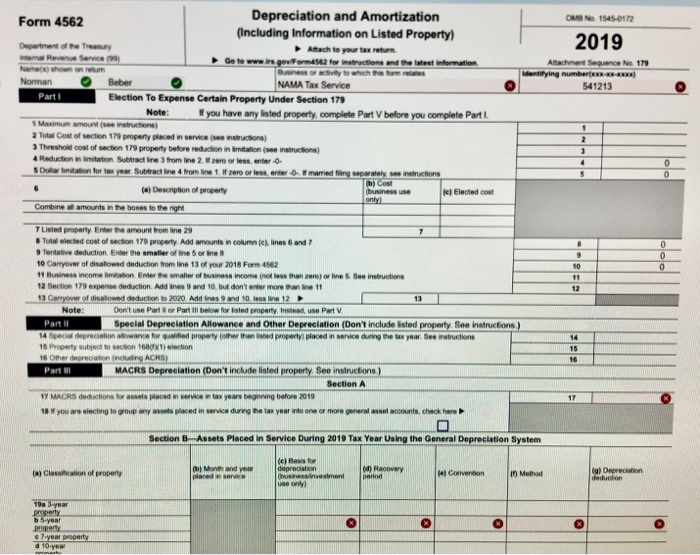

Question: I need help with Form 4562 lines 17 and 19b thank you Norman and Leslie Beber are married and file a joint return in 2019.

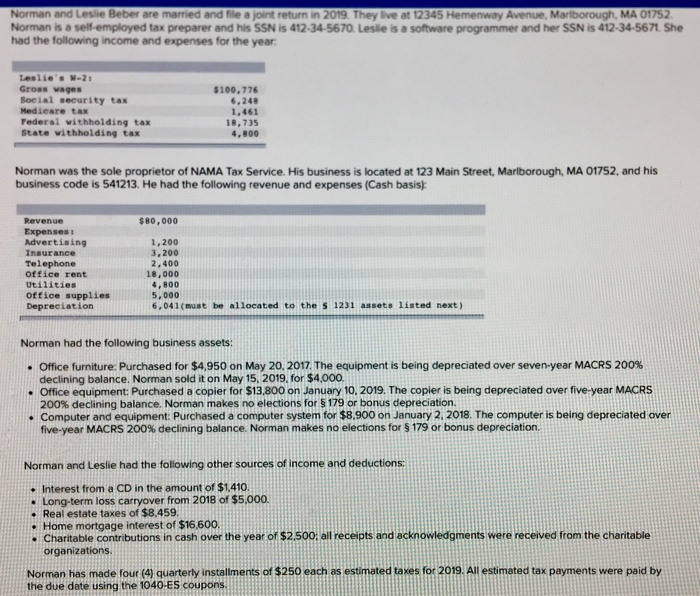

Norman and Leslie Beber are married and file a joint return in 2019. They live at 12345 Hemenway Avenue, Marlborough, MA 01752 Norman is a self-employed tax preparer and his SSN is 412-34-5670. Leslie is a software programmer and her SSN is 412-34-5671. She had the following income and expenses for the year Leslie's W-25 Gross wages Social security tax Medicare tax Federal withholding tax State withholding tax $100,776 6,240 1.461 18,735 Norman was the sole proprietor of NAMA Tax Service. His business is located at 123 Main Street, Marlborough, MA 01752. and his business code is 541213. He had the following revenue and expenses (Cash basis: $80,000 Revenue Expenses Advertising Insurance Telephone office rent Utilities office supplies Depreciation 1,200 3.200 2.400 18,000 4,800 5,000 6,041(must be allocated to the S 1231 assets listed next) Norman had the following business assets: Office furniture: Purchased for $4,950 on May 20, 2017. The equipment is being depreciated over seven-year MACRS 200% declining balance. Norman sold it on May 15, 2019, for $4,000. Office equipment: Purchased a copier for $13,800 on January 10, 2019. The copler is being depreciated over five-year MACRS 200% declining balance. Norman makes no elections for $179 or bonus depreciation. Computer and equipment: Purchased a computer system for $8.900 on January 2, 2018. The computer is being depreciated aver five-year MACRS 200% declining balance. Norman makes no elections for $ 179 or bonus depreciation Norman and Leslie had the following other sources of income and deductions Interest from a CD in the amount of $1.410. Long-term loss carryover from 2018 of $5,000. Real estate taxes of $8,459. Home mortgage interest of $16.600. Charitable contributions in cash over the year of $2,500: all receipts and acknowledgments were received from the charitable organizations. Norman has made four (4) quarterly installments of $250 each as estimated taxes for 2019. All estimated tax payments were paid by the due date using the 1040-ES coupons. Form 4562 Depreciation and Amortization (Including Information on Listed Property) Detent of the Treasury Aach to your tax return Getowwe in govor4542 formation and the latest information Bun t o which has formas Norman Baber NAMA Tax Service Parti Election To Expense Certain Property Under Section 179 Note: you have any listed property, complete Part before you complete Part I. MSN 15450172 2019 ASN 17 541213 2Ton Cost of section 17 property placed in service instructions The cost of action 17 property before reduction in Imitations in 4 Reduction in t on Subtract line from ine 2 were or less enter- SD torty Subtract line from t er o ss enter t o intructions married ang separately Il cost (a) Description of property Elected cost Combine amounts the boxes to the gre Listed property Enthe amount from line 29 Tollected cost of section 179 property. Add amount in column lines 6 and 7 Tentative deduction Enter the smaller of inesorine 10 Carryover of disallowed deduction from ine 13 of your 2018 Form 4562 11 Business income ion Enter the male of business come to less than 2 ) rinse instructions 12 Section 179 empre detion Add nesand 10, but don't ner more than in 11 13 Carryover of dislowed deduction 2020 Add nesand 10 less line 12 Note: Don't use Parts Part Ill below for sted property Insinad, use Part Part II Special Depreciation Allowance and Other Depreciation (Don't include listed property See instructions.) 14 Special depreciation wave for Nified property and properly placed in service during the way you See Instructions 15 Property subject to section 16 c tion 16 Other depreciation (including ACRS) Parti MACRS Depreciation (Don't include listed property See instructions) Section A 17 MACRSections for anses placed in w x years being before 2018 18 you are clecting to group any placed in service during the tax year one or more general accounts, check here Section B Assets Placed in Service During 2019 Tax Year Using the General Depreciation System Month and year e Basis for depreciation business investiment (dRecovery Closition of property Convention Method Deprecation property toy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts