Question: i need solution with explanition please from qs 1 - 4 A local engineering firm here in Stillwater does residential development planning for the City

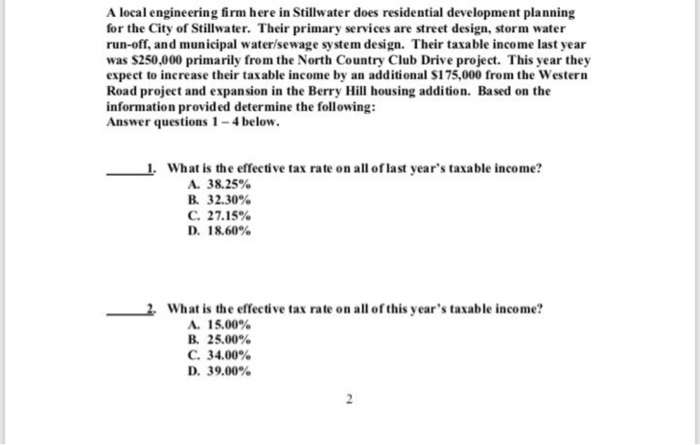

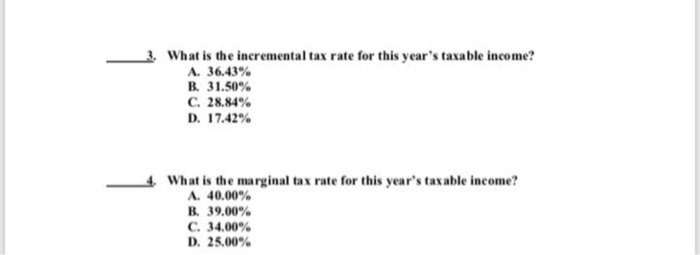

A local engineering firm here in Stillwater does residential development planning for the City of Stillwater. Their primary services are street design, storm water run-off, and municipal water/sewage system design. Their taxable income last year was $250,000 primarily from the North Country Club Drive project. This year they expect to increase their taxable income by an additional $175,000 from the Western Road project and expansion in the Berry Hill housing addition. Based on the information provided determine the following: Answer questions 1 - 4 below. 1. What is the effective tax rate on all of last year's taxable income? A. 38.25% B. 32.30% C. 27.15% D. 18,60% What is the effective tax rate on all of this year's taxable income? A. 15.00% B. 25.00% C. 34.00% D. 39.00% 3. What is the incremental tax rate for this year's taxable income? A. 36.43% B. 31.50% C. 28.84% D. 17.42% What is the marginal tax rate for this year's taxable income? A. 40.00% B. 39.00% C. 34.00% D. 25.00% A local engineering firm here in Stillwater does residential development planning for the City of Stillwater. Their primary services are street design, storm water run-off, and municipal water/sewage system design. Their taxable income last year was $250,000 primarily from the North Country Club Drive project. This year they expect to increase their taxable income by an additional $175,000 from the Western Road project and expansion in the Berry Hill housing addition. Based on the information provided determine the following: Answer questions 1 - 4 below. 1. What is the effective tax rate on all of last year's taxable income? A. 38.25% B. 32.30% C. 27.15% D. 18,60% What is the effective tax rate on all of this year's taxable income? A. 15.00% B. 25.00% C. 34.00% D. 39.00% 3. What is the incremental tax rate for this year's taxable income? A. 36.43% B. 31.50% C. 28.84% D. 17.42% What is the marginal tax rate for this year's taxable income? A. 40.00% B. 39.00% C. 34.00% D. 25.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts