Question: I need step by step clear explenation asap please Description: A firm considers purchasing a machine in 2023 for $5,000,000. The machine has a 5-year

I need step by step clear explenation asap please

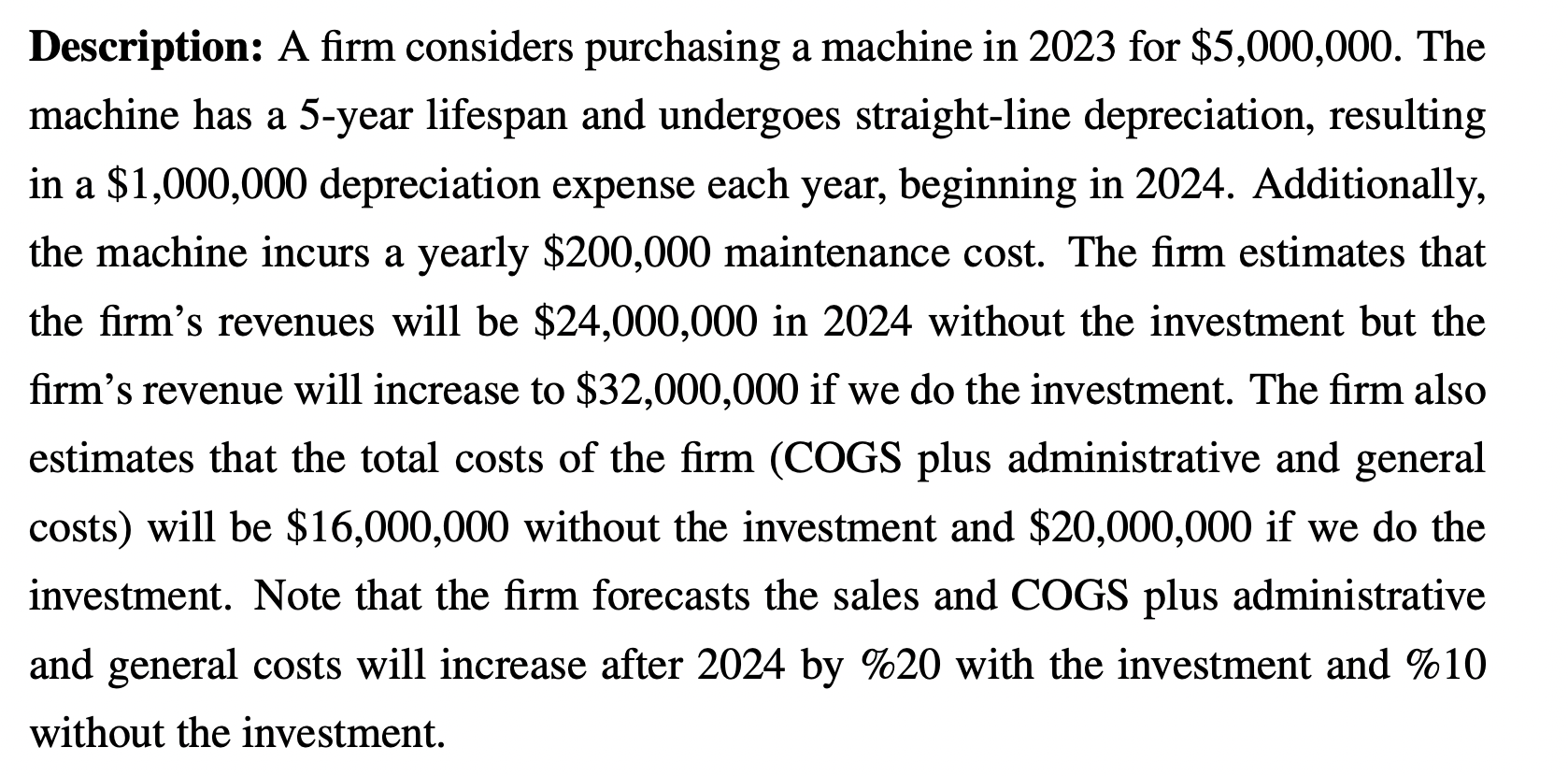

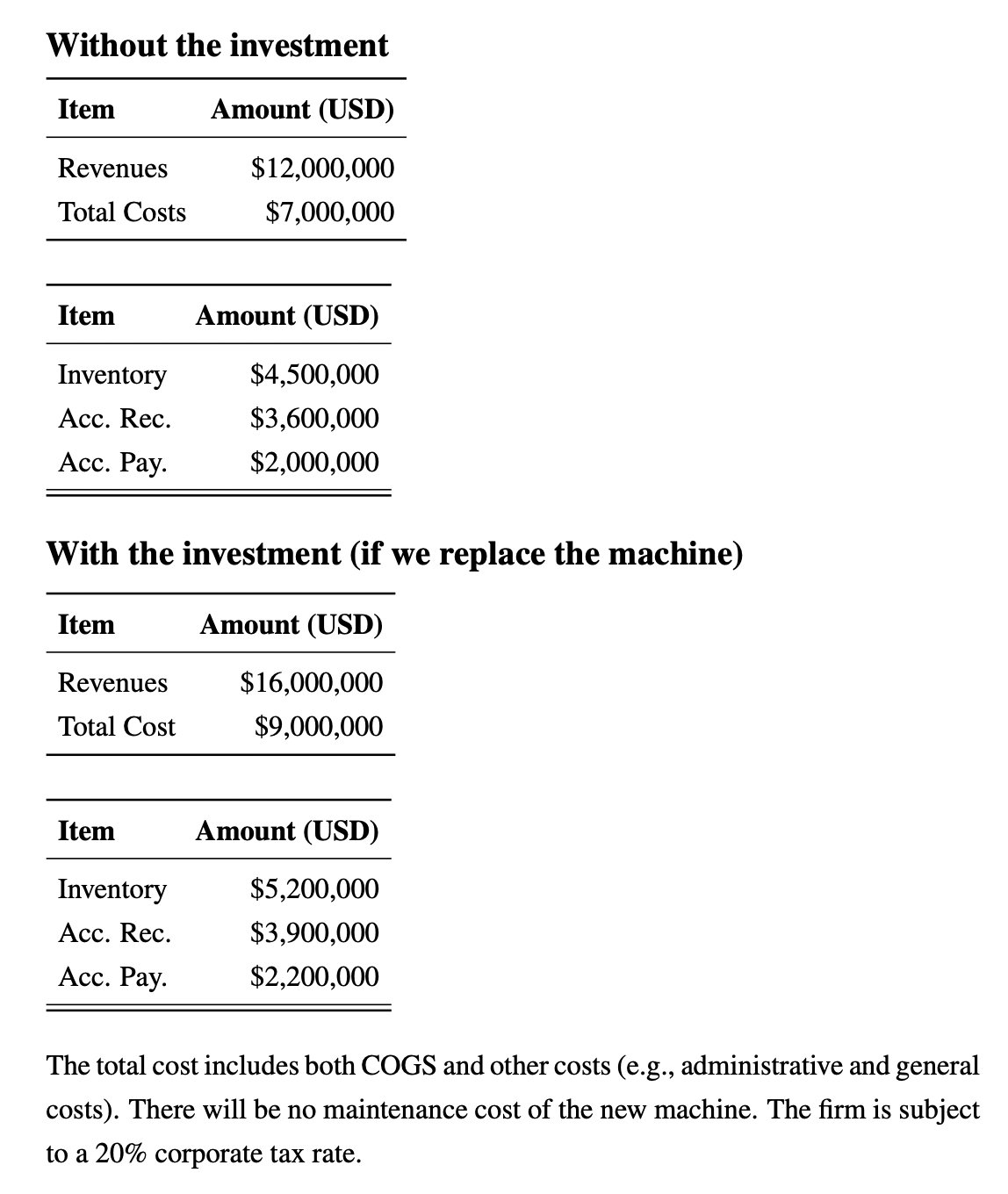

Description: A firm considers purchasing a machine in 2023 for $5,000,000. The machine has a 5-year lifespan and undergoes straight-line depreciation, resulting in a $1,000,000 depreciation expense each year, beginning in 2024. Additionally, the machine incurs a yearly $200,000 maintenance cost. The firm estimates that the firm's revenues will be $24,000,000 in 2024 without the investment but the firm's revenue will increase to $32,000,000 if we do the investment. The firm also estimates that the total costs of the firm (COGS plus administrative and general costs) will be $16,000,000 without the investment and $20,000,000 if we do the investment. Note that the firm forecasts the sales and COGS plus administrative and general costs will increase after 2024 by %20 with the investment and %10 without the investment. With the investment (if we replace the machine) The total cost includes both COGS and other costs (e.g., administrative and general costs). There will be no maintenance cost of the new machine. The firm is subject to a 20% corporate tax rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts