Question: I need help with this auditing homework. During the audit of Painter Products the audit team discovered the following: The accounts receivable confirmation process revealed

I need help with this auditing homework.

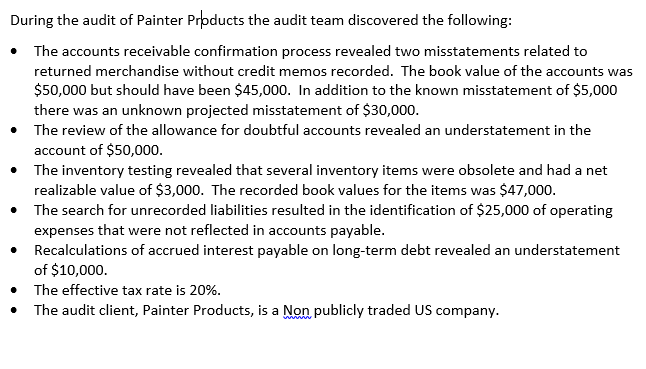

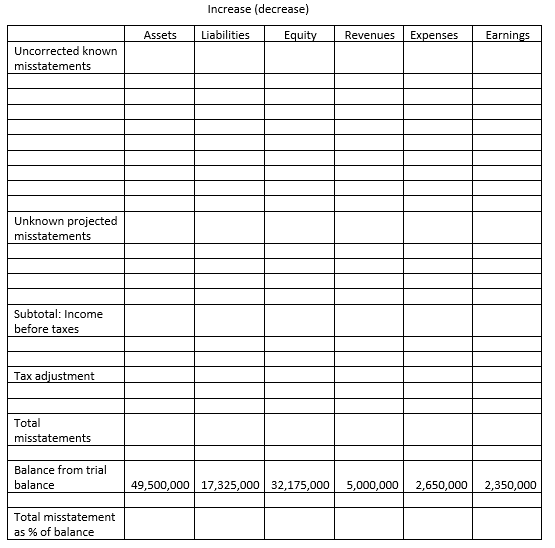

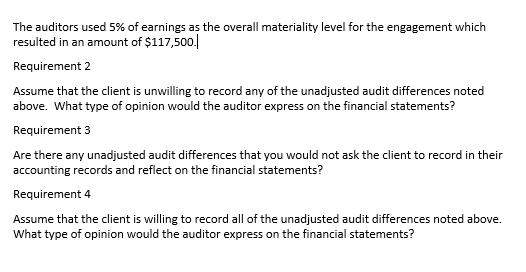

During the audit of Painter Products the audit team discovered the following: The accounts receivable confirmation process revealed two misstatements related to returned merchandise without credit memos recorded. The book value of the accounts was $50,000 but should have been $45,000. In addition to the known misstatement of $5,000 there was an unknown projected misstatement of $30,000 The review of the allowance for doubtful accounts revealed an understatement in the account of $50,000. The inventory testing revealed that several inventory items were obsolete and had a net realizable value of $3,000. The recorded book values for the items was $47,000. The search for unrecorded liabilities resulted in the identification of $25,000 of operating expenses that were not reflected in accounts payable. Recalculations of accrued interest payable on long-term debt revealed an understatement of $10,000. The effective tax rate is 20%. The audit client, Painter Products, is a Non publicly traded US company. Increase (decrease) Assets Liabilities Equity Revenues Expenses Earnings Uncorrected known misstatements Unknown projected misstatements Subtotal: Income before taxes Tax adjustment Total misstatements Balance from trial balance 49,500,000 17,325,000 32,175,000 5,000,000 2,650,000 2,350,000 Total misstatement as % of balance The auditors used 5% of earnings as the overall materiality level for the engagement which resulted in an amount of $117,500. Requirement 2 Assume that the client is unwilling to record any of the unadjusted audit differences noted above. What type of opinion would the auditor express on the financial statements? Requirement 3 Are there any unadjusted audit differences that you would not ask the client to record in their accounting records and reflect on the financial statements? Requirement 4 Assume that the client is willing to record all of the unadjusted audit differences noted above. What type of opinion would the auditor express on the financial statements? During the audit of Painter Products the audit team discovered the following: The accounts receivable confirmation process revealed two misstatements related to returned merchandise without credit memos recorded. The book value of the accounts was $50,000 but should have been $45,000. In addition to the known misstatement of $5,000 there was an unknown projected misstatement of $30,000 The review of the allowance for doubtful accounts revealed an understatement in the account of $50,000. The inventory testing revealed that several inventory items were obsolete and had a net realizable value of $3,000. The recorded book values for the items was $47,000. The search for unrecorded liabilities resulted in the identification of $25,000 of operating expenses that were not reflected in accounts payable. Recalculations of accrued interest payable on long-term debt revealed an understatement of $10,000. The effective tax rate is 20%. The audit client, Painter Products, is a Non publicly traded US company. Increase (decrease) Assets Liabilities Equity Revenues Expenses Earnings Uncorrected known misstatements Unknown projected misstatements Subtotal: Income before taxes Tax adjustment Total misstatements Balance from trial balance 49,500,000 17,325,000 32,175,000 5,000,000 2,650,000 2,350,000 Total misstatement as % of balance The auditors used 5% of earnings as the overall materiality level for the engagement which resulted in an amount of $117,500. Requirement 2 Assume that the client is unwilling to record any of the unadjusted audit differences noted above. What type of opinion would the auditor express on the financial statements? Requirement 3 Are there any unadjusted audit differences that you would not ask the client to record in their accounting records and reflect on the financial statements? Requirement 4 Assume that the client is willing to record all of the unadjusted audit differences noted above. What type of opinion would the auditor express on the financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts