Question: i need help with these questions and calculations please. i hope this is better check this one please, its clear when i open it Copy

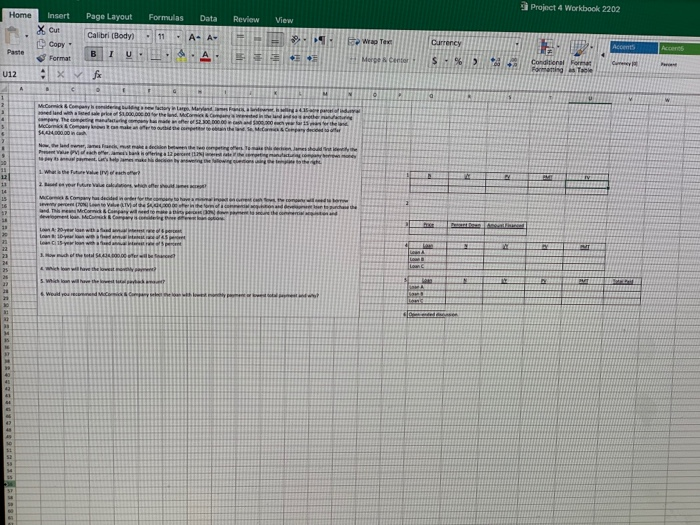

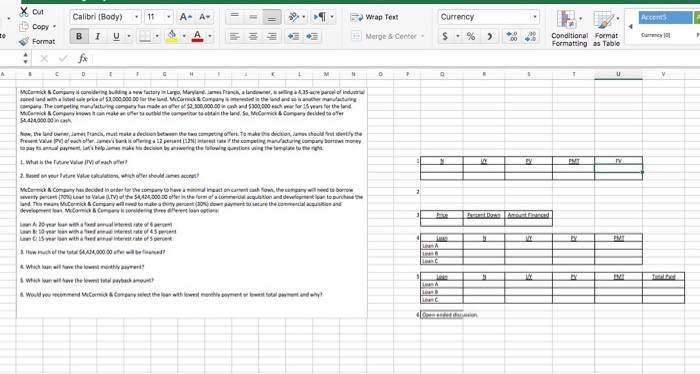

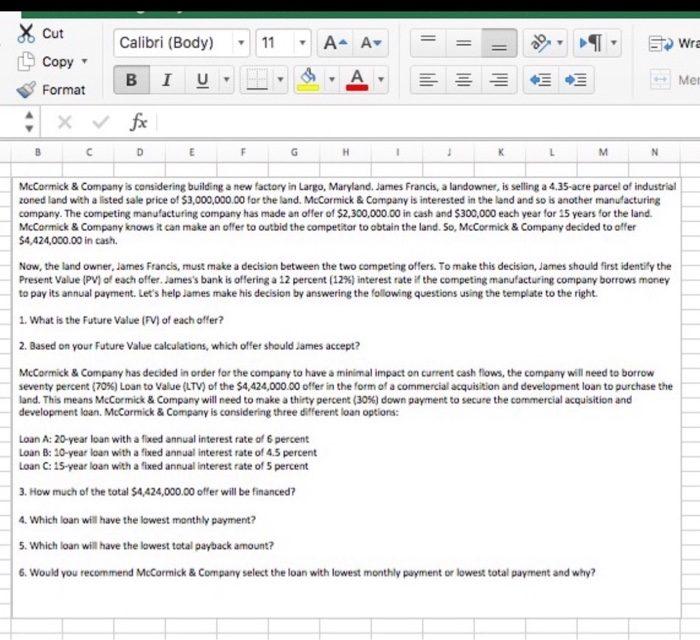

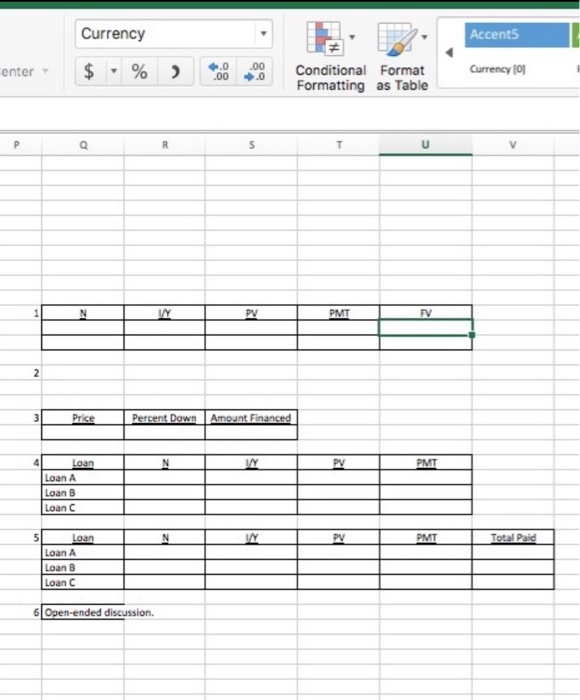

Copy %) Paste Curen B Merge Center 1 U. Conditional Forest Formatting Table Format U12 XFx M 4 o R U 5 D MC Malandrakaldo, and were coming SMC LABLE he 3 he E 11 11 15 11 BY . Paste Formatting Table Format x x U12 0 Q 3 U find Mwanams, ling 2 ned and the proef.000 DOGO ore Me C The commande M SOLO De WP 11 2 24 why 15 Financing and Investing Corporation Pete B Format Morge & Center $. % 2 Our Conditional Format Formatting as Table 012 DINI M P 9 5 w M RAP Med The 14 Wet RI BY 17 d. The 21 23 R IS RI y! COM Project 4 Workbook 2202 Home Page Layout Formulas Data Review View Calibri (Body 11 - A A Insert X Cut Copy Format X HD Wrap Toe Currency Acants Paste Accents B I U- Merpecie S%) Conditional Format Fronting Tag C U12 . fx M N d w 2 . 4 3 6 2 My factory. Maar and are the eng camping manager the Merontharder 9 ering th 11 TY 11 14 Future TV shoe? Future Company has decided on Value The Mc Camper womentan. MeComed Lywo 2 he RON und the 31 39 21 LAMI UA 23 20 25 1. How much of the 100.00 icon will have the 5. Who with BUT Woo co 15 11 53 Project 4 Workbook 2202 Formulas Data Review View A- A- Wrap Text Currency Accents Home Insert Page Layout X out Calibri (Bodyl Copy Paste U Format U12 xVfx . Merge Center 5 - % ) Conditional Format Formatting as GUT + U wa month om. The MC . 2 Future her Free 14 15 1 100 Info many women went to the More 10 21 N www 15 hat? 27 2 14 15 49 3 40 Out Calibri (Body) 11 A- A Wrap Text Currency Accents Accent Paste Copy Format B I U Merge Center $%) Conditional Format Formatting as Table U12 fx A . N w 1 2 McCormick & Company is comidering building new factory in Largo, Maryland. James Franck, a landowner, welling Self Industrial ed and with a sedler 1.000.000 and is covered in the demande company. The competing acting company has made an der of 2,800.000,00 cash and 500,000 each year for 15 years for the land SE64,200.00 . 5 5 7 . . 10 11 12 Prewest Value Machofter, men bare 3 percent interest rate if the competing mandatering company borrow money TV 14 15 10 2 McCormick Company has decided in wider the company to how malata care a low, the company wild te boren er om te weeSAA.000.00 en het meer in development teaches the lund. This means cornia Company wed to make a tree down to the commercio telopment sur Camic Congrecordering the effettuation 18 19 10 TA PVT Lot 10 year wheel werttelet 2. How much the SA24.000,00 er will be named Land 5 N 53 54 6 10 Instructions Financing and Investing Corporate Valuation Annuities + Ready X Out Calibri (Body) 11 A- A Wrap Text Currency Accents ze Copy Format B I Merge & Center $ . % ) co Conditional Format Formatting as Table A c N T U McCormick Company is considering building a new factory in Large, Maryland, dannes Franck, a landowner, wiiga s-acre paralel Indur and land with a lite sale price of 51.000.000 for the land. McCormic Company the land und sehr lecturing comery The competing manufacturing company has made another of 2.200.000.00 in curhand 500,000 each for 15 years for the land. McCormick & Company is it can make an offerta tid the competitor obtain the land. So, McCormick & Company decided to other 54.44.000.00 Now, the land owner, James Franca, must make a decision between the two competing offer. To make decision, James should not deny the Presente achter de bankenga 12 percent (12 terest rate the competing and acturing company borrow money to pay payment. Let's homemade decor by answering the following itong the template to the 1. What there with 2. Based on your ture Value caution, which offer should not? MeCormick & Company has decided in order for the company to have an impact on current cash flow, the company will need to borrow eventy percent (70) Loan ta Valve (LTV) at the SA2,000 Dotter in the form of a commercial acquisition and development loan to purchase the and McCormick Company will need to make any percent down payment to secure the commercial and development Comida como considering the relation am 2 year with a freda interese percent 10 years with auderet of 43 per want you with a few terest rate percent 2 WY WY Joan & Would you recommend McCord & Company select the with lowest athly paymenter lowest total payment and way! Cut Calibri (Body) 11 A- A Wra Copy BI U A Mer Format XV fx D B E M N McCormick & Company is considering building a new factory in Largo, Maryland, James Francis, a landowner, is selling a 4.35-acre parcel of industrial zoned land with a listed sale price of $3,000,000.00 for the land. McCormick & Company is interested in the land and so is another manufacturing company. The competing manufacturing company has made an offer of $2,300,000.00 in cash and $300,000 each year for 15 years for the land. McCormick & Company knows it can make an offer to outbid the competitor to obtain the land. So, McCormick & Company decided to offer 54,424,000.00 in cash. Now, the land owner, James Francis, must make a decision between the two competing offers. To make this decision, James should first identify the Present Value (PV) of each offer. James's bank is offering a 12 percent (12%) interest rate if the competing manufacturing company borrows money to pay its annual payment. Let's help dames make his decision by answering the following questions using the template to the right. 1. What is the Future Value (FV) of each offer? 2. Based on your Future Value calculations, which offer should James accept? McCormick & Company has decided in order for the company to have a minimal impact on current cash flows, the company will need to borrow seventy percent (70%) Loan to Value (LTV) of the $4,424,000.00 offer in the form of a commercial acquisition and development loan to purchase the Land. This means McCormick & Company will need to make a thirty percent (306) down payment to secure the commercial acquisition and development loan. MeCormick & Company is considering three different loan options: Loan A: 20-year loan with a fixed annual interest rate of 6 percent Loan B: 10-year loan with a fixed annual interest rate of 4.5 percent Loan C: 15-year loan with a fixed annual interest rate of 5 percent 3. How much of the total 54,424,000.00 offer will be financed? 4. Which loan will have the lowest monthly payment? 5. Which loan will have the lowest total payback amount? 6. Would you recommend McCormick & Company select the loan with lowest monthly payment or lowest total payment and why? Currency Accents enter $ % ) .00 2.0 .00 Conditional Format Formatting as Table Currency 101 Q S WY PV PMT FV N Price Percent Down Amount Financed 4 PV PMT Loan Loan A Loan B Loan C 5 KO PV PMT Total Paid Loan Loan A Loan B Loan 6 Open-ended discussion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts