Question: I need some help , please do NOT use AI to solve it as it cannot solve it correctly. (Round dallors to the nearest cent

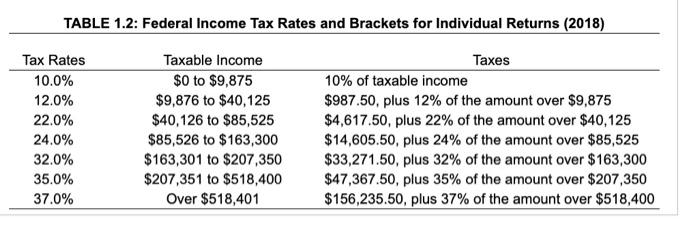

Using the individual tax rate schedule , perform the following: a. Calculate the tax liability, after-tax earnings, and average tax rates for the following levels of partnership earnings before taxes: $13,300;$77,700;$325,000;$493,000;$1.2 million; \$1.6 million; and \$2.1 million. b. Plot the average tax rates (measured on the y-axis) against the pretax income levels (measured on the x-axis). What generalization can be made concerning the relationship between these variables? TABLE 1.2: Federal Income Tax Rates and Brackets for Individual Returns (2018) Using the individual tax rate schedule , perform the following: a. Calculate the tax liability, after-tax earnings, and average tax rates for the following levels of partnership earnings before taxes: $13,300;$77,700;$325,000;$493,000;$1.2 million; \$1.6 million; and \$2.1 million. b. Plot the average tax rates (measured on the y-axis) against the pretax income levels (measured on the x-axis). What generalization can be made concerning the relationship between these variables? TABLE 1.2: Federal Income Tax Rates and Brackets for Individual Returns (2018)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts