Question: i need question #2 to be done please asap d-1. During 9o19, Nguyen Enterprises raised $669 in new long-term debt. How much long- d-e During

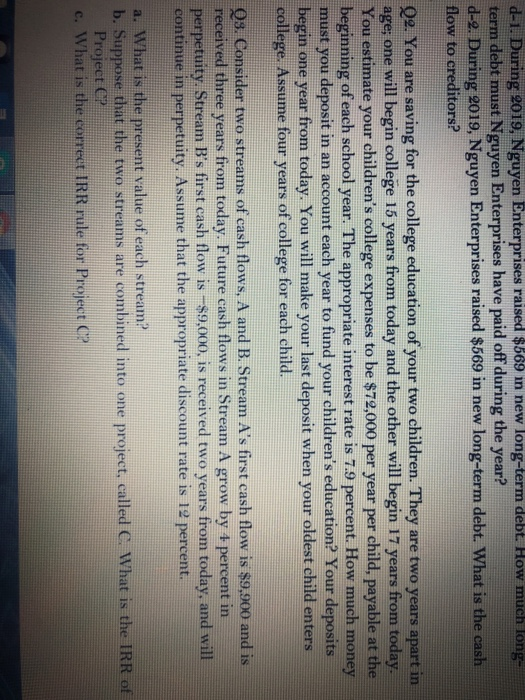

d-1. During 9o19, Nguyen Enterprises raised $669 in new long-term debt. How much long- d-e During 8019, Nguyen Enterprises raised $569 in new long-term debt. What is the cash term debt must Nguyen Enterprises have paid off during the year? flow to creditors? 09. You are saving for the college education of your two children. They are two years apart in ages one will begin college 15 years from today and the other will begin 17 years from today You estimate your children's college expenses to be $72,000 per year per child, payable at the beginning of each school year. The appropriate interest rate is 7.9 percent. How much money must you deposit in an account each year to fund your children's education? Your deposits begin one year from today. You will make your last deposit when your oldest child enters 1 college Assume four years of college for each child. Qs. Consider two streams of cash flows, A and B. Stream A's first cash flow is $9,900 and is received three years from today. Future cash flows in Stream A grow by percent in perpetuity Stream B's first cash flow is -$9,000, is received two years from today, and will continue in perpetuity. Assume that the appropriate discount rate is 12 percent. a. What is the present value of each stream? b. Suppose that the two streams are combined into one project, called C. What is the IRR of Project C c. What is the correet IRR rule for Project C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts