Question: Please answer part c. Partnership Income Allocation-Various Options The January 1, 2020, balance sheet of the partnership of Linda Kingston and Jeannette Allen is shown

Please answer part c.

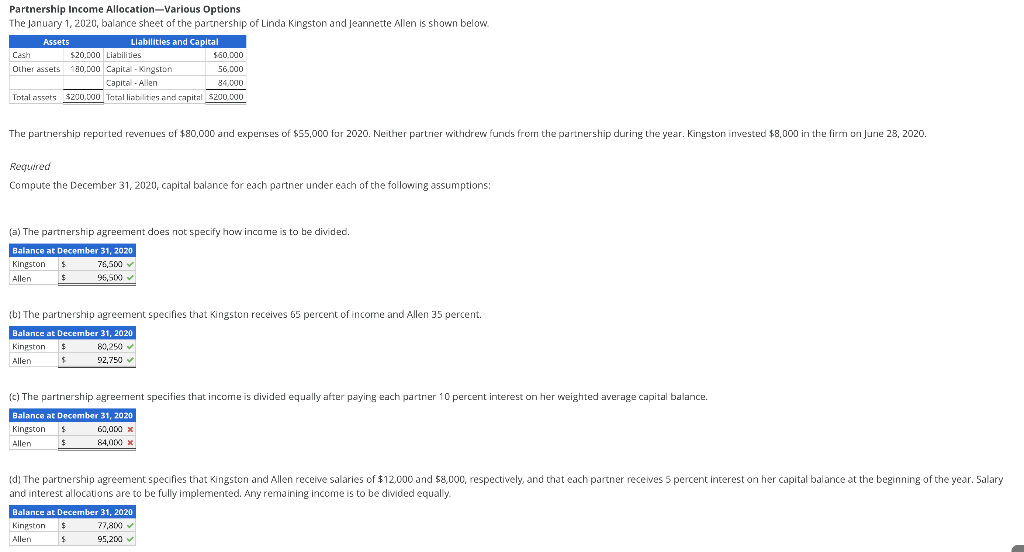

Partnership Income Allocation-Various Options The January 1, 2020, balance sheet of the partnership of Linda Kingston and Jeannette Allen is shown below. Assets Liabilities and Capital Cash $20.000 Liabilities $60.000 Other assets 120.000 Capital - Kingston 56,000 Capital - Allen 84 000 Total assets $200.000 Total liabilities and capital s200.000 The partnership reported revenues of $80.000 and expenses of $55,000 for 2020. Neither partner withdrew funds from the partnership during the year. Kingston invested $8,000 in the firm on June 28, 2020. Required Compute the December 31, 2020, capital balance for each partner under each of the following assumptions: (a) The partnership agreement does not specify how income is to be divided Balance at December 31, 2020 Kingston $ 76,500 Allen $ 95,500 (b) The partnership agreement specifies that Kingston receives 65 percent of income and Allen 35 percent. Balance at December 31, 2020 Kinston $ 80,250 Allen 92.750 (c) The partnership agreement specifies that income is divided equally after paying each partner 10 percent interest on her weighted average capital balance. Balance at December 31, 2020 Kingston $ 60,000 x Allen $ 84,000 x Idi The partnership agreement specifies that Kingston and Allen receive salaries of $12,000 and $8,000, respectively, and that each partner receives 5 percent interest on her capital balance at the beginning of the year. Salary and interest allocations are to be fully implemented. Any remaining income is to be divided equally Balance at December 31, 2020 Kinpston $ 77,800 Allen 95,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts