Question: I need help with these questions. Can you all answer these questions with explanations? QUESTION 23 Jeremy is married to Amy, who abandoned him in

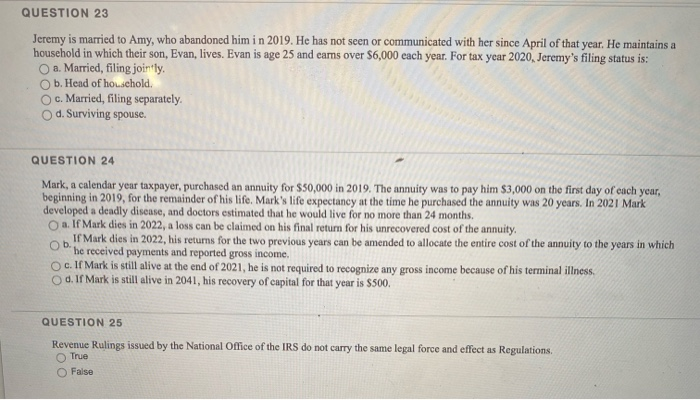

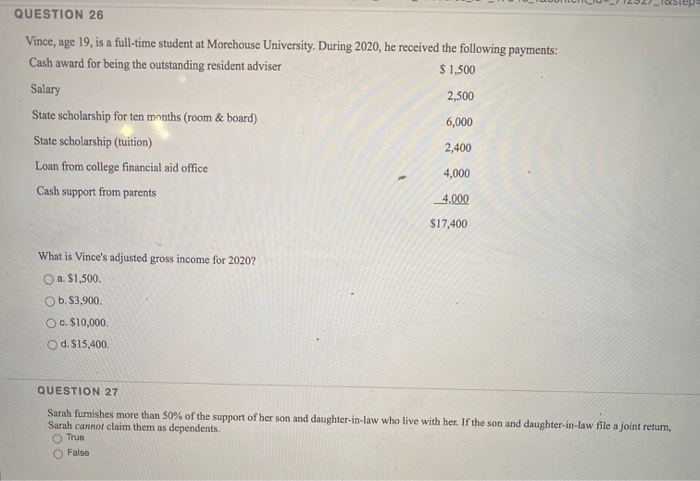

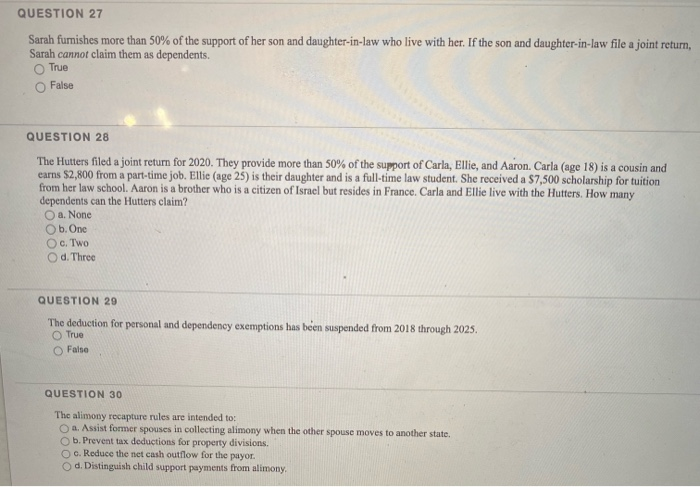

QUESTION 23 Jeremy is married to Amy, who abandoned him in 2019. He has not seen or communicated with her since April of that year. He maintains a household in which their son, Evan, lives. Evan is age 25 and cams over $6,000 each year. For tax year 2020, Jeremy's filing status a. Married, filing jointly, Ob. Head of household OC. Married, filing separately. Od. Surviving spouse. QUESTION 24 Mark, a calendar year taxpayer, purchased an annuity for $50,000 in 2019. The annuity was to pay him $3,000 on the first day of each year, beginning in 2019, for the remainder of his life. Mark's life expectancy at the time he purchased the annuity was 20 years. In 2021 Mark developed a deadly disease, and doctors estimated that he would live for no more than 24 months. a. if Mark dies in 2022, a loss can be claimed on his final return for his unrecovered cost of the annuity. If Mark dies in 2022, his returns for the two previous years can be amended to allocate the entire cost of the annuity to the Ob in which years he received payments and reported gross income, c. If Mark is still alive at the end of 2021, he is not required to recognize any gross income because of his terminal illness. Od. If Mark is still alive in 2041, his recovery of capital for that year is $500. QUESTION 25 Revenue Rulings issued by the National Office of the IRS do not carry the same legal force and effect as Regulations True False QUESTION 26 Vince, age 19, is a full-time student at Morchouse University. During 2020, he received the following payments: Cash award for being the outstanding resident adviser $ 1,500 Salary 2,500 State scholarship for ten months (room & board) 6,000 State scholarship (tuition) 2,400 Loan from college financial aid office 4,000 Cash support from parents __4.000 $17,400 What is Vince's adjusted gross income for 2020? a. $1,500. b. $3,900 O c. $10,000 O d. $15,400. QUESTION 27 Sarah furnishes more than 50% of the support of her son and daughter-in-law who live with her. If the son and daughter-in-law file a joint return, Sarah cannot claim them as dependents. True False QUESTION 27 Sarah furnishes more than 50% of the support of her son and daughter-in-law who live with her. If the son and daughter-in-law file a joint return, Sarah cannot claim them as dependents. True False QUESTION 28 The Hutters filed a joint return for 2020. They provide more than 50% of the support of Carla, Ellie, and Aaron. Carla (age 18) is a cousin and earns $2,800 from a part-time job. Ellic (age 25) is their daughter and is a full-time law student . She received a $7,500 scholarship for tuition from her law school. Aaron is a brother who is a citizen of Israel but resides in France. Carla and Ellie live with the Hutters. How many dependents can the Hutters claim? O a None b. One O c. Two Od. Three QUESTION 29 The deduction for personal and dependency exemptions has been suspended from 2018 through 2025. True Falso QUESTION 30 The alimony recapture rules are intended to: 2. Assist former spouses in collecting alimony when the other spouse moves to another state. b. Prevent tax deductions for property divisions. c. Reduce the net cash outflow for the puyor. Od. Distinguish child support payments from alimony

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts