Question: I need help with solving and filling out Part a, b, c, and d Please :) Partnership Income Allocation-Various Options The January 1, 2017 ,

I need help with solving and filling out Part a, b, c, and d Please :)

I need help with solving and filling out Part a, b, c, and d Please :)

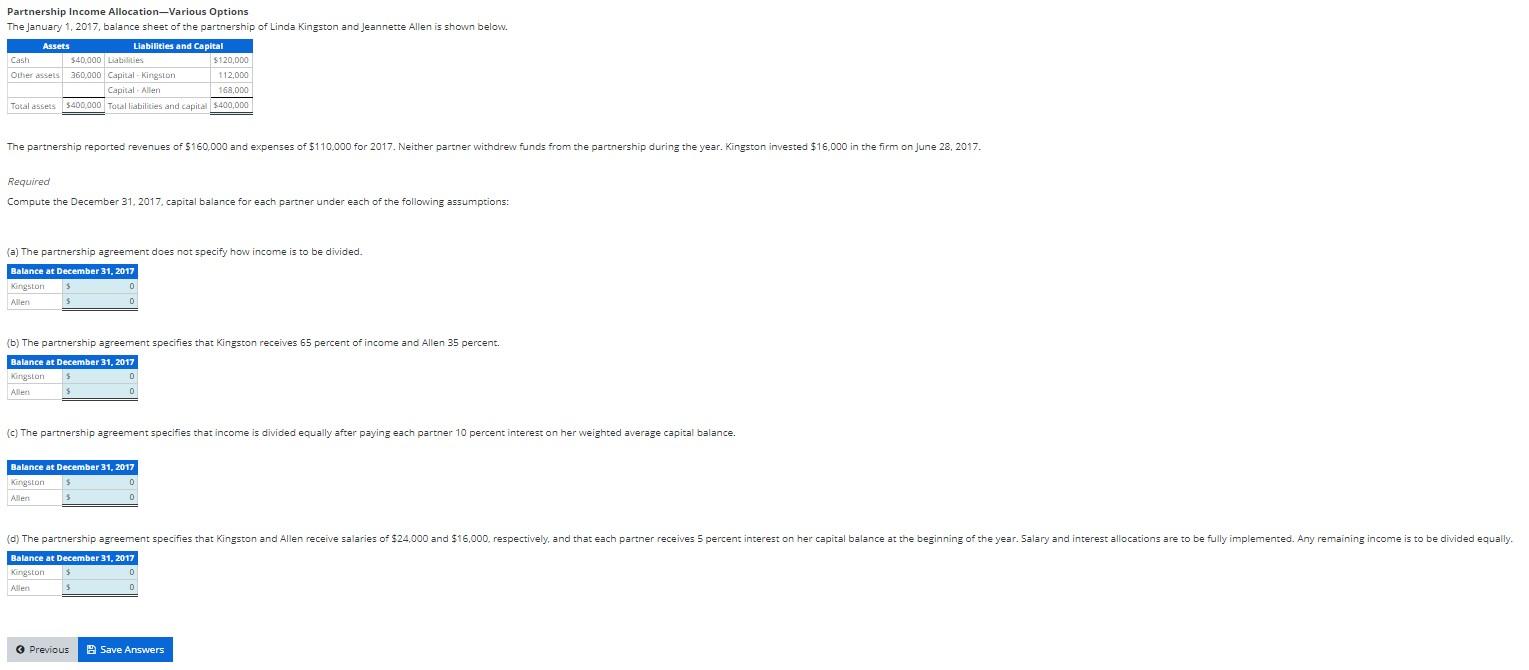

Partnership Income Allocation-Various Options The January 1, 2017 , balance sheet of the partnership of Linda Kingston and Jeannette Allen is shown below. The partnership reported revenues of $160,000 and expenses of $110,000 for 2017. Neither partner withdrew Required Compute the December 31,2017 , capital balance for each partner under each of the following assumptions: (a) The partnership agreement does not specify how income is to be divided. (b) The partnership agreement specifies that Kingston receives 65 percent of income and Allen 35 percent

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock