Question: I need solution ras ry The Adjusting Process 15 3.8 Journalizing and posting an adjusting entry for depreciation determining book value On October 1, espected

I need solution

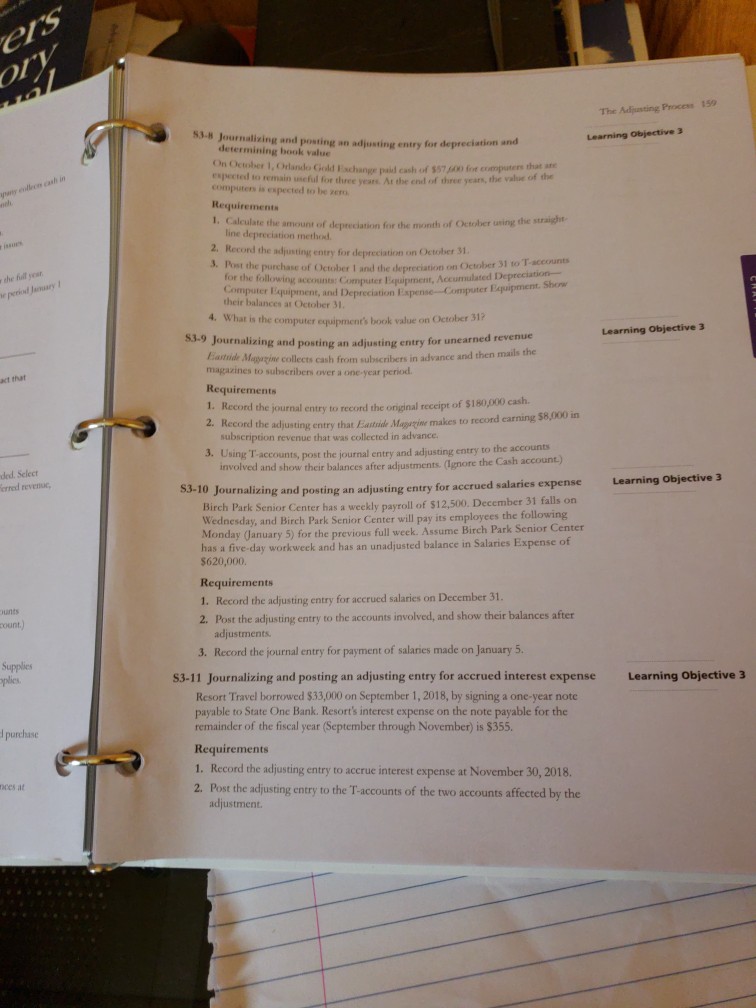

ras ry The Adjusting Process 15 3.8 Journalizing and posting an adjusting entry for depreciation determining book value On October 1, espected to remain uneful for three years At the end of thre years, the valve of the Orlando Gold Eschange paid cash of $57 5400 for computers that are computers is expected to be zero Requirements 1. Calculate the amount of depreciation for the month of October using the straight line depreciation method. 2. Recond the adjusting entry for depreciation on Oetoher S 3. Pest the purchase of Octuber 1 and the depreciaion on Depreciation October 31 to T-accounts for the following accounts: Computer Eaquipment, Computer I the hll year qupnent, and Depreciation EspenseComputer Eapuipment sh at October 31 4. What is the computer equipment's book value on October 312 and posting an adjusting entry for unearned revenue Eastide A Maprine collects cash from subscribers in advance and then mails the magazines to subscribers over a one-year period Requirements 1. Record the journal entry to recond the original receipt of $180,000 cash. act that 2. Recond the subscription revenue that was collected in advance. 3. Using Taccounts, post the journal entry and adjusting entry to involved and show their balances after adjustments. (Ignore the Cash Select reven ded. ng and posting an adjusting entry for accrued salaries expense Learning Objective 3 k Senior Center has a weekly payroll of $12,500. December 31 falls on erred Wednesday, and Birch Park Senior Center will pay its employees the following Monday (January 5) for the previous full week. Assume Birch Park Senior Center has a five-day workweek and has an unadjusted balance in Salaries Expense of $620,000. Requirements 1. Record the adjusting entry for accrued salaries on December 31 2. Post the ad unts count) justing entry to the accounts involved, and show their balances after 3. Record the journal entry for payment of salaries made on January 5. Supplies plies S3-11 Journalizing and posting an adjusting entry for accrued interest expense Learning Objective 3 Resort Travel borrowed $33,000 on September 1, 2018, by signing a one-year note payable to State One Bank. Resort's interest expense on the note payable for the remainder of the fiscal year (September through November) is $355. Requirements 1. Record the adjusting entry to accrue interest expense at November 30, 2018. 2. Post the adjusting entry to the Taccounts of the two accounts affected by the lpurchase ees at

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts