Question: I need help with this question QUESTION 1 ABC Lid. is planning to set up a new plant. The new plant requires an initial investment

I need help with this question

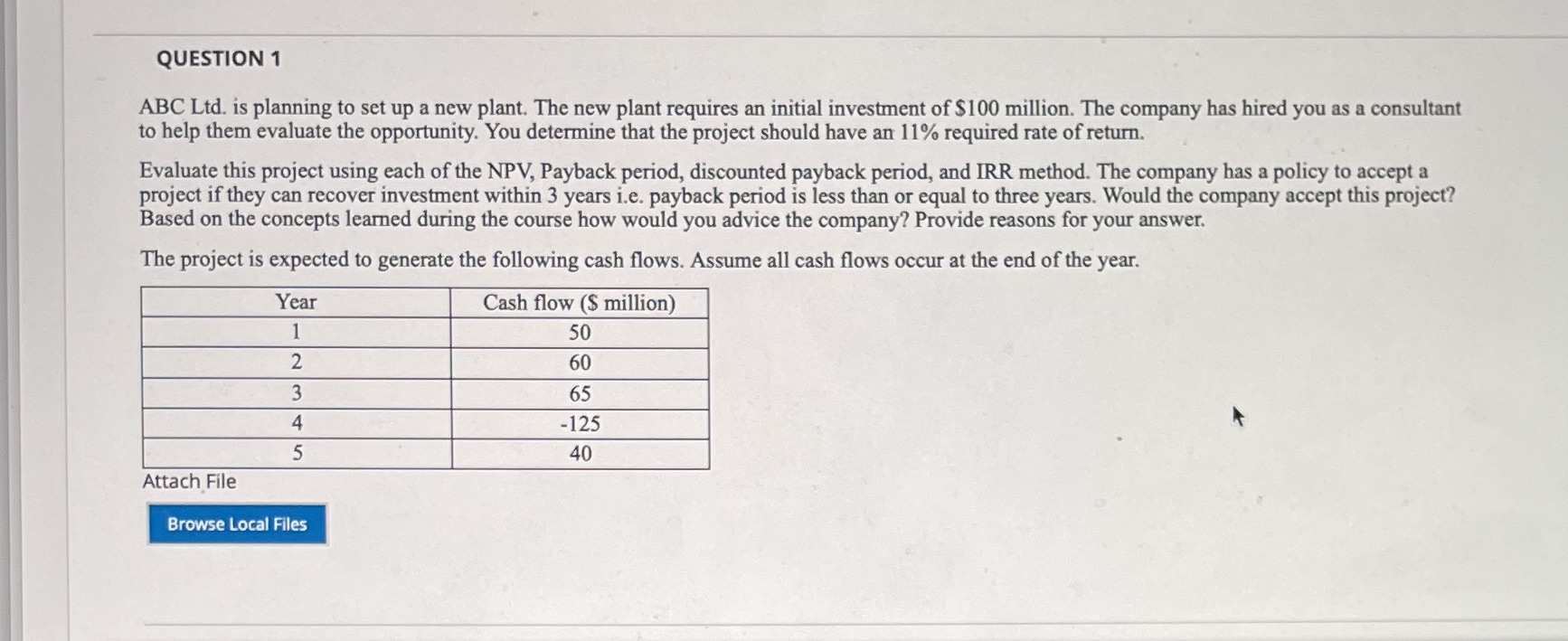

QUESTION 1 ABC Lid. is planning to set up a new plant. The new plant requires an initial investment of $100 million. The company has hired you as a consultant to help them evaluate the opportunity. You determine that the project should have an 11% required rate of return. Evaluate this project using each of the NPV, Payback period, discounted payback period, and IRR method. The company has a policy to accept a project if they can recover investment within 3 years i.e. payback period is less than or equal to three years. Would the company accept this project? Based on the concepts learned during the course how would you advice the company? Provide reasons for your answer. The project is expected to generate the following cash flows. Assume all cash flows occur at the end of the year. Year Cash flow ($ million) 50 N 60 3 65 4 -125 40 Attach File Browse Local Files

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts